SunTrust 2008 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

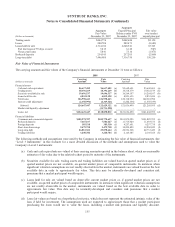

As of December 31, 2008 and 2007, approximately $48.5 million and $105.7 million, respectively, of leases held for sale

were included in loans held for sale in the Consolidated Balance Sheets and were not eligible for fair value election under

SFAS No. 159.

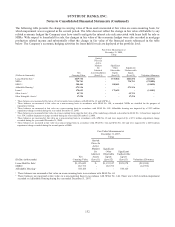

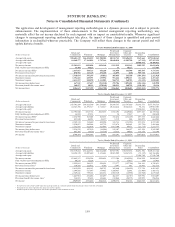

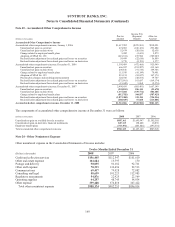

The following tables show a reconciliation of the beginning and ending balances for fair valued assets measured on a

recurring basis using significant unobservable inputs:

Fair Value Measurements

Using Significant Unobservable Inputs

(Dollars in thousands)

Trading

Assets

Securities

Available

for Sale

Loans

Held

for Sale Loans

Long-term

Debt

Beginning balance January 1, 2008 $2,950,145 $869,707 $481,327 $220,784 $-

Total gains/(losses) (realized/unrealized):

Included in earnings (401,347)1, 5 (80,251) 2,5 (60,114) 3(30,261) 4(52,600) 1

Included in other comprehensive income 249,5476(20,708) - - -

Purchase accounting adjustments - - - 5,141 -

Purchases and issuances 414,936 193,054 - 112,153 -

Settlements (50,682) (70,643) - - -

Sales (1,628,149) (116,555) (34,049) - -

Repurchase of debt - - - - 151,966

Paydowns and maturities (852,052) (164,230) (216,861) (57,537) -

Transfers from loans held for sale to loans held in portfolio - - (83,894) (83,894) -

Loan foreclosures transferred to other real estate owned - - (5,884) (63,832) -

Level 3 transfers, net 708,987 879,230 406,920 - (3,595,627)

Ending balance December 31, 2008 $1,391,385 $1,489,604 $487,445 $270,342 ($3,496,261)

The amount of total losses for the year ended December 31, 2008 included in earnings

attributable to the change in unrealized gains/(losses) relating to instruments still held at

December 31, 2008 ($208,377) 1($45,098) 2($70,975) 3($26,804) 4($52,699) 1

1Amounts included in earnings are recorded in trading account profits and commissions.

2Amounts included in earnings are recorded in net securities gains/(losses).

3Amounts included in earnings are recorded in mortgage production related income.

4Amounts are generally included in mortgage production income except $4.2 million in the year ended December 31, 2008, related to loans acquired in the GB&T acquisition. The mark on the loans is

included in trading account profits and commissions.

5Amounts included in earnings do not include losses accrued as a result of the ARS settlement discussed in Note 21 “Contingencies,” to the Consolidated Financial Statements.

6Amount recorded in other comprehensive income is the effective portion of the Cash Flow hedges related to the Company’s forward sale of its shares of the Coca-Cola Company stock as discussed in

Note 17 “Derivative Financial Instruments,” to the Consolidated Financial Statements.

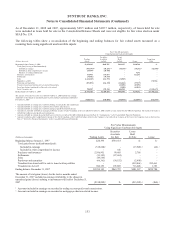

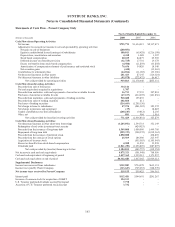

Fair Value Measurements

Using Significant Unobservable Inputs

(Dollars in thousands) Trading Assets

Securities

Available

for Sale

Loans

Held

for Sale Loans

Beginning balance January 1, 2007 $24,393 $734,633 $- $-

Total gains/losses (realized/unrealized):

Included in earnings (518,242) 1- (15,528) 2(60) 2

Included in other comprehensive income - 416 - -

Purchases and issuances 2,586,901 90,605 2,786 -

Settlements (11,149) (27,604) - -

Sales (49,550) - - -

Paydowns and maturities (66,361) (34,152) (2,498) -

Transfers from loans held for sale to loans held in portfolio - - (219,461) 219,461

Transfers into Level 3 984,153 105,809 716,028 1,383

Ending balance December 31, 2007 $2,950,145 $869,707 $481,327 $220,784

The amount of total gains/(losses) for the twelve months ended

December 31, 2007 included in earnings attributable to the change in

unrealized gains/(losses) relating to instruments still held at December 31,

2007 ($518,242) 1$- ($15,528) 2($60) 2

1Amounts included in earnings are recorded in trading account profits and commissions.

2Amounts included in earnings are recorded in mortgage production related income.

153