SunTrust 2008 Annual Report Download - page 50

Download and view the complete annual report

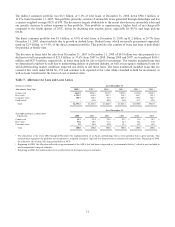

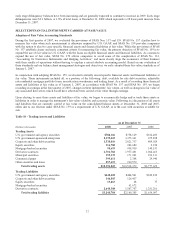

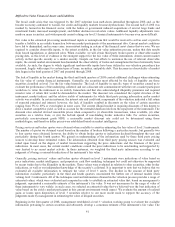

Please find page 50 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Trading Assets and Liabilities

Trading assets include loans, investment securities and derivatives that relate to capital markets trading activities by acting as

broker/dealer on behalf of our clients, investment securities, and derivatives that are periodically acquired for corporate

balance sheet management purposes. All trading assets and liabilities are carried at fair value as required under U.S. GAAP,

or due to our election under SFAS No. 159 to carry certain assets at fair value. Trading accounts profits/(losses) and

commissions on the Consolidated Statements of Income are primarily comprised of gains and losses on trading assets and

liabilities. For additional information regarding trading account profits/(losses) and commissions, refer to “Noninterest

Income” within this MD&A. Additionally, see Note 20, “Fair Value Election and Measurement,” to the Consolidated

Financial Statements for additional information regarding financial instruments carried at fair value.

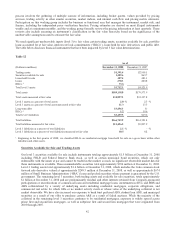

We utilize trading assets such as fixed rate agency MBS and derivatives, primarily interest rate swaps, for balance sheet

management purposes that are intended to provide an economic hedge to a portion of the changes in fair value of our

publicly-traded debt that is measured at fair value pursuant to our election of the fair value option. As of December 31, 2008,

the amount of trading securities outstanding for this purpose was approximately $166.1 million of fixed rate corporate bonds

in financial services companies.

Derivative assets and liabilities increased during 2008 by $2.7 billion and $1.1 billion, respectively. This increase was driven

by the movements in fair values of interest rate based derivatives as both current and projected future interest rates declined

significantly during the fourth quarter of 2008. The higher increase in derivative assets relative to derivative liabilities during

the year is due to gains in fair value from derivative positions that we use as risk management tools. See Note 17, “Derivative

Financial Instruments”, to the Consolidated Financial Statements for additional information regarding risk management

strategies involving derivatives.

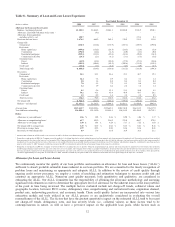

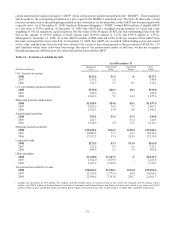

Certain ABS were purchased during the fourth quarter of 2007 from affiliates and certain ARS were purchased primarily in

the fourth quarter of 2008. The securities acquired during the fourth quarter of 2007 included SIVs that are collateralized by

various domestic and foreign assets, residential MBS, including Alt-A and subprime collateral, collateralized debt

obligations (“CDO”), and commercial loans, as well as super-senior interests retained from Company-sponsored

securitizations. During 2008, we recognized approximately $255.9 million in net market valuation losses related to these

ABS. Through sales, maturities and write downs, we reduced our exposure to these distressed assets by approximately $3.2

billion since the acquisition of these in the fourth quarter of 2007, making the exposure at December 31, 2008 approximately

$250.0 million. During the year, we sold over $1.5 billion in securities and received over $870 million in payments related to

securities acquired during the fourth quarter of 2007.

We continue to actively evaluate our holdings of these securities with the objective of opportunistically lowering our

exposure to them. In addition, we expect paydowns to continue on many of the residential MBS; however, more than half of

the remaining acquired portfolio consists of SIVs undergoing enforcement proceedings, and therefore any significant

reduction in the portfolio will largely depend on the status of those proceedings. While further losses are possible, our

experience during the year reinforces our belief that we have appropriately written these assets down to fair value as of

December 31, 2008. The estimated market value of these securities is based on market information, where available, along

with significant, unobservable third party data. As a result of the high degree of judgment and estimates used to value these

illiquid securities, the market values could vary significantly in future periods. See “Difficult to Value Financial Assets”

included in this MD&A for more information.

The amount of ARS recorded in trading assets at fair value totaled $133.1 million at December 31, 2008. The majority of

these ARS are preferred equity securities, and the remaining securities consist of ABS backed by trust preferred bank debt or

student loans.

In September 2008, we purchased, at amortized cost plus accrued interest, a Lehman Brothers security from the RidgeWorth

Prime Quality Money Market Fund (the “Fund”). The Fund received a cash payment for the accrued interest along with a $70

million note that we issued. RidgeWorth, one of our wholly-owned subsidiaries, is the investment adviser to the Fund. The

Lehman Brothers security went into default when Lehman Brothers filed for bankruptcy in September 2008. We took this

action in response to the unprecedented market events during the third quarter and to protect investors in the Fund from

losses associated with this specific security. When purchased by the Fund, the Lehman Brothers security was rated A-1/P-1

and was a Tier 1 eligible security. Lehman Brothers is currently in liquidation and the ultimate timing and form of repayment

on the security is not known at this time. During 2008, we recorded a pre-tax market valuation loss of $63.8 million as a

result of the purchase. We evaluated this transaction under the applicable accounting guidance and concluded that we were

not the primary beneficiary and therefore consolidation of the Fund was not appropriate.

In September 2008, the Federal Reserve Bank of Boston (the “Fed”) instituted the ABCP MMMF Liquidity Facility program

(the “Program”) that allows eligible depository institutions, bank holding companies and affiliated broker/dealers to purchase

38