SunTrust 2008 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

See Note 11, “Certain Transfers of Financial Assets, Mortgage Servicing Rights and Variable Interest Entities,” to the

Consolidated Financial Statements for discussion of the impairment reserve recorded with respect to MSRs during 2008.

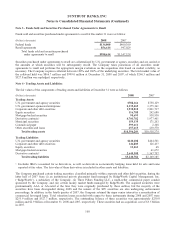

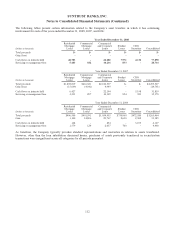

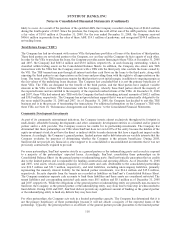

The estimated amortization expense for intangible assets, excluding amortization of MSRs, is as follows:

(Dollars in thousands)

Core Deposit

Intangible Other Total

2009 $41,081 $15,372 $56,453

2010 33,059 11,400 44,459

2011 26,533 8,493 35,026

2012 20,016 8,074 28,090

2013 13,617 6,917 20,534

Thereafter 11,005 29,386 40,390

Total $145,311 $79,642 $224,953

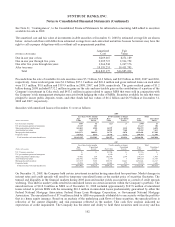

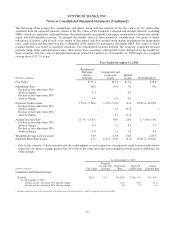

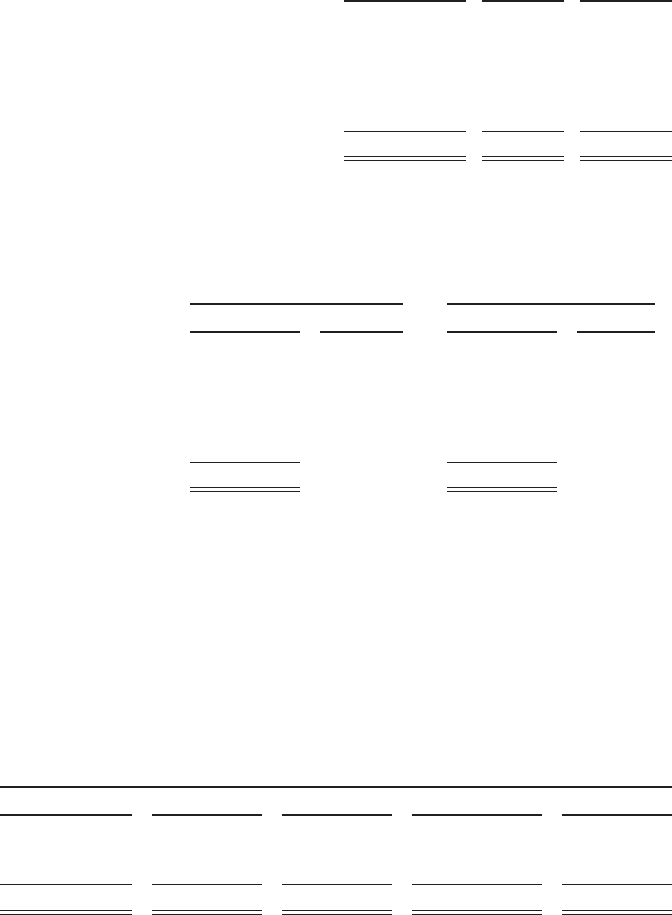

Note 10 - Other Short-Term Borrowings and Contractual Commitments

Other short-term borrowings as of December 31 include:

2008 2007

(Dollars in thousands) Balance Rates Balance Rates

Term Auction Facility $2,500,000 .49 % $- - %

Dealer collateral 1,055,606 various 445,836 various

Master notes 1,034,555 .25 1,683,387 3.45

Short-term promissory notes 70,000 1.50 678,000 various

U.S. Treasury demand notes 39,200 - 123,000 3.55

Other 466,999 various 91,135 various

Total other short-term borrowings $5,166,360 $3,021,358

The average balances of other short-term borrowings for the years ended December 31, 2008, 2007, and 2006 were $3.1

billion, $2.5 billion, and $1.5 billion, respectively, while the maximum amounts outstanding at any month-end during the

years ended December 31, 2008, 2007, and 2006 were $5.2 billion, $3.8 billion, and $2.4 billion, respectively. As of

December 31, 2008, the Company had collateral pledged to the Federal Reserve discount window to support $10.7 billion of

available borrowing capacity.

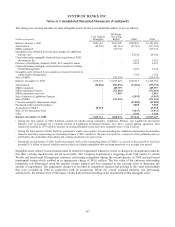

In the normal course of business, the Company enters into certain contractual obligations. Such obligations include

obligations to make future payments on debt and lease arrangements, contractual commitments for capital expenditures, and

service contracts. As of December 31, 2008, the Company had the following in unconditional obligations:

As of December 31, 2008

(Dollars in millions) 1 year or less 1-3 years 3-5 years After 5 years Total

Operating lease obligations $208 $375 $313 $728 $1,624

Capital lease obligations 113 2 10 16

Purchase obligations 2104 282 226 640 1,252

Total $313 $660 $541 $1,378 $2,892

1Amounts do not include accrued interest.

2Includes contracts with a minimum annual payment of $5 million.

108