SunTrust 2008 Annual Report Download - page 55

Download and view the complete annual report

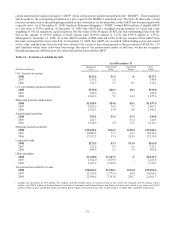

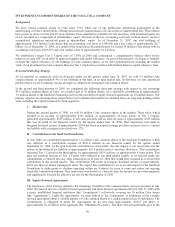

Please find page 55 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ARS purchased since the auction rate market began failing in February 2008 have all been considered level 3 securities.

We classify ARS as securities available for sale or trading securities. ARS include municipal bonds, nonmarketable

preferred equity securities, and ABS collateralized by student loans or trust preferred bank obligations. Under a

functioning ARS market, ARS could be remarketed with tight interest rate caps to investors targeting short-term

investment securities that repriced generally every 7 to 28 days. Unlike other short-term instruments, these ARS do not

benefit from back-up liquidity lines or letters of credit, and therefore, as auctions began to fail, investors were left with

securities that were more akin to longer-term, 20-30 year, illiquid bonds, with the anticipation that auctions will

continue to fail in the foreseeable future. The combination of materially increased tenors, capped interest rates and

general market illiquidity has had a significant impact on the risk profiles and market values of these securities and has

resulted in the use of valuation techniques and models that rely on significant inputs that are largely unobservable.

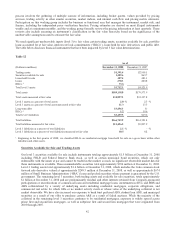

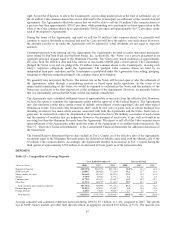

At December 31, 2008, we hold SIV assets which are in receivership and are carried at a fair value of approximately

$188 million. In addition, we hold corporate bond exposure to Lehman Brothers, which is undergoing bankruptcy

proceedings, that is carried at a fair value of approximately $6.7 million. At December 31, 2008, 40 level 3 ABS and

MBS that we own were downgraded during the year ended December 31, 2008 due to continued deterioration in the

credit quality of the underlying collateral and in many cases, the downgrade of a monoline insurer of the security. The

fair value of the downgraded securities totaled approximately $200 million at December 31, 2008 and includes $135

million of first lien mortgages, $14 million of second lien mortgages, $45 million of trust preferred bank obligations, $1

million of student loan ARS, and $5 million of special purpose vehicles (“SPV”) repackaged risk. We recognized

additional unrealized losses of approximately $68 million for the year ended December 31, 2008 on these downgraded

securities. There is also approximately $32 million of unrealized losses that have not been recognized in earnings related

to two MBS available for sale that were downgraded in 2008, but continue to maintain an investment grade rating. We

have evaluated these securities for impairment and believe all contractual principal and interest payments will be

received timely for these securities, and therefore, have taken no impairment through earnings. If future performance in

the underlying collateral of ABS and MBS further declines, we would anticipate additional downgrades and valuation

reductions, as well as other-than-temporary impairment adjustments.

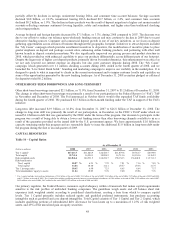

Residual and other retained interests classified as securities available for sale or trading securities are valued based on

internal models which incorporate assumptions, such as prepayment speeds and estimated credit losses, which are not

market observable. Generally, we attempt to obtain pricing for our securities from a third party pricing provider or third

party brokers who have experience in valuing certain investments. This pricing may be used as either direct support for

our valuation or used to validate outputs from our own proprietary models. Although third party price indications have

been available for the majority of the securities, limited trading activity makes it difficult to support the observability of

these quotations. Therefore, we evaluate third party pricing to determine the reasonableness of the information relative

to changes in market data such as trades we executed during the quarter, market information received from outside

market participants and analysts, or changes in the underlying collateral performance. When third party pricing is not

available to corroborate pricing information received, we will use industry standard or proprietary models to estimate

fair value, and will consider assumptions such as relevant market indices that correlate to the underlying collateral,

prepayment speeds, default rates, loss severity rates, and discount rates.

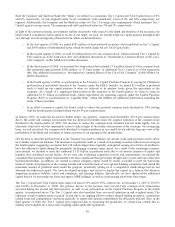

The Asset-backed Securities Indices (“ABX Indices”) have a high correlation to subprime, second lien and certain Alt-A

exposures, particularly for the direct residential MBS exposure where vintage and collateral type are more easily

determined. As such, the dollar prices and corresponding discount margins from the ABX indices are a relevant market

data point to consider when estimating the fair value of certain ABS. We will also consider premiums or discounts

relative to an index based on information we have obtained from our trades of similar assets and other information made

available to us. The use of ABX indices to value certain level 3 ABS was minimal at December 31, 2008 as the size of

our exposure to these types of assets has decreased through sales and paydowns or as other market information becomes

available to use in estimations of fair value. We also may use ABX indices, as well as other synthetic indices such as the

Credit Derivatives Index (“CDX”) and Commercial Mortgage-backed Securities Index (“CMBX”), when valuing

collateral underlying CDO and SIV assets as an input to assist in determining overall valuation of the CDO or SIV

security owned. Pricing on these securities declined significantly due to the significant widening in these indices for

year ended December 31, 2008.

Due to the continued illiquidity and credit risk of level 3 securities, these market values are highly sensitive to

assumption changes and market volatility. In many instances, pricing assumptions for level 3 securities may fall within

an acceptable range of values. In those cases, we attempt to consider all information to determine the most appropriate

price within that range. Improvements may be made to our pricing methodologies on an ongoing basis as observable and

relevant information becomes available to us, including a comparison of actual sales prices to the most recent value

placed on the asset prior to sale to validate our pricing methodologies. During the year ended December 31, 2008, we

sold approximately $1.6 billion of level 3 ABS, and received approximately $50.7 million through the settlement

proceeding of one SIV under enforcement, providing us with relevant and timely market data to utilize in determining

43