SunTrust 2008 Annual Report Download - page 62

Download and view the complete annual report

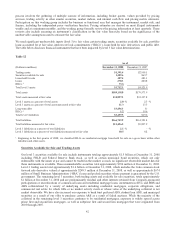

Please find page 62 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Tangible equity to tangible assets increased to 8.40% as of December 31, 2008 from 6.31% last year. The increase was

primarily due to the issuance of the preferred stock to the Treasury. Tangible common equity to tangible assets declined 49

basis points to 5.53% as of December 31, 2008. The decline is primarily the result of a $9.5 billion increase in tangible

assets. This increase relates to cash and securities from the temporary deployment of proceeds received from the issuance of

preferred stock and debt securities, as well as $6.4 billion of unsettled sales of securities available for sale that settled in

January 2009, increasing tangible common equity to tangible assets approximately 20 basis points. We declared and paid

common dividends totaling $1.0 billion in 2008, or $2.85 per common share, on net income available to common

shareholders of $746.9 million. The dividend payout ratio was 134.4% for 2008 versus 64.0% for 2007. The increase in the

payout ratio was the result of the decline in earnings caused largely by an increased provision for loan losses during 2008.

In connection with the issuances of the Series A Preferred Stock of SunTrust Banks, Inc., the Fixed to Floating Rate Normal

Preferred Purchase Securities of SunTrust Preferred Capital I, the 6.10% Enhanced Trust Preferred Securities of SunTrust

Capital VIII, and the 7.875% Trust Preferred securities of SunTrust Capital IX (collectively, the “Issued Securities”), we

entered into Replacement Capital Covenants (“RCCs”). The RCCs limit our ability to repay, redeem or repurchase the Issued

Securities (or certain related securities). We executed each RCCs in favor of the holders of certain debt securities, which are

initially the holders of our 6% Subordinated Notes due 2026. The RCCs are more fully described in Current Reports on Form

8-K filed on September 12, 2006, November 6, 2006, December 6, 2006, and March 4, 2008.

In connection with the issuance of the Series C and D Preferred Stock of SunTrust Banks, Inc. we agreed to certain terms

affecting repurchase, redemption, and repayment of the preferred stock and restriction on payment of common stock

dividends, among other terms. Also included with the issuance of the preferred stock was issuance of ten-year warrants to the

Treasury to purchase approximately 11.9 million and 6.0 million shares of our common stock at initial exercise prices of

$44.15 and $33.70. The preferred stock and related warrants were issued at a total discount of approximately $132.0 million,

which will be accreted into U.S. Treasury preferred dividend expense using the effective yield method over a five year period

from each respective issuance date. The terms of the warrants as well as the restrictions related to the issuance of the

preferred stock is more fully described in Current Reports on Form 8-K filed on November 17, 2008 and January 2, 2009.

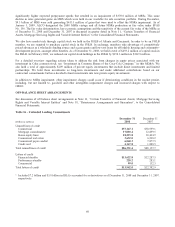

ENTERPRISE RISK MANAGEMENT

In the normal course of business, we are exposed to various risks. To manage the major risks that we face and to provide

reasonable assurance that key business objectives will be achieved, we have established an enterprise risk governance

process and established the SunTrust Enterprise Risk Program (“SERP”). Moreover, we have policies and various risk

management processes designed to effectively identify, monitor and manage risk.

We continually refine and enhance our risk management policies, processes and procedures to maintain effective risk

management and governance, including identification, measurement, monitoring, control, mitigation and reporting of all

material risks. Over the last several years, we have enhanced risk measurement applications and systems capabilities that

provide management information on whether we are being appropriately compensated for the risk profile we have adopted.

We balance our strategic goals, including revenue and profitability objectives, with the risks associated with achieving our

goals. Effective risk management is an important element supporting our business decision making.

Corporate Risk Management’s focus is on synthesizing, assessing, reporting and mitigating the full set of risks at the

enterprise level, and providing senior management with a holistic picture of the organization’s risk profile. We have

implemented an enterprise risk management framework that has improved our ability to manage our aggregate risk profile.

At the core of the framework is our risk vision and risk mission.

Risk Vision: To deliver sophisticated risk management capabilities that are consistent with those of top-tier

financial institutions and that support the needs of SunTrust business units.

Risk Mission: To measure, monitor and manage risk throughout the SunTrust footprint to ensure that risk at the

transaction, portfolio and institution levels is viewed consistently in order to optimize risk-adjusted return decision

making.

The Board of Directors is wholly responsible for oversight of our corporate risk governance process. The Risk Committee of

the Board assists the Board of Directors in executing this responsibility.

The Chief Risk Officer (“CRO”) reports to the Chief Executive Officer and is responsible for the oversight of the Corporate

Risk Management organization as well as the risk governance processes. The CRO provides overall leadership, vision and

direction for our enterprise risk management framework. In addition, the CRO provides regular risk assessments to the Risk

Committee of the Board and to the full Board of Directors, and provides other information to Executive Management and the

Board, as requested.

50