SunTrust 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

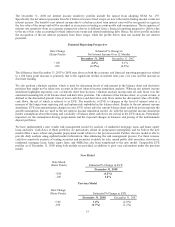

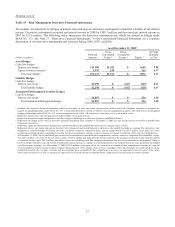

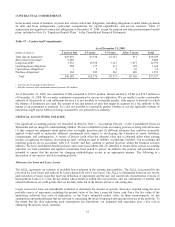

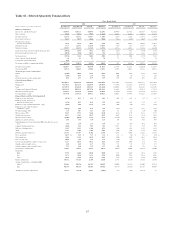

The following tables present the expected maturities of interest rate swaps currently designated as hedging instruments under

SFAS No. 133. Certain other derivatives that are effective for risk management purposes, but which are not in designated

hedging relationships of interest rate risk under SFAS No. 133, are not incorporated in the tables.

(Dollars in millions)

As of December 31, 2008

1 Year

or Less

1-2

Years

2-5

Years

5-7

Years

After 7

Years Total

CASH FLOW ASSET HEDGES

Notional amount - swaps $1,100 $- $6,000 $4,000 $- $11,100

Net unrealized gain (loss) 5 - 575 522 - 1,102

Weighted average receive rate 15.32 % - % 4.73 % 4.52 % - % 4.71 %

Weighted average pay rate 11.90 - 1.90 1.90 - 1.90

CASH FLOW LIABILITY HEDGES

Notional amount - swaps $2,250 $- $- $- $- $2,250

Net unrealized gain (loss) (47) ----(47)

Weighted average receive rate 10.91 % - % - % - % - % 0.91 %

Weighted average pay rate 15.26 ----5.26

1The average pay and receive rates are those in effect at December 31, 2008 weighted on the notional of the corresponding interest rate swaps. The variable rates of all interest rate swaps

reset within six months.

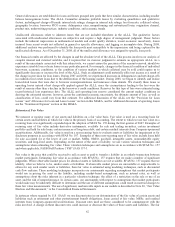

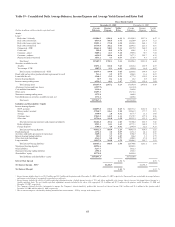

(Dollars in millions)

As of December 31, 2007

1 Year

or Less

1-2

Years

2-5

Years

5-7

Years

After 7

Years Total

CASH FLOW ASSET HEDGES

Notional amount – swaps $600 $2,100 $4,500 $3,000 $- $10,200

Net unrealized gain (loss) (1) 39 167 41 - 246

Weighted average receive rate 13.95 % 5.13 % 5.08 % 4.64 % - % 4.89 %

Weighted average pay rate 15.23 5.23 5.23 5.09 - 5.18

CASH FLOW LIABILITY HEDGES

Notional amount – swaps $1,115 $2,750 $- $- $- $3,865

Net unrealized gain (loss) 3 (47) - - - (44)

Weighted average receive rate 15.04 % 4.87 % - % - % - % 4.92 %

Weighted average pay rate 13.85 5.05 - - - 4.70

1The average pay and receive rates are those in effect at December 31, 2007 weighted on the notional of the corresponding interest rate swaps. The variable rates of all interest rate swaps reset

within six months.

Other Market Risk

Other sources of market risk include the risk associated with holding residential and commercial mortgage loans prior to

selling them into the secondary market, commitments to clients to make mortgage loans that will be sold to the secondary

market, and our investment in MSRs. We manage the risks associated with the residential and commercial mortgage loans

classified as held for sale (i.e., the warehouse) and our IRLCs on residential loans intended for sale. The warehouses and

IRLCs consist primarily of fixed and adjustable rate single family residential and commercial real estate loans. The risk

associated with the warehouses and IRLCs is the potential change in interest rates between the time the customer locks in the

rate on the anticipated loan and the time the loan is sold on the secondary market, which is typically 60-150 days.

We manage interest rate risk predominantly with interest rate swaps, futures, and forward sale agreements, where the

changes in value of the instruments substantially offset the changes in value of the warehouse and the IRLCs. The IRLCs on

residential mortgage loans intended for sale are classified as free standing derivative financial instruments in accordance with

SFAS No. 149, “Amendment of Statement 133 on Derivative Instruments and Hedging Activities,” and are not designated in

SFAS No. 133 hedge accounting relationships.

MSRs are the present value of future net cash flows that are expected to be received from the mortgage servicing portfolio.

The value of MSRs is highly dependent upon the assumed prepayment speed of the mortgage servicing portfolio which is

driven by the level of certain key interest rates, primarily the 30-year current coupon par mortgage rate known as the par

mortgage rate. Future expected net cash flows from servicing a loan in the mortgage servicing portfolio would not be realized

if the loan pays off earlier than anticipated.

We have not historically hedged MSRs, but have managed the market risk through our overall asset/liability management

process with consideration to the natural counter-cyclicality of servicing and production that occurs as interest rates rise and

fall over time with the economic cycle as well as with securities available for sale. The precipitous drop in mortgage rates as

evidenced by the decline in the par mortgage rate, (down over 200 basis points) during the fourth quarter of 2008, generated

59