SunTrust 2008 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

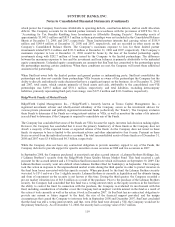

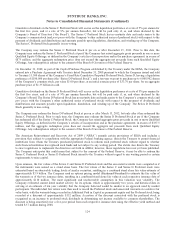

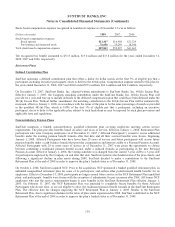

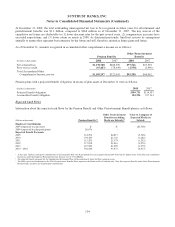

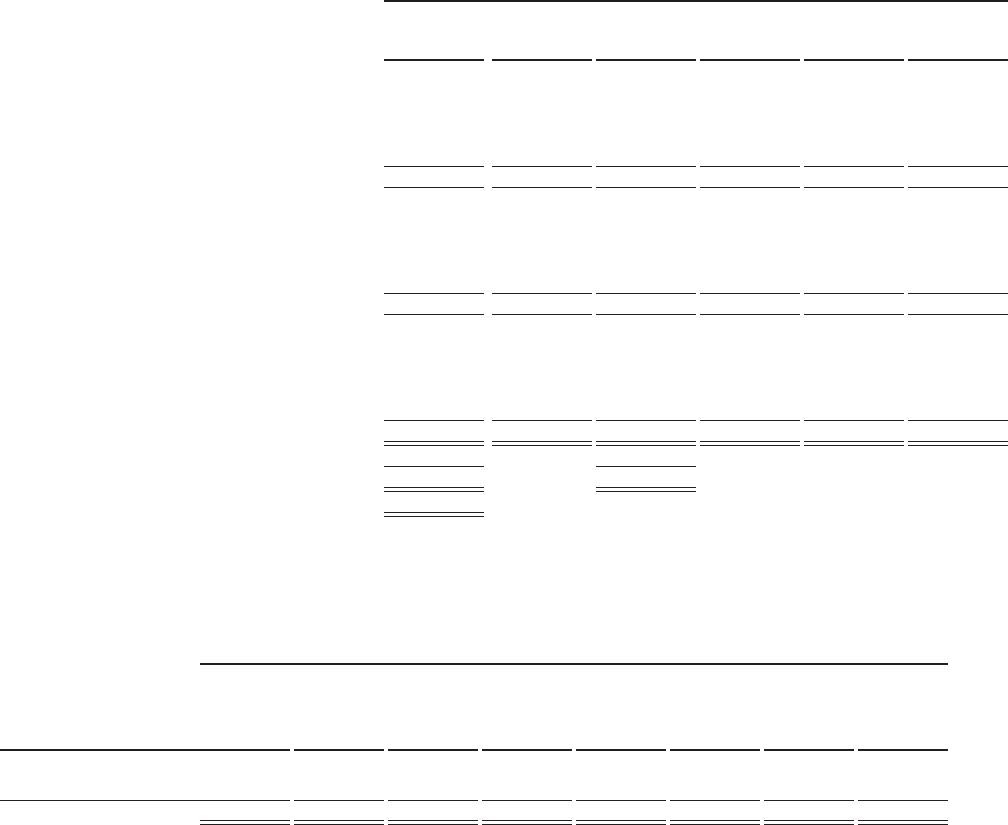

The following table presents a summary of stock option and performance and restricted stock activity:

Stock Options Performance and Restricted Stock

(Dollars in thousands except per share data) Shares

Price

Range

Weighted

Average

Exercise Price Shares

Deferred

Compensation

Weighted

Average

Grant Price

Balance, January 1, 2006 21,790,455 $14.18 -$76.50 $62.46 2,326,969 $26,222 $34.58

Granted 956,106 71.03 - 83.74 71.17 860,959 62,355 72.42

Exercised/vested (3,594,131) 14.18 - 74.89 53.63 (1,157,148) - 22.68

Cancelled/expired/forfeited (471,720) 14.18 - 73.40 70.81 (160,176) (9,750) 60.87

