SunTrust 2008 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

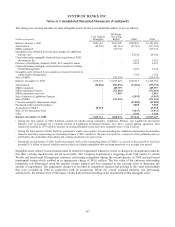

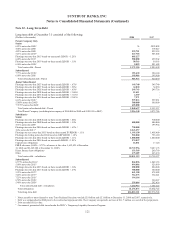

The following tables present key assumptions and inputs, along with the impacts on the fair values of two unfavorable

variations from the expected amounts, related to the fair values of the Company’s retained and residual interests, excluding

MSRs, which are separately addressed herein. Retained interests in residential mortgage securitization transactions include

senior and subordinated securities. To estimate the market value of these securities, consideration was given to dealer

indications of market value as well as the results of discounted cash flow models using market assumptions for prepayment

rates, credit losses and discount rates due to illiquidity in the market for non-agency residential MBS. Fair value for senior

retained interest was based on modeled valuations. For subordinated retained interests, the Company valued the retained

interests using dealer indicated prices since these prices more accurately reflected the severe disruption in the market for

these securities. The fair value of subordinated interest totaled $4.4 million as of December 31, 2008 based on a weighted

average price of 12.3% of par.

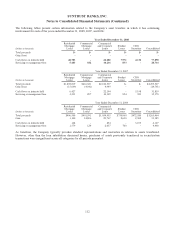

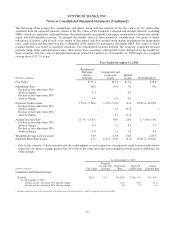

Year Ended December 31, 2008

(Dollars in millions)

Residential

Mortgage

Senior

Interests

Commercial and

Corporate

Loans

Student

Loans CDO Securities

Fair Value $135.2 $23.0 $13.4 $45.0

Prepayment Rate 14% 10% 7% 0%

Decline in fair value from 10%

adverse change 1.9 - 0.3 -

Decline in fair value from 20%

adverse change 4.0 0.1 0.6 -

Expected Credit Losses 1.51% - 2.78% 1.21% -5.0% N/A 22.81% -30.58%

Decline in fair value from 10%

adverse change - 12.3 N/A - 1

Decline in fair value from 20%

adverse change - 14.3 N/A - 1

Annual Discount Rate 11.5% - 16.0% 40% 25% L + 6% to 8%

Decline in fair value from 10%

adverse change 4.9 1.2 0.9 2.7

Decline in fair value from 20%

adverse change 9.9 2.3 1.8 8.6

Weighted Average Life (in years) 5.69 2.69 5.83 24.97

Expected Static Pool Losses 2.31 1.21% - 5.0% N/A 22.81% -30.58%

1Due to the seniority of these interests and the credit support in each transaction, the expected credit losses would need to

experience an adverse change greater than 20% before the expected credit loss assumption would result in additional fair

value changes.

As of December 31, 2007

(Dollars in millions) Fair Value

Weighted

Average Life

(in years)

Prepayment

Rate

Expected

Credit Losses

Annual

Discount Rate

Commercial and Corporate Loans 1

Residual $90.9 4.37 7% -20% 0.35% -2% 13% -22%

As of December 31, 2007

Decline in fair value from 10% adverse change $1.0 $1.0 $3.2

Decline in fair value from 20% adverse change 1.8 1.7 6.2

1Includes residual interests held in association with student loan securitization activity, which are separately presented in 2008.

113