SunTrust 2008 Annual Report Download - page 77

Download and view the complete annual report

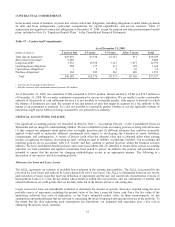

Please find page 77 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• estimated net realizable value of the underlying collateral

• price indications from independent third parties

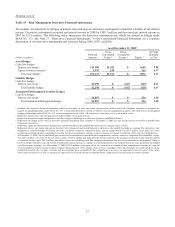

Observable market information is utilized to the extent available and relevant. The estimated fair values reflect

management’s assumptions regarding how a market participant would value the net assets and includes appropriate credit,

liquidity, and market risk premiums that are indicative of the current environment. Currently, estimated liquidity and market

risk premiums on certain loan categories ranged from 5% to 20% due to the distressed nature of the market; however, those

values may not be indicative of the ultimate economic value of those assets. For example, the fair value of the loans based on

estimated future cash flows discounted at new origination rates for loans with similar terms and credit quality, (i.e. discount

rates exclusive of the market risk premium and liquidity discount) derives an estimated fair value that approximates 95% of

the loans’ carrying value.

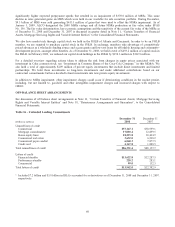

If the implied fair value of the goodwill for the reporting unit exceeds the carrying value of the goodwill for the respective

reporting unit, no goodwill impairment is recorded. Changes in the estimated fair value of the individual assets and liabilities

may result in a different amount of implied goodwill, and ultimately the amount of goodwill impairment, if any. Sensitivity

analysis is performed to assess the potential ranges of implied goodwill. In the case of separately estimating the implied

goodwill for our Mortgage, Commercial Real Estate, and Corporate and Investment Banking reporting units, the fair value of

the reporting unit’s assets and liabilities was estimated to be a net liability as of December 31, 2008, which caused the

implied fair value of the reporting unit’s goodwill to exceed its carrying value, resulting in no goodwill impairment. The size

of the implied goodwill was significantly affected by the estimated fair value of the loans pertaining to these reporting units.

The fair value estimate of these loan portfolios ranged from approximately 75% to 90%. The estimated fair value of these

loan portfolios is based on an exit price, and the assumptions used are intended to approximate those that a market participant

would use in valuing the loans in an orderly transaction, including a market liquidity discount. As previously mentioned, the

significant market risk premium that is a consequence of the current distressed market conditions was a significant

contributor to the valuation discounts associated with these loans. However, it is possible that future changes in the fair value

of the reporting unit’s net assets could result in future goodwill impairment. For example, to the extent that market liquidity

returns and the fair value of the individual assets of a reporting unit increases at a faster rate than the fair value of the

reporting unit as a whole, that may cause the implied goodwill of a reporting unit to be lower than the carrying value of

goodwill, resulting in goodwill impairment.

Income Taxes

We are subject to the income tax laws of the various jurisdictions where we conduct business and estimate income tax

expense based on amounts expected to be owed to these various tax jurisdictions. On a quarterly basis, we evaluate the

reasonableness of our effective tax rate based upon a current estimate of net income, tax credits, non-taxable income and the

applicable statutory tax rates expected for the full year. The estimated income tax expense is reported in the Consolidated

Statements of Income.

Accrued taxes represent the net estimated amount due to or to be received from tax jurisdictions either currently or in the

future and are reported in other liabilities on the Consolidated Balance Sheets. We assess the appropriate tax treatment of

transactions and filing positions after considering statutes, regulations, judicial precedent and other pertinent information and

maintain tax accruals consistent with our evaluation. Changes in the estimate of accrued taxes occur periodically due to

changes in tax rates, interpretations of tax laws, the status of examinations by the tax authorities and newly enacted statutory,

judicial and regulatory guidance that could impact the relative merits of tax positions. These changes, when they occur,

impact accrued taxes and can materially affect our operating results.

We periodically evaluate our uncertain tax positions and estimate the appropriate level of tax reserves related to each of these

positions. Additionally, we evaluate the realizability of deferred tax asset positions based on expectations of future taxable

income. The evaluation pertaining to the tax expense and related tax asset and liability balances involves a high degree of

judgment and subjectivity around the ultimate measurement and resolution of these matters.

Pension Accounting

Several variables affect the annual pension cost and the annual variability of cost for our retirement programs. The main

variables are: (1) size and characteristics of the employee population, (2) discount rate, (3) expected long-term rate of return

on plan assets, (4) recognition of actual asset returns, (5) other actuarial assumptions and (6) healthcare cost. Below is a brief

description of these variables and the effect they have on our pension costs.

Size and Characteristics of the Employee Population

Pension cost is directly related to the number of employees covered by the plans, and other factors including salary, age,

years of employment, and benefit terms. Effective January 1, 2008, retirement plan participants who were employed as of

65