Amortization of compensation

for performance and restricted stock - - - - (18,340) -

Balance, December 31, 2006 18,680,710 14.56 - 83.74 64.39 1,870,604 60,487 57.12

Granted 717,494 77.75 - 85.06 85.04 1,054,837 88,892 84.27

Exercised/vested (2,887,293) 14.56 - 78.39 60.50 (339,437) - 50.21

Cancelled/expired/forfeited (452,765) 14.56 - 85.06 72.36 (315,660) (20,612) 65.30

Amortization of compensation element

for performance and restricted stock - - - - (35,299) -

Repurchase of AMA member interests - - - - (2,846) -

Balance, December 31, 2007 16,058,146 17.06 - 85.06 65.79 2,270,344 90,622 69.63

Granted 1,473,284 29.54 - 64.58 57.43 2,021,564 117,039 57.90

Exercised/vested (514,149) 18.77 - 65.33 49.16 (213,431) - 55.16

Cancelled/expired/forfeited (1,476,358) 31.80 -154.61 69.30 (275,065) (17,611) 64.04

Acquisition of GB&T 100,949 46.39 -154.61 76.82 - - -

Amortization of compensation element for performance and

restricted stock - - - - (76,656) -

Balance, December 31, 2008 15,641,872 $17.06 -$150.45 $65.29 3,803,412 $113,394 $64.61

Exercisable, December 31, 2008 12,827,330 $64.90

Available for Additional Grant, December 31, 2008 110,914,555

1Includes 4,108,204 shares available to be issued as restricted stock.

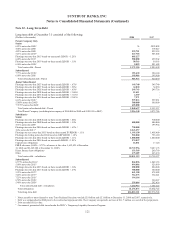

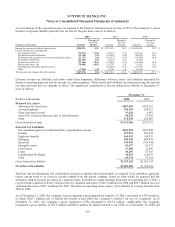

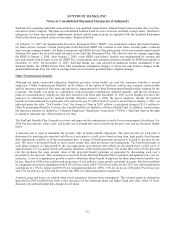

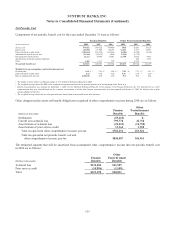

The following table presents information on stock options by ranges of exercise price:

(Dollars in thousands, except per share data)

Options Outstanding Options Exercisable

Range of Exercise

Prices

Number

Outstanding at

December 31,

2008

Weighted

Average

Exercise Price

Weighted

Average

Remaining

Contractual Life

(Years)

Total

Aggregate

Intrinsic

Value

Number

Exercisable at

December 31,

2008

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Life (Years)

Total

Aggregate

Intrinsic

Value

$17.06 to 49.46 861,071 $39.34 5.47 $61 561,071 $44.58 3.04 $61

$49.47 to 64.57 5,314,741 56.51 3.25 - 5,304,157 56.50 3.25 -

$64.58 to 150.45 9,466,060 72.58 5.56 - 6,962,102 72.93 4.57 -

15,641,872 $65.29 4.77 $61 12,827,330 $64.90 3.96 $61

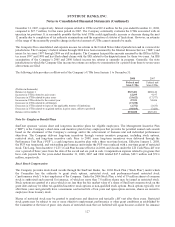

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the difference between the

Company’s closing stock price on the last trading day of 2008 and the exercise price, multiplied by the number of

in-the-money options) that would have been received by the option holders had all option holders exercised their options on

December 31, 2008. This amount changes based on the fair market value of the Company’s stock. Total intrinsic value of

options exercised for the twelve months ended December 31, 2008, 2007, and 2006 was $4.5 million, $68.2 million, and

$85.7 million, respectively. Total fair value of performance and restricted shares vested was $11.8 million, $17.0 million, and

$26.2 million, for the twelve months ended December 31, 2008, 2007 and 2006, respectively.

As of December 31, 2008 and 2007, there was $126.7 million and $105.3 million unrecognized stock-based compensation

expense related to nonvested stock options and performance and restricted stock. The amount recorded as of December 31,

2008 is expected to be recognized over a weighted average period of 1.79 years.

129