SunTrust 2008 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

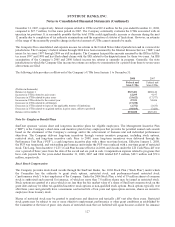

likely to occur. As a result of the purchase of the qualified ABS, the Company recorded a trading loss of $144.8 million

during the fourth quarter of 2007. Since the purchase, the Company has sold all but one of the ABS positions, which has

a fair value of $10.8 million at December 31, 2008. For the year ended December 31, 2008, the Company received

$406.6 million in proceeds from the sales of these ABS, $14.1 million of paydowns, and recognized $144.8 million in

net trading losses.

Total Return Swaps (“TRS”)

The Company has had involvement with various VIEs that purchase portfolios of loans at the direction of third parties.

These third parties are not related parties to the Company, nor are they and the Company de facto agents of each other.

In order for the VIEs to purchase the loans, the Company provides senior financing to these VIEs; at December 31, 2008

and 2007, the Company had $603.4 million and $38.0 million, respectively, in such financing outstanding, which is

classified within trading assets on the Consolidated Balance Sheets. In addition, the Company also enters into TRS

transactions with the VIEs that the Company mirrors with a TRS with the third party who controls the loans owned by

the VIE. The TRS transactions pass through all interest and other cash flows on the loans to the third party, along with

exposing the third parties to any depreciation on the loans and providing them with the rights to all appreciation on the

loans. The terms of the TRS transactions require the third parties to post initial margin, in addition to ongoing margin as

the fair values of the underlying loans decrease. The Company has concluded that it is not the primary beneficiary of

these VIEs. The VIEs are designed for the benefit of the third parties, and the third parties have implicit variable

interests in the VIEs via their TRS transactions with the Company, whereby these third parties absorb the majority of

the expected losses and are entitled to the majority of the expected residual returns of the VIEs. At December 31, 2008

and 2007, these VIEs had entered into TRS with the Company that had outstanding notional amounts of $602.1 million

and $38.0 million, respectively. The Company has not provided any support that it was not contractually obligated to for

the years ended December 31, 2008 and 2007. As of December 31, 2008, the Company has decided to exit this TRS

business and is in the process of terminating the transactions. For additional information on the Company’s TRS with

these VIEs, see Note 18, “Reinsurance Arrangements and Guarantees,” to the Consolidated Financial Statements.

Community Development Investments

As part of its community reinvestment initiatives, the Company invests almost exclusively throughout its footprint in

multi-family affordable housing developments and other community development entities as a limited and/or general

partner and/or a debt provider. The Company receives tax credits for its partnership investments. The Company has

determined that these partnerships are VIEs when SunTrust does not own 100% of the entity because the holders of the

equity investment at risk do not have the direct or indirect ability to make decisions that have a significant impact on the

business. Accordingly, the Company’s general partner, limited partner and/or debt interests are variable interests that the

Company evaluates for purposes of determining whether the Company is the primary beneficiary. During 2008,

SunTrust did not provide any financial or other support to its consolidated or unconsolidated investments that it was not

previously contractually required to provide.

For some partnerships, SunTrust operates strictly as a general partner or the indemnifying party and as such is exposed

to a majority of the partnerships’ expected losses. Accordingly, SunTrust consolidates these partnerships on its

Consolidated Balance Sheet. As the general partner or indemnifying party, SunTrust typically guarantees the tax credits

due to the limited partner and is responsible for funding construction and operating deficits. As of December 31, 2008

and 2007, total assets, which consists primarily of fixed assets and cash, attributable to the consolidated partnerships

was $20.5 million and $21.5 million, respectively, and total liabilities, excluding intercompany liabilities, primarily

representing the minority interest liability for the limited partner investments, was $14.6 million and $15.8 million,

respectively. Security deposits from the tenants are recorded as liabilities on SunTrust’s Consolidated Balance Sheet.

The Company maintains separate cash accounts to fund these liabilities and these assets are considered restricted. The

tenant liabilities and corresponding restricted cash assets were $0.1 million and $0.1 million as of December 31, 2008

and 2007, respectively. While the obligations of the general partner or indemnifying entity are generally non-recourse to

SunTrust, the Company, as the general partner or the indemnifying entity, may from time to time step in when needed to

fund deficits. During 2008 and 2007, SunTrust did not provide any significant amount of funding as the general partner

or the indemnifying entity to fund any deficits they may have had.

For other partnerships, the Company acts only in a limited partnership capacity. The Company has determined that it is

not the primary beneficiary of these partnerships because it will not absorb a majority of the expected losses of the

partnership. Typically, the general partner or an affiliate of the general partner provide guarantees to the limited partner

118