SunTrust 2008 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

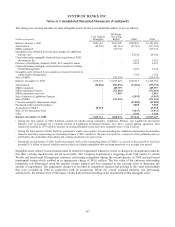

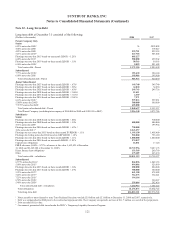

As of December 31, 2008, 2007, and 2006, the total unpaid principal balance of mortgage loans serviced was $162.0 billion,

$149.9 billion, and $130.0 billion, respectively. Included in these amounts were $130.5 billion, $114.6 billion, and $91.5

billion as of December 31, 2008, 2007, and 2006, respectively, of loans serviced for third parties. No valuation allowances

were required at December 31, 2007 and 2006, for the Company’s MSRs. As of December 31, 2008, the Company had

established a valuation allowance of $370.0 million. No permanent impairment losses were written-off against the allowance

during the year ended December 31, 2008.

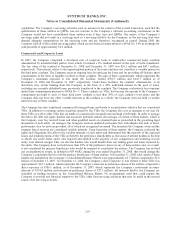

Prepayment risk subjects the MSRs to impairment risk. Impairment of MSRs is recognized when the fair value is less than

the amortized cost basis of the MSRs. For purposes of measuring impairment, MSRs are stratified based on interest rate and

type of related loan. When fair value is less than amortized cost for an individual stratum and the impairment is believed to

be temporary, the impairment is recorded to a valuation allowance; the impairment is recorded as a write-down of the

amortized cost basis of the MSRs when the impairment is deemed other-than-temporary. The Company has not historically

specifically hedged MSRs but has managed the potential impairment risk through the Company’s overall asset/liability

management process with consideration to the natural counter-cyclicality of servicing and mortgage originations, as well as

available for sale securities. See further discussion in Note 5, “Securities Available for Sale”, to the Consolidated Financial

Statements.

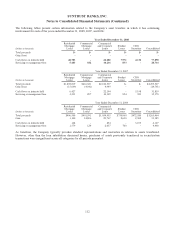

A summary of the key characteristics, inputs, and economic assumptions used to estimate the fair value of the Company’s

MSRs and the sensitivity of the December 31, 2008 and 2007 fair values to immediate 10% and 20% adverse changes in

those assumptions follows.

(Dollars in millions) 2008 2007

Fair value of retained MSRs $815.6 $1,407.1

Prepayment rate assumption (annual) 32.8% 16.5%

Decline in fair value of 10% adverse change $61.2 $60.5

Decline in fair value of 20% adverse change 113.8 115.4

Discount rate (annual) 9.3% 9.9%

Decline in fair value of 10% adverse change $17.9 $45.8

Decline in fair value of 20% adverse change 35.0 88.7

Weighted-average life (in years) 2.50 5.30

Weighted-average coupon 6.15 6.21

The above sensitivities are hypothetical and should be used with caution. As the amounts indicate, changes in fair value

based on variations in assumptions generally cannot be extrapolated because the relationship of the change in assumption to

the change in fair value may not be linear. Also, in this table, the effect of a variation in a particular assumption on the fair

value of the retained interest is calculated without changing any other assumption. In reality, changes in one factor may result

in changes in another, which might magnify or counteract the sensitivities.

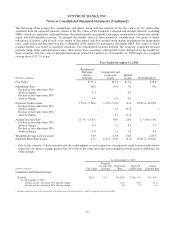

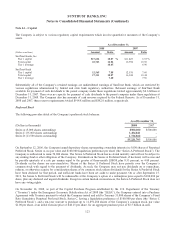

Variable Interest Entities (“VIEs”)

In addition to the Company’s involvement with VIEs that has arisen due to certain transfers of financial assets, which is

discussed herein under “Certain Transfers of Financial Assets”, the Company also has involvement with VIEs from other

business activities.

Three Pillars Funding, LLC

SunTrust assists in providing liquidity to select corporate clients by directing them to a multi-seller commercial paper

conduit, Three Pillars Funding, LLC (“Three Pillars”). Three Pillars provides financing for direct purchases of financial

assets originated and serviced by SunTrust’s corporate clients. Three Pillars finances this activity by issuing A-1/P-1

rated commercial paper (“CP”). The result is a favorable funding arrangement for these clients. Three Pillars had no

other form of funding outstanding as of December 31, 2008 or 2007.

The Company’s involvement with Three Pillars includes the following activities: services related to the administration

of Three Pillars’ activities and client referrals to Three Pillars; the issuing of letters of credit, which provide partial

credit protection to the commercial paper holders; and providing the majority of the liquidity arrangements that would

115