SunTrust 2008 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

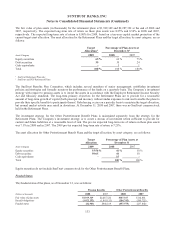

obligations of, the Company, were $245.2 million and $401.4 million, respectively. The fair values of the written CDS

were $34.7 million and $11.6 million at December 31, 2008 and 2007, respectively, and the fair values of the purchased

CDS were $45.8 million and $16.2 million at December 31, 2008 and 2007, respectively.

The Company writes swap participations, which are credit derivatives whereby the Company has guaranteed payment to

a dealer counterparty in the event that the counterparty experiences a loss on a derivative instrument, such as an interest

rate swap, due to a failure to pay by the counterparty’s customer (the “obligor”) on that derivative instrument. The

Company monitors its payment risk on its swap participations by monitoring the creditworthiness of the obligors, which

is based on the normal credit review process the Company would have performed had it entered into the derivative

instruments directly with the obligors. The obligors are all corporations or partnerships. At December 31, 2008, the

average credit risk of the overall portfolio of obligors approximated investment grade, such that the Company does not

believe that it is likely that it will be required to make payments on the swap participations. However, the Company

continues to monitor the creditworthiness of its obligors and the likelihood of payment could change at any time due to

unforeseen circumstances. Further, during 2008 and 2007, the Company did not make any payments under its written

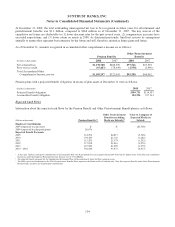

swap participations. At December 31, 2008, the remaining terms on these swap participations generally ranged from one

to ten years, with a weighted average on the maximum estimated exposure of 3.8 years. The Company’s maximum

estimated exposure to written swap participations, as measured by projecting a maximum value of the guaranteed

derivative instruments based on interest rate curve simulations and assuming 100% default by all obligors on the

maximum values, was approximately $125.7 million and $18.3 million at December 31, 2008 and 2007, respectively.

The fair values of the written swap participations were de minimis at December 31, 2008 and 2007. As part of its trading

activities, the Company may enter into purchased swap participations, but such activity is not matched, as discussed

herein related to CDS or TRS.

The Company has also entered into TRS contracts on loans. In certain of these contracts, the Company would be

required to pay the depreciated value, if any, of an underlying reference asset upon termination of the TRS; in this

manner, a TRS functions similar to a guarantee. However, the terms of the TRS would also entitle the Company to

receive the appreciated value, if any, of the underlying reference asset, which is different from traditional guarantees.

The Company’s TRS business consists of matched trades, such that when the Company pays depreciation on one TRS,

it receives the same depreciation on the matched TRS. As such, the Company does not have any long or short exposure,

other than credit risk of its counterparty, which is managed through collateralization. The Company typically receives

initial cash collateral from the counterparty upon entering into the TRS and is entitled to additional collateral as the fair

value of the underlying reference assets deteriorate. At December 31, 2008 and 2007, the Company had $602.1 million

and $38.0 million, respectively, of outstanding and offsetting TRS notional. The fair values of the TRS derivative

liabilities were $166.6 million and $0.1 million at December 31, 2008 and 2007, respectively. The fair values of the

offsetting TRS derivative assets at December 31, 2008 and 2007 were $171.0 million and $0.1 million, respectively, and

related collateral held at December 31, 2008 and 2007 was $296.8 million and $77.7 million, respectively. As of

December 31, 2008, the Company had decided to exit its TRS business, which will result in the underlying reference

assets being sold and the outstanding TRS notional amounts being terminated. The Company has not incurred any losses

on these unwinds to date and does not expect to incur any, as the TRS trades have been appropriately collateralized and

payables and receivables resulting from depreciation or appreciation of the referenced assets will offset.

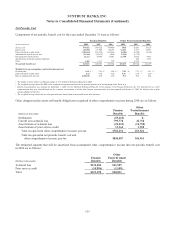

Other

In the normal course of business, the Company enters into indemnification agreements and provides standard

representations and warranties in connection with numerous transactions. These transactions include those arising from

securitization activities, underwriting agreements, merger and acquisition agreements, loan sales, contractual

commitments, payment processing sponsorship agreements, and various other business transactions or arrangements.

The extent of the Company’s obligations under these indemnification agreements depends upon the occurrence of future

events; therefore, the Company’s potential future liability under these arrangements is not determinable.

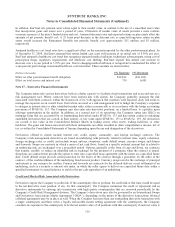

SunTrust Investment Services, Inc. (“STIS”) and SunTrust Robinson Humphrey, Inc. (“STRH”), broker-dealer affiliates

of SunTrust, use a common third party clearing broker to clear and execute their customers’ securities transactions and

to hold customer accounts. Under their respective agreements, STIS and STRH agree to indemnify the clearing broker

for losses that result from a customer’s failure to fulfill its contractual obligations. As the clearing broker’s rights to

charge STIS and STRH have no maximum amount, the Company believes that the maximum potential obligation cannot

be estimated. However, to mitigate exposure, the affiliate may seek recourse from the customer through cash or

securities held in the defaulting customers’ account. For the year ended ended December 31, 2008 and December 31,

143