SunTrust 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

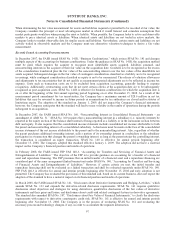

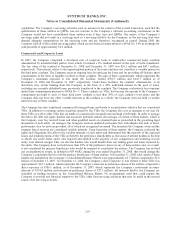

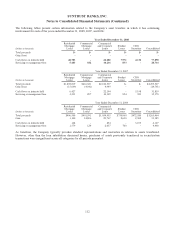

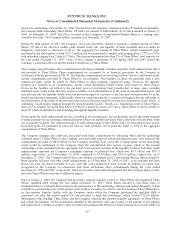

The changes in carrying amounts of other intangible assets for the years ended December 31 are as follows:

(Dollars in thousands)

Core Deposit

Intangible

Mortgage

Servicing

Rights Other Total

Balance, January 1, 2007 $241,614 $810,509 $129,861 $1,181,984

Amortization (68,959) (181,263) (27,721) (277,943)

MSRs originated - 639,158 - 639,158

Intangible assets obtained from sale upon merger of Lighthouse

Partners, net 1- - 24,142 24,142

Client relationship intangible obtained from acquisition of TBK

Investments, Inc. - - 6,520 6,520

Purchase of GenSpring (formerly AMA, LLC) minority shares - - 2,205 2,205

Client relationship intangible obtained from acquisition of Inlign

Wealth Management - - 4,120 4,120

Intangible assets obtained from acquisition of minority interest in

Alpha Equity Management - - 1,788 1,788

Sale of MSRs - (218,979) - (218,979)

Balance, December 31, 2007 $172,655 $1,049,425 $140,915 $1,362,995

Amortization (56,854) (223,092) (19,406) (299,352)

MSRs originated - 485,597 - 485,597

MSRs impairment reserve - (371,881) - (371,881)

MSRs impairment recovery - 1,881 - 1,881

Sale of interest in Lighthouse Partners - - (5,992) (5,992)

Sale of MSRs - (131,456) - (131,456)

Customer intangible impairment charge - - (45,000) (45,000)

Purchased credit card relationships 2- - 9,898 9,898

Acquisition of GB&T 329,510 - - 29,510

Sale of First Mercantile Trust - - (3,033) (3,033)

Other - - 2,260 2,260

Balance, December 31, 2008 $145,311 $810,474 $79,642 $1,035,427

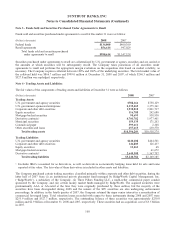

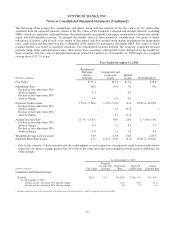

1During the first quarter of 2007 SunTrust merged its wholly-owned subsidiary, Lighthouse Partners, into Lighthouse Investment

Partners, LLC in exchange for a minority interest in Lighthouse Investment Partners, LLC and a revenue-sharing agreement. This

transaction resulted in a $7.9 million decrease in existing intangible assets and a new intangible asset of $32.0 million.

2During the third quarter of 2008, SunTrust purchased a credit card portfolio of loans including the cardholder relationships from another

financial institution representing an outstanding balance of $82.4 million at the time of acquisition. A majority of the premium paid was

attributed to the cardholder relationships and is being amortized over seven years.

3During the second quarter of 2008, SunTrust acquired 100% of the outstanding shares of GB&T. As a result of the acquisition, SunTrust

assumed $1.4 billion of deposit liabilities and recorded core deposit intangibles that are being amortized over an eight year period.

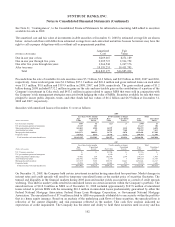

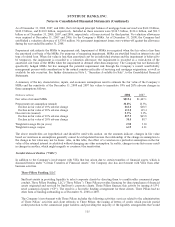

Intangible assets subject to amortization must be tested for impairment whenever events or changes in circumstances indicate

that their carrying amounts may not be recoverable. The Company experienced a triggering event with respect to certain

Wealth and Investment Management customer relationship intangibles during the second quarter of 2008 and performed

impairment testing which resulted in an impairment charge of $45.0 million. The fair value of the customer relationship

intangibles was determined using the residual income method and was compared to the carrying value to determine the

amount of impairment. The impairment charge was recorded in noninterest expense and pertains to the client relationships

that were recorded in 2004 in connection with an acquisition. While the overall acquired business was performing

satisfactorily, the attrition level of the legacy clients had increased resulting in the impairment of this intangible asset.

107