SunTrust 2008 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Shareholders:

As we all know, the banking landscape has changed

significantly, and not for the better, since I wrote our

annual report shareholder letter a year ago. Indeed,

the operating environment in 2008 for our industry —

and for our institution — was the most difficult I have

experienced in my entire career. The largely unprecedented

combination of punishing economic and market forces

that battered our industry throughout 2008 has been

well reported and need not be recounted here. We are

acutely aware that, from an investor perspective, 2008

was not a good year.

At the end of the day, any bank’s financial performance

largely reflects the economy in the markets in which it

operates. There is no way to minimize the negative impact

a deteriorating economy and meltdown in the housing

and credit markets had on SunTrust’s 2008 financial

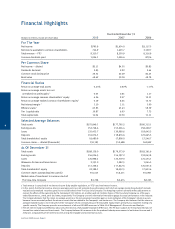

results: Net income available to common shareholders

was $746.9 million, or $2.13 per average common

diluted share, for 2008, compared to $1,603.7 million,

or $4.55 per average common diluted share, for the

previous year. A comprehensive discussion of our 2008

financial results can be found in the Form 10-K that

follows this letter.

The effects of increasingly dismal market conditions in

2008 were most visibly reflected in the credit arena, as

net charge-offs, nonperforming loans, and credit-related

expenses all climbed higher as the economy sank lower.

Annual net charge-offs in 2008 were $1,564.3 million,

compared to $422.8 million in 2007; the corresponding

net charge-off ratios were 1.25% in 2008 and 0.35% in

the prior year. Total nonperforming loans were $3.9 billion,

or 3.10% of total loans, as of December 31, 2008,

compared to $1.4 billion, or 1.17% of total loans, as

of December 31, 2007. The increase in nonperforming

loans was mainly due to an increase in nonperforming

residential mortgages and real estate construction

loans, as the overall weakening of the housing markets

and economy continued to increase delinquencies and

decrease the value of our collateral.

One of the most difficult decisions we had to make in

light of the bleak economic environment was to reduce

the quarterly dividend to $0.10 per common share

outstanding beginning in 2009. Although dividend

reductions essentially became common practice in our

industry, we took this decision very seriously, as we are

sensitive to the impact it has on our shareholders. We

know that many of you have come to rely on a certain

level of dividend income from your SunTrust investment.

However, given the pressures on the industry and on

SunTrust, we concluded that maintaining the dividend

at previous levels was neither realistic nor responsible,

and, regrettably, the reduced dividend was the appropriate

financial decision for the preservation of long-term

shareholder value. You should know that this situation

merits, and will receive, ongoing analysis.

Financial Strength & Fundamentals

Ultimately, responsible financial stewardship calls for us

to manage the institution in a prudent manner to maintain

fundamental financial strength, which is always important

but never more so than in times of severe economic stress.

In this context, and reflecting our specific priority of

managing capital resources to provide strength and

stability against uncertainty as well as to support growth

initiatives, we completed three separate transactions

to optimize our long-term holdings of The Coca-Cola

Company (“Coke”) common stock. These Coke-related

transactions increased SunTrust’s regulatory capital

by $1.1 billion at an important time. Further, to balance

our responsibilities to our clients and our shareholders

with our responsibilities to help support the financial

system, we participated in the U.S. Treasury’s Capital

Purchase Program of the Emergency Economic Stabilization

Act of 2008.

The additional $4.9 billion in capital resulting from our

sale of preferred securities under this program enhances

our capacity to continue to make good loans to qualied

borrowers and work with homeowners under pressure.

SunTrust believes foreclosure prevention is central to

helping stabilize the housing market and is an active

participant in a cross section of industrywide homeowner

relief programs. In addition, we work aggressively to

directly help SunTrust clients at risk of foreclosure stay

SunTrust 2008 Annual Report

1