SunTrust 2008 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

The average recorded investment in certain impaired loans for the years ended December 31, 2008, 2007, and 2006 was

$1,021.7 million, $130.4 million, and $131.7 million, respectively. For 2008, 2007, and 2006, interest income recognized on

certain impaired loans totaled $23.1 million, $8.6 million, and $10.6 million, respectively.

During 2008 and 2007, the Company transferred $656.1 million and $837.4 million, respectively, in loans held for sale to

loans held for investment in response to liquidity issues in the market with respect to these loans. The loans transferred

included loans carried at fair value under SFAS No. 159 which continue to be reported at fair value while classified as held

for investment, as well as loans transferred at the lower of cost or market which had associated write-downs of $35.4 million

and $27.2 million during 2008 and 2007, respectively. At December 31, 2008 and 2007, $33.6 billion and $36.1 billion,

respectively, of loans were pledged as collateral for borrowings.

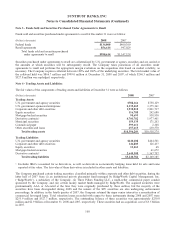

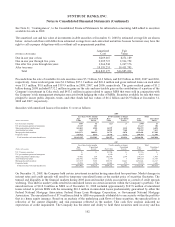

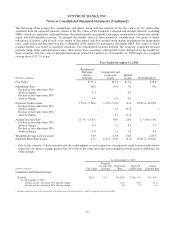

Note 7 - Allowance for Loan and Lease Losses

Activity in the allowance for loan and lease losses for the year ended December 31 is summarized in the table below:

(Dollars in thousands) 2008 2007 2006

Balance at beginning of year $1,282,504 $1,044,521 $1,028,128

Allowance associated with loans at fair value 1-(4,100) -

Allowance from GB&T acquisition 158,705 --

Provision for loan losses 2,474,215 664,922 262,536

Loan charge-offs (1,680,552) (514,348) (356,569)

Loan recoveries 116,124 91,509 110,426

Balance at end of year $2,350,996 $1,282,504 $1,044,521

1Amount removed from the allowance for loan losses related to the Company’s election to record $4.1 billion of residential

mortgages at fair value.

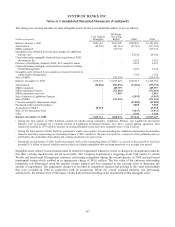

Note 8 - Premises and Equipment

Premises and equipment at December 31 were as follows:

(Dollars in thousands) Useful Life 2008 2007

Land Indefinite $399,657 $382,066

Buildings and improvements 2 -40 years 894,534 1,002,105

Leasehold improvements 1 -30 years 509,736 481,877

Furniture and equipment 1 -20 years 1,376,403 1,381,130

Construction in progress 164,968 163,119

3,345,298 3,410,297

Less accumulated depreciation and amortization 1,797,406 1,814,606

Total premises and equipment $1,547,892 $1,595,691

During 2007, the Company completed multiple sale/leaseback transactions, consisting of over 300 of the Company’s branch

properties and various individual office buildings. In total, the Company sold and concurrently leased back $545.9 million in

land and buildings with associated accumulated depreciation of $285.7 million. Net proceeds were $764.4 million, resulting

in a gain, net of transaction costs, of $504.2 million. For the year ended December 31, 2007, the Company recognized $118.8

million of the gain immediately. The remaining $385.4 million in gains were deferred and are being recognized ratably over

the expected term of the respective leases, predominantly 10 years, as an offset to net occupancy expense.

During 2008, the Company completed sale/leaseback transactions, consisting of 152 branch properties and various individual

office buildings. In total, the Company sold and concurrently leased back $201.9 million in land and buildings with

associated accumulated depreciation of $110.3 million. Net proceeds were $288.9 million, resulting in a gross gain, net of

transaction costs, of $197.3 million. For the year ended December 31, 2008, the Company recognized $37.0 million of the

gain immediately. The remaining $160.3 million in gains were deferred and are being recognized ratably over the expected

term of the respective leases, predominantly 10 years, as an offset to net occupancy expense.

104