SunTrust 2008 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

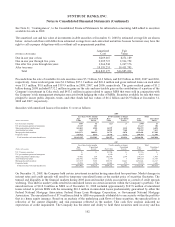

leases. Construction and software in process primarily includes in-process branch expansion, branch renovation, and software

development projects. Upon completion, branch related projects are maintained in premises and equipment while completed

software projects are reclassified to other assets. Maintenance and repairs are charged to expense, and improvements are

capitalized.

Goodwill and Other Intangibles Assets

Goodwill represents the excess of purchase price over the fair value of identifiable net assets of acquired companies.

Goodwill is assigned to reporting units, which are operating segments or one level below an operating segment, as of the

acquisition date. Goodwill is assigned to the Company’s reporting units that are expected to benefit from the synergies of the

business combination.

Goodwill is not amortized and instead is tested for impairment, at least annually, at the reporting unit level. The goodwill

impairment test is performed in two steps. The first step is used to identify potential impairment and the second step, if

required, identifies the amount of impairment by comparing the carrying amount of goodwill to its implied fair value. If the

implied fair value of the goodwill exceeds the carrying amount, there is no impairment. If the goodwill assigned to a

reporting unit exceeds the implied fair value of the goodwill, an impairment charge is recorded for the excess.

Identified intangible assets that have a finite life are amortized over their useful lives and are evaluated for impairment

whenever events or changes in circumstances indicate the carrying amount of the assets may not be recoverable.

Mortgage Servicing Rights (“MSRs”)

The Company recognizes as assets the rights to service mortgage loans based on the estimated fair value of the MSRs when

loans are sold and the associated servicing rights are retained. Fair value is determined using models which depend on

estimates of prepayment rates, discount rate and other valuation assumptions that are supported by market and economic data

collected from various outside sources.

Currently, the Company maintains one class of MSR asset and has elected to account for that class using the amortized cost

method. Amortization of MSRs is based on estimated future net servicing cash flows. The projected future cash flows are

derived from the same model and assumptions used to estimate the fair value of MSRs.

Impairment of MSRs is recognized when the fair value is less than the amortized cost basis of the MSRs. For purposes of

measuring impairment, MSRs are stratified based on interest rate and type of related loan. When fair value is less than

amortized cost for an individual stratum and the impairment is believed to be temporary, the impairment is recorded to a

valuation allowance through mortgage servicing income in the Consolidated Statement of Income; the impairment is

recorded as a write-down of the amortized cost basis of the MSRs when the impairment is deemed other-than-temporary. The

carrying value of MSRs is maintained on the Consolidated Balance Sheets in other intangible assets.

The Company has not historically hedged MSRs but has managed the economic risk through the Company’s overall asset/

liability management process with consideration to the natural counter-cyclicality of servicing and mortgage originations.

Effective January 1, 2009, the Company elected to create a second class of MSR asset that will be reported at fair value and

will be actively hedged. The new MSR class will include MSRs recognized on loans sold after December 31, 2008, as well as

MSRs related to loans originated and sold in 2008. The portion of existing MSRs being transferred to fair value reflects

management’s desire to actively hedge this portion of the existing MSR and also considers the availability of market inputs

used to determine fair value. MSRs associated with loans sold prior to 2008 will continue to be accounted for using the

amortized cost method and managed through the Company’s overall asset/liability management process.

Other Real Estate Owned

Assets acquired through, or in lieu of, loan foreclosure are held for sale and are initially recorded at the lower of the loan

balance or fair value at the date of foreclosure, less estimated costs to sell, establishing a new cost basis. Subsequent to

foreclosure, valuations are periodically performed by management, and the assets are carried at the lower of carrying amount

or fair value, less estimated costs to sell.

93