SunTrust 2008 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

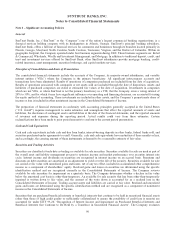

When determining the fair value measurement for assets and liabilities required or permitted to be recorded at fair value, the

Company considers the principal or most advantageous market in which it would transact and considers assumptions that

market participants would use when pricing the asset or liability. When possible, the Company looks to active and observable

markets to price identical assets or liabilities. When identical assets and liabilities are not traded in active markets, the

Company looks to market observable data for similar assets and liabilities. Nevertheless, certain assets and liabilities are not

actively traded in observable markets and the Company must use alternative valuation techniques to derive a fair value

measurement.

Recently Issued Accounting Pronouncements

In December 2007, the FASB issued SFAS No. 141R, “Business Combinations,” which revises SFAS No. 141 and changes

multiple aspects of the accounting for business combinations. Under the guidance in SFAS No. 141R, the acquisition method

must be used, which requires the acquirer to recognize most identifiable assets acquired, liabilities assumed, and

noncontrolling interests in the acquiree at their fair value on the acquisition date. Goodwill is to be recognized as the excess

of the consideration transferred plus the fair value of the noncontrolling interest over the fair values of the identifiable net

assets acquired. Subsequent changes in the fair value of contingent consideration classified as a liability are to be recognized

in earnings, while contingent consideration classified as equity is not to be remeasured. The release of valuation allowances

and adjustments to tax uncertainties that do not qualify as measurement period adjustments are to be reflected in income tax

expense. Costs such as transaction costs are to be excluded from acquisition accounting, generally leading to expense

recognition. Additionally, restructuring costs that do not meet certain criteria at the acquisition date are to be subsequently

recognized as post-acquisition costs. SFAS No. 141R is effective for business combinations for which the acquisition date is

on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. As a result of the

measurement period amendment for tax uncertainties, the Company has a maximum amount of $28.6 million in net tax

liabilities that may be reversed to income in future periods as examinations by tax authorities are closed and/or statutes of

limitations expire. The adoption of the standard on January 1, 2009, did not impact the Company’s financial statements;

however, the Company anticipates that the standard will lead to more volatility in the results of operations during the periods

subsequent to an acquisition.

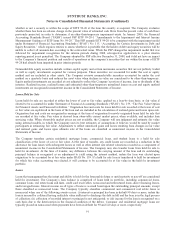

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interest in Consolidated Financial Statements – an

amendment of ARB No. 51.” SFAS No. 160 requires that a noncontrolling interest in a subsidiary (i.e. minority interest) be

reported in the equity section of the balance sheet instead of being reported as a liability or in the mezzanine section between

debt and equity. It also requires that the consolidated income statement include consolidated net income attributable to both

the parent and noncontrolling interest of a consolidated subsidiary. A disclosure must be made on the face of the consolidated

income statement of the net income attributable to the parent and to the noncontrolling interest. Also, regardless of whether

the parent purchases additional ownership interest, sells a portion of its ownership interest in a subsidiary or the subsidiary

participates in a transaction that changes the parent’s ownership interest, as long as the parent retains the controlling interest,

the transaction is considered an equity transaction. SFAS No. 160 is effective for annual periods beginning after

December 15, 2008. The Company adopted this standard effective January 1, 2009. The adoption did not have a material

impact on the Company’s financial position and results of operations.

In February 2008, the FASB issued FSP FAS 140-3, “Accounting for Transfers and Servicing of Financial Assets and

Extinguishments of Liabilities.” The objective of the FSP is to provide guidance on accounting for a transfer of a financial

asset and repurchase financing. The FSP presumes that an initial transfer of a financial asset and a repurchase financing are

considered part of the same arrangement (linked transaction) under SFAS No. 140, “Accounting for Transfers and Servicing

of Financial Assets and Extinguishments of Liabilities.” However, if certain criteria are met, the initial transfer and

repurchase financing shall not be evaluated as a linked transaction and shall be evaluated separately under SFAS No. 140.

FSP FAS 140-3 is effective for annual and interim periods beginning after November 15, 2008 and early adoption is not

permitted. The Company has evaluated the provisions of this standard and, based on its current business, does not expect the

adoption of the standard to have a material impact on its financial position and results of operations.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging Activities,” which

amends SFAS No. 133 and expands the derivative-related disclosure requirements. SFAS No. 161 requires qualitative

disclosures about objectives and strategies for using derivatives, quantitative disclosures of the fair values of derivative

instruments and their gains and losses, and disclosures about credit-risk related contingent features in derivative agreements.

The standard also amended SFAS No. 107, “Disclosures about Fair Value of Financial Instruments,” to clarify the disclosure

requirements with respect to derivative counterparty credit risk. SFAS No. 161 is effective for annual and interim periods

beginning after November 15, 2008. The Company is in the process of evaluating SFAS No. 161 and evaluating the

necessary process and technology changes, if any, in order to accumulate the requisite information.

97