SunTrust 2008 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

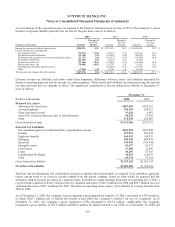

Notes to Consolidated Financial Statements (Continued)

provide funding to Three Pillars in the event it can no longer issue commercial paper or in certain other circumstances.

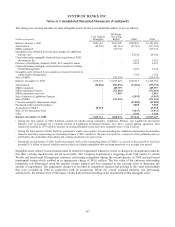

The Company’s activities with Three Pillars generated total fee revenue for the Company, net of direct salary and

administrative costs incurred by the Company, of approximately $48.2 million, $28.7 million, and $31.0 million for the

years ended December 31, 2008, 2007, and 2006, respectively.

Three Pillars has issued a subordinated note to a third party, which matures in March 2015; however, the note holder

may declare the note due and payable upon an event of default, which includes any loss drawn on the note funding

account that remains unreimbursed for 90 days. The subordinated note holder absorbs the first dollar of loss in the event

of nonpayment of any of Three Pillars’ assets. Only the remaining balance of the first loss note, after any incurred

losses, will be due. If the first loss note holder declared its loss note due under such circumstances and a new first loss

note or other first loss protection was not obtained, the Company would likely consolidate Three Pillars on a prospective

basis. The outstanding and committed amounts of the subordinated note were $20.0 million at December 31, 2008 and

2007.

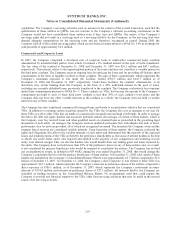

The Company has determined that Three Pillars is a VIE, as Three Pillars has not issued sufficient equity at risk, as

defined by FIN 46(R), that would otherwise control Three Pillars. The Company and the holder of the subordinated note

are the two significant VIE holders in Three Pillars. The Company and this holder are not related parties or de facto

agents of one another. As such, the Company has developed a mathematical model that calculates the expected losses

and expected residual returns of Three Pillar’s assets and operations, based on a Monte Carlo simulation, and allocates

each to the Company and the holder of the subordinated note. The results of this model, which the Company evaluates

monthly, have shown that the holder of the subordinated note absorbs the majority of Three Pillars’ expected losses. The

Company believes the subordinated note is sized in an amount sufficient to absorb the expected loss of Three Pillars

based on current commitment levels as well as on the forecasted growth in Three Pillars’ assets and, therefore, has

concluded it is not Three Pillars’ primary beneficiary and is not required to consolidate Three Pillars. Should future

losses reduce the subordinated note funding account below its required level or if the note is reduced to a size deemed

insufficient to support the growth of the assets in Three Pillars, the Company would likely be required to consolidate

Three Pillars, if an amendment of the current subordinate note or a new subordinate note could not be obtained. The

Company currently believes events resulting in consolidation are unlikely to occur.

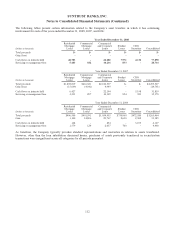

As of December 31, 2008 and December 31, 2007, Three Pillars had assets not included on the Company’s

Consolidated Balance Sheets of approximately $3.5 billion and $5.3 billion, respectively, consisting primarily of

secured loans. Funding commitments and outstanding receivables extended by Three Pillars to its customers totaled $5.9

billion and $3.5 billion, respectively, as of December 31, 2008, almost all of which renew annually. Funding

commitments and outstanding receivables extended by Three Pillars to its customers totaled $7.7 billion and $4.6

billion, respectively, as of December 31, 2007. The majority of the commitments are backed by trade receivables and

commercial loans that have been originated by companies operating across a number of industries. Assets supporting

those commitments have a weighted average life of 1.52 years. The majority of the commitments are backed by trade

receivables and commercial loans, which collateralize 47% and 20%, respectively, of the outstanding commitments, as

of December 31, 2008. Each transaction added to Three Pillars is typically structured to an implied ‘A/A2’ rating

according to established credit and underwriting policies as approved by Credit Risk Management and monitored on a

regular basis to ensure compliance with each transaction’s terms and conditions. Typically, transactions contain

dynamic credit enhancement structures that provide increased credit protection in the event asset performance

deteriorates. If asset performance deteriorates beyond predetermined covenant levels, the transaction could become

ineligible for continued funding by Three Pillars. This could result in the transaction being amended with the approval

of Credit Risk Management or Three Pillars could terminate the transaction and enforce any rights or remedies

available; including amortization of the transaction or liquidation of the collateral. In addition, Three Pillars has the

option to fund under the liquidity facility provided by the Company in connection with the transaction and may be

required to fund under the liquidity facility if the transaction remains in breach. In addition, each commitment renewal

requires Credit Risk Management approval. The Company is not aware of unfavorable trends within Three Pillars for

which the Company expects to suffer material losses. During the years ended December 31, 2008 and 2007, there were

no write-downs of Three Pillars’ assets.

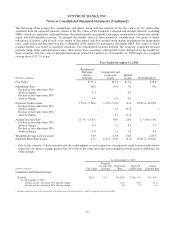

At December 31, 2008, Three Pillars’ outstanding CP used to fund the above assets totaled $3.5 billion, with remaining

weighted-average lives of 13.5 days and maturities through March 19, 2009. Three Pillars was generally able to fund

itself by issuing CP on behalf of commercial clients, despite the lack of market liquidity. However, during the month of

September 2008, the illiquid markets put a significant strain on the CP market and, as a result of this temporary

disruption, the Company purchased approximately $275.4 million par amount of Three Pillars overnight CP, none of

116