SunTrust 2008 Annual Report Download - page 52

Download and view the complete annual report

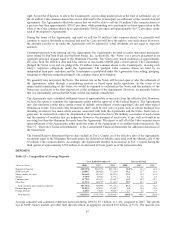

Please find page 52 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Securities Available for Sale

The securities available for sale portfolio is managed as part of the overall asset and liability management process to

optimize income and market performance over an entire interest rate cycle while mitigating risk. For much of 2008 the

securities portfolio remained relatively constant with cash flow from maturities and prepayments primarily reinvested into

longer duration agency MBS.

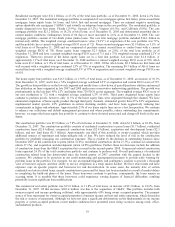

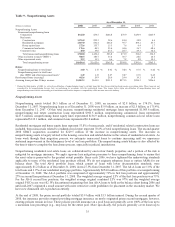

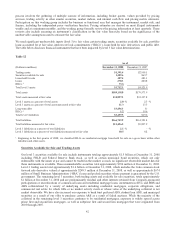

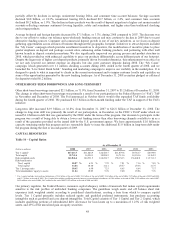

The size of the portfolio was $19.7 billion as of December 31, 2008, an increase of $3.4 billion, or 21.1%, from

December 31, 2007, due primarily to the net purchases during the fourth quarter of 2008 of MBS issued by federal agencies,

offset by the sale and contribution of a portion of our investment in Coke common stock along with a decline in the fair value

of the remaining portion of the Coke common stock.

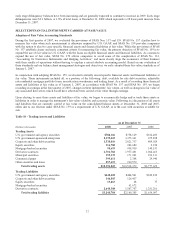

Net securities gains of $1.1 billion were realized during 2008, primarily due to the sale and contribution of a portion of our

investment in Coke common stock from which a $732.2 million gain was realized. Additionally in the fourth quarter of 2008,

$14.6 billion of MBS issued by federal agencies were purchased and $9.3 billion of primarily agency MBS were sold

generating a $413.1 million realized gain. The securites sold were held in conjunction with our risk management strategies

associated with economically hedging the value of MSRs. Net securities gains realized for the year ended December 31,

2007 were $243.1 million primarily related to the sale of Coke common stock, while we realized net securities losses of

$50.5 million for the year ended December 31, 2006.

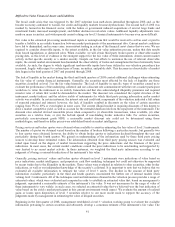

The portfolio’s effective duration decreased to 2.8% as of December 31, 2008 from 3.9% as of December 31, 2007. The

decline was caused by an increase in prepayment assumptions on our MBS portfolio. Effective duration is a measure of price

sensitivity of a bond portfolio to an immediate change in market interest rates, taking into consideration embedded options.

An effective duration of 2.8% suggests an expected price change of 2.8% from a one percent instantaneous change in market

interest rates. The average yield for 2008 declined to 5.99% compared to 6.20% during 2007. The yield remained relatively

constant during the first half of 2008 but began to decline significantly from 6.30% during the second quarter to 5.86%

during the third quarter, and 5.65% during the fourth quarter. The decline in yield during the second half of 2008 was

primarily driven by a decline in dividend income as a result of the sale and contribution of a portion of our investment in

Coke common stock. The yield during the fourth quarter was also negatively impacted by the decision of the FHLB to delay

the declaration of their quarterly dividend until the first quarter of 2009. We expect to see a further decline in the yield on

available for sale securities in the first quarter of 2009 due to the timing of the net purchase of lower-yielding MBS issued by

federal agencies in late December. In addition, should we experience an increase in prepayments on these newly acquired

MBS during the first quarter of 2009, we would see an additional decrease in yield due to the immediate recognition of the

unamortized premium on these securities.

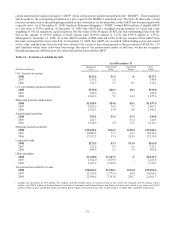

The carrying value of available for sale securities reflected $1.5 billion in net unrealized gains as of December 31, 2008,

comprised of a $1.4 billion unrealized gain from our remaining 30.0 million shares of Coke common stock and a less than

$0.1 billion net unrealized gain on the remainder of the portfolio.

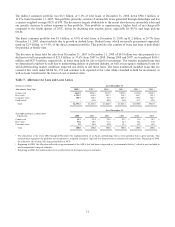

The credit quality of the securities portfolio was bolstered as a result of our purchase of agency MBS, with approximately

94% of the total securities available for sale portfolio rated “AAA,” the highest possible rating by nationally recognized

rating agencies. We review all of our securities with unrealized losses for other-than-temporary impairment at least quarterly.

During 2008, we recorded $83.8 million in other-than-temporary impairment charges within securities gains/(losses),

primarily related to $269.4 million in residential MBS and residual interests in which the default rates and loss severities of

the underlying collateral, including subprime and Alt-A loans, increased significantly during the year. These securities were

valued using either third party pricing data, including broker indicative bids, or expected cash flow models. There were no

similar charges recorded in 2007.

There is a potential in the future that proposed bankruptcy legislation may lead to future other-than-temporary impairment

charges associated primarily with super-senior private MBS, the amount of which is uncertain. The amortized cost of these

securities was $619.2 million with associated net unrealized losses of approximately $108.9 million as of December 31,

2008.

We hold stock in the FHLB of Atlanta and FHLB of Cincinnati totaling $493.2 million as of December 31, 2008. We account

for the stock based on the industry guidance in Statement of Position (“SOP”) 01-6 “Accounting by Certain Entities

(Including Entities With Trade Receivables) That Lend to or Finance the Activities of Others”, which requires the investment

be carried at cost and be evaluated for impairment based on the ultimate recoverability of the par value. We evaluated our

holdings in FHLB stock at December 31, 2008 and believe our holdings in the stock are ultimately recoverable at par. In

addition, we do not have operational or liquidity needs that would require a redemption of the stock in the foreseeable future

and therefore determined that the stock was not other-than-temporarily impaired.

40