SunTrust 2008 Annual Report Download - page 61

Download and view the complete annual report

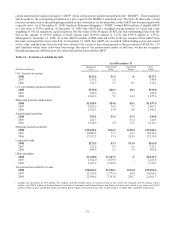

Please find page 61 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Both the Company and SunTrust Bank (the “Bank”) are subject to a minimum Tier 1 Capital and Total Capital ratios of 4%

and 8%, respectively, of risk weighted assets. To be considered “well-capitalized,” ratios of 6% and 10%, respectively, are

required. Additionally, the Company and the Bank are subject to Tier 1 Leverage ratio requirements, which measures Tier 1

Capital against average assets. The minimum and well-capitalized ratios are 3% and 5%, respectively.

In light of the current economic environment and the uncertainty with respect to the depth and duration of the recession, we

believe that it is prudent to hold capital in excess of our target. As such, we steadily built our capital position throughout the

year through several strategically planned actions which are detailed below.

• In the first quarter of 2008, we issued $685 million of trust preferred securities, which qualified as Tier 1 Capital,

and $500 million of subordinated notes, which favorably impacted our Total Capital ratio.

• In the second quarter of 2008, we sold 10 million shares of Coke common stock, which increased Tier 1 Capital by

$345 million as of the transaction date. See additional discussion in “Investment in Common Shares of the Coca-

Cola Company” in this MD&A for further discussion.

• In the third quarter of 2008, we executed two transactions that included 33.6 million shares of Coke common stock

that generated approximately $800 million, or 47 basis points, of additional Tier 1 Capital as of the transaction

date. See additional discussion in “Investment in Common Shares of the Coca-Cola Company” in this MD&A for

further discussion.

• In the fourth quarter of 2008, we participated in the Treasury’s Capital Purchase Program by issuing $4.9 billion in

preferred stock and related warrants to the Treasury under the EESA. Initially, we issued $3.5 billion in preferred

stock to build up our capital position to what we believed to be prudent levels given the uncertainty in the

economy. As a result of a significant deterioration in the economy in the fourth quarter, we chose to issue an

additional $1.35 billion in preferred stock, which represented our remaining capacity under the Capital Purchase

Program. Refer to our discussion in “Liquidity Risk” within this MD&A for additional information regarding the

terms of these securities.

• In an effort to preserve capital, the Board voted to reduce the quarterly common stock dividend by 30% starting

with the fourth quarter dividend which was $0.54 per common share.

In January 2009, we made the decision to further reduce our quarterly common stock dividend to $0.10 per common share

due to the credit and earnings environment that has deteriorated further since the original reduction of the common stock

dividend in the fourth quarter of 2008. Our decision to reduce the common stock dividend was not made lightly, but we

ultimately believed it was the responsible action to take in light of the further deterioration of the economy. On an ongoing

basis, we will reevaluate the common stock dividend, to balance prudence in our capital levels with the long-run view of the

profitability of the Bank and our desire to return a portion of our earnings to the shareholders.

Our decision to issue the preferred stock to the Treasury was made to enhance our already solid capital position and to allow

us to further expand our business. The decision was primarily made as a result of worsening economic indicators occurring in

the fourth quarter suggesting a recession that will endure longer than originally anticipated causing us to believe it prudent to

have the additional capital during the potentially challenging economic times ahead. As a result of the worsening economic

environment, we decided to issue the additional $1.35 billion in preferred stock due to an internal analysis of capital and

liquidity that considered several factors. As we were also evaluating acquisition activity and opportunities, we reached the

conclusion that potential capital requirements were more significant than previously thought due to asset and loan values that

had declined further. In addition, we wanted to ensure adequate capital would be readily available to meet the borrowing

needs of clients and prospects in the coming months and noted that most of our regional banking competitors had issued the

maximum amount of preferred stock under the program, potentially putting us at a competitive disadvantage had we not

obtained the additional capital. We have developed strategies and tactics to deploy the capital in a fashion that balances

supporting economic stability, safety and soundness, and earnings dilution. Specifically, we have deployed the additional

capital thus far by increasing our loans and agency MBS holdings, as well as in decreasing short-term borrowings.

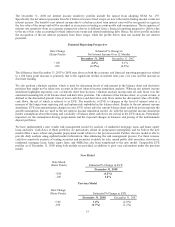

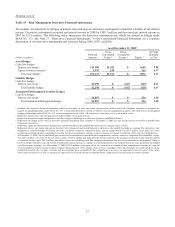

The Tier 1 Capital and Total Capital ratios improved from 6.93% and 10.30%, respectively, at December 31, 2007 to 10.87%

and 14.04% at December 31, 2008. The primary drivers of the increase were several Coke common stock transactions

executed during the second and third quarters, as well as our participation in the Capital Purchase Program in the fourth

quarter, as mentioned above. The Tier 1 Capital ratio also benefited from an overall reduction in risk weighted assets. The

reduction in risk weighted assets occurred, in part due to an ongoing effort to reduce illiquid trading securities, construction

related loans and commitments, and more generally to ensure that unused commitments are efficiently utilized. Also, in the

third quarter of 2008, the Tier 1 Capital ratio improved due to increasing the granularity of certain loan related data to

identify assets eligible for a lower risk weighting under applicable regulations.

49