SunTrust 2008 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

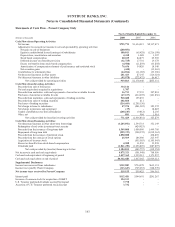

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

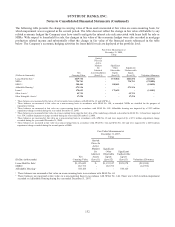

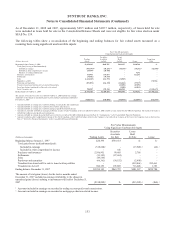

(Dollars in thousands)

Aggregate

Fair Value

December 31, 2007

Aggregate

Unpaid Principal

Balance under FVO

December 31, 2007

Fair value

over/(under)

unpaid principal

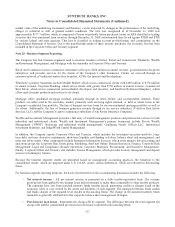

Trading assets $444,774 $442,624 $2,150

Loans 220,784 229,473 (8,689)

Loans held for sale 6,314,106 6,248,541 65,565

Past due loans of 90 days or more 5,213 6,140 (927)

Nonaccrual loans 5,841 7,316 (1,475)

Brokered deposits 234,345 237,205 (2,860)

Long-term debt 7,446,980 7,316,750 130,230

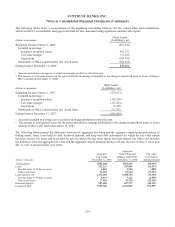

Fair Value of Financial Instruments

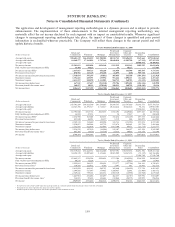

The carrying amounts and fair values of the Company’s financial instruments at December 31 were as follows:

2008 2007

(Dollars in thousands)

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Financial assets

Cash and cash equivalents $6,637,402 $6,637,402 (a) $5,642,601 $5,642,601 (a)

Trading assets 10,396,269 10,396,269 (b) 10,518,379 10,518,379 (b)

Securities available for sale 19,696,537 19,696,537 (b) 16,264,107 16,264,107 (b)

Loans held for sale 4,032,128 4,032,128 (c) 8,851,695 8,853,694 (c)

Total loans 126,998,443 126,998,443 122,318,994 122,318,994

Interest/credit adjustment (2,350,996) (4,369,121) (1,282,504) (1,050,039)

Subtotal 124,647,447 122,629,322 (d) 121,036,490 121,268,955 (d)

Market risk/liquidity adjustment - (11,731,290) --

Loans, net $124,647,447 $110,898,032 (d) $121,036,490 $121,268,955 (d)

Financial liabilities

Consumer and commercial deposits $105,275,707 $105,770,657 (e) $101,870,025 $101,889,709 (e)

Brokered deposits 7,667,167 7,586,427 (f) 11,715,024 11,693,673 (f)

Foreign deposits 385,510 385,510 (f) 4,257,601 4,257,738 (f)

Short-term borrowings 9,479,750 9,479,750 (f) 12,200,820 12,200,820 (f)

Long-term debt 26,812,381 25,878,644 (f) 22,956,508 22,733,420 (f)

Trading liabilities 3,240,784 3,240,784 (b) 2,160,385 2,160,385 (b)

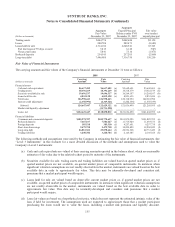

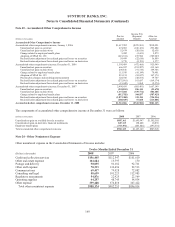

The following methods and assumptions were used by the Company in estimating the fair value of financial instruments. See

“Level 3 Instruments” in this footnote for a more detailed discussion of the methods and assumptions used to value the

Company’s Level 3 instruments:

(a) Cash and cash equivalents are valued at their carrying amounts reported in the balance sheet, which are reasonable

estimates of fair value due to the relatively short period to maturity of the instruments.

(b) Securities available for sale, trading assets and trading liabilities are valued based on quoted market prices or, if

quoted market prices are not available, on quoted market prices of comparable instruments. In instances when

significant valuation assumptions are not readily observable in the market, instruments are valued based on the best

available data in order to approximate fair value. This data may be internally-developed and considers risk

premiums that a market participant would require.

(c) Loans held for sale are valued based on observable current market prices or, if quoted market prices are not

available, on quoted market prices of comparable instruments. In instances when significant valuation assumptions

are not readily observable in the market, instruments are valued based on the best available data in order to

approximate fair value. This data may be internally-developed and considers risk premiums that a market

participant would require.

(d) Loan fair values are based on a hypothetical exit price, which does not represent the estimated intrinsic value of the

loan if held for investment. The assumptions used are expected to approximate those that a market participant

purchasing the loans would use to value the loans, including a market risk premium and liquidity discount.

155