SunTrust 2008 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

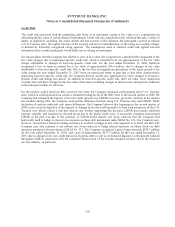

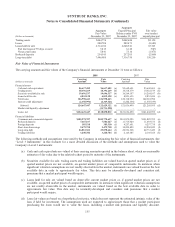

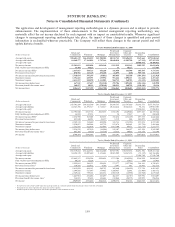

The following table presents the change in carrying value of those assets measured at fair value on a non-recurring basis, for

which impairment was recognized in the current period. The table does not reflect the change in fair value attributable to any

related economic hedges the Company may have used to mitigate the interest rate risk associated with loans held for sale or

MSRs. With respect to loans held for sale, the changes in fair value of the economic hedges were also recorded in mortgage

production related income and substantially offset the change in fair value of the financial assets referenced in the table

below. The Company’s economic hedging activities for loans held for sale are deployed at the portfolio level.

Fair Value Measurement at

December 31, 2008,

Using

(Dollars in thousands)

Net

Carrying Value

Quoted

Prices In

Active

Markets

for

Identical

Assets/Liabilities

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3) Valuation Allowance

Loans Held for Sale 1$839,758 - $738,068 $101,690 ($68,154)

MSRs 2794,783 - - 794,783 (370,000)

OREO 3500,481 - 500,481 - (54,450)

Affordable Housing 3471,156 - - 471,156 -

Loans 4178,692 - 178,692 - (34,105)

Other Assets 545,724 - - 45,724 -

Other Intangible Assets 617,298 - - 17,298 -

1These balances are measured at the lower of cost or market in accordance with SFAS No. 65 and SOP 01-6.

2These balances are measured at fair value on a non-recurring basis in accordance with SFAS No. 140, as amended. MSRs are stratified for the purpose of

impairment testing.

3These balances are measured at fair value on a non-recurring basis in accordance with SFAS No. 144. Affordable housing was impacted by a $19.9 million

impairment charge recorded during the year ended December 31, 2008.

4These balances are measured at fair value on a non-recurring basis using the fair value of the underlying collateral as described in SFAS No. 114 and were impacted

by a $34.1 million impairment charge recorded during the year ended December 31, 2008.

5These balances are measured at fair value on a non-recurring basis in accordance with APB No. 18 and were impacted by a $27.2 million impairment charge

recorded during the year ended December 31, 2008.

6These balances are measured at fair value on a non-recurring basis in accordance with SFAS No. 142 and SFAS No. 144 and were impacted by a $45.0 million

impairment charge recorded during the second quarter of 2008.

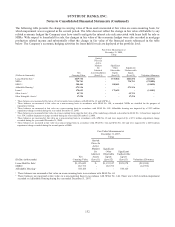

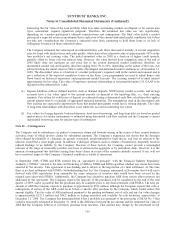

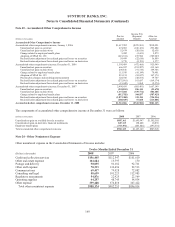

Fair Value Measurement at

December 31, 2007,

Using

(Dollars in thousands)

Net

Carrying Value

Quoted

Prices In

Active

Markets

for

Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3) Valuation Allowance

Loans Held for Sale 1$1,476,425 $- $1,155,347 $321,078 ($81,054)

OREO2183,753 - 183,753 - (12,393)

Affordable Housing 2544,160 - - 544,160 -

1These balances are measured at fair value on a non-recurring basis in accordance with SFAS No. 65.

2These balances are measured at fair value on a non-recurring basis in accordance with SFAS No. 144. There was a $63.4 million impairment

recorded on Affordable Housing during the year ended December 31, 2007.

152