SunTrust 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.capacity to borrow at the Federal Reserve discount window and from the FHLB system and the ability to sell, pledge or

borrow against unencumbered securities in the investment portfolio. As of December 31, 2008, the potential liquidity from

these sources exceeded $23 billion. In addition, we may have the ability to raise funds by selling or securitizing loans,

including single-family mortgage loans.

Uses and Sources of Funds. Our primary uses of funds include the extension of loans and credit, the purchase of investment

securities, working capital, and debt and capital service. Our sources of funds include a large, stable retail deposit base;

various forms of wholesale funding, including access to the capital markets and secured advances from the FHLB; and access

to the Federal Reserve discount window. Wholesale funding, particularly the unsecured variety, comes from uncommitted

sources and is subject to market conditions and various risks and uncertainties.

Our credit ratings are an important factor in our access to unsecured wholesale funds, and significant changes in these ratings

could affect the cost and availability of these sources. Factors that affect our credit ratings include, but are not limited to, the

credit risk profile of our assets, the adequacy of our loan loss reserves, the liquidity profile of both the Bank and the parent

company, and the adequacy of our capital base. On January 27, 2009, Standard & Poor’s Rating Services lowered, by one

rating, its long-term counterparty credit ratings on SunTrust Banks, Inc. to ‘A’ and SunTrust Bank to ‘A+’, citing

deterioration in the quality of our loan portfolio. Consistent with this view, we consider the primary risk of downgrade to our

credit ratings is the potential for additional material credit losses in our loan portfolio if the U.S. economy does not begin to

recover during 2009 from the current sharp, broad and sustained recession.

Core deposits, primarily gathered from our retail branch network, are our largest and most cost-effective source of funding.

Core deposits comprised approximately 93% of total deposits at December 31, 2008. These deposits averaged $101.3 billion,

or 67.4% of the funding base, during 2008, up from an average of 64.1% during 2007. Core deposits totaled $105 billion at

year end 2008 and increased $3.5 billion during the fourth quarter. Growth in core deposits, along with an increase in term

wholesale funding and balance sheet de-leveraging, has reduced the Bank’s average daily overnight borrowing position

materially over the past two years, resulting in a strong liquidity position. As of December 31, 2008, the daily overnight

borrowing position was zero. Much of the growth in core deposits occurred amidst a period of some consolidation in the

banking industry, giving us reason to expect these new deposits will be stable.

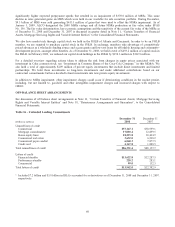

We maintain access to a diversified base of wholesale funding sources. These uncommitted sources include Fed Funds

purchased from other banks, securities sold under agreements to repurchase, negotiable certificates of deposit, offshore

deposits, FHLB advances, global bank notes, and commercial paper. Aggregate wholesale funding totaled $44.0 billion as of

December 31, 2008 compared to $50.4 billion as of December 31, 2007. Net short-term unsecured borrowings, which

includes wholesale domestic and foreign deposits and Fed Funds purchased, totaled $14.2 billion as of December 31, 2008,

down from $21.9 billion as of December 31, 2007.

An additional source of wholesale liquidity is our access to the capital markets. SunTrust Banks, Inc. (the “parent company”)

maintains a registered debt shelf from which it may issue senior or subordinated notes, commercial paper and various capital

securities such as common or preferred stock. SunTrust Bank (the “Bank”) maintains a global notes program under which it

may issue senior or subordinated debt with various terms. As of December 31, 2008, the parent company had authority to

issue an additional $3.2 billion of securities under its shelf registration and the Bank had authority to issue an additional

$30.1 billion of notes under the global bank note program. Borrowings under these programs are designed to appeal

primarily to domestic and international institutional investors. Institutional investor demand for these securities is dependent

upon numerous factors, including but not limited to our credit ratings and investor perception of financial market conditions

and the health of the banking sector.

Parent Company Liquidity. We measure parent company liquidity by comparing sources of liquidity from short-term assets,

such as unencumbered and other investment securities and cash, relative to short-term liabilities, which include overnight

sweep funds, seasoned long-term debt and commercial paper. As of December 31, 2008, the parent company had $5.6 billion

in such sources compared to short-term debt of $1.4 billion. We also manage the parent company’s liquidity by structuring its

maturity schedule to minimize the amount of debt maturing within a short period of time. A $350 million parent company

note matured in October 2008 and the next parent company debt maturity is $300 million in October 2009. Much of the

parent company’s liabilities are long-term in nature, coming from the proceeds of our capital securities and long-term senior

and subordinated notes.

The primary uses of parent company liquidity include debt service, dividends on capital, the periodic purchase of investment

securities and loans to our subsidiaries. We believe the parent company holds cash adequate to satisfy these working capital

needs. We fund corporate dividends primarily with dividends from our banking subsidiaries. We are subject to both state and

federal regulations that limit our ability to pay common stock dividends in certain circumstances. In the context of an

ongoing U.S. economic recession and credit market turmoil in 2008, we announced a reduction of our quarterly common

stock dividend on October 27, 2008 from $0.77 per share to $0.54 per share and on January 22, 2009 to its current level of

$0.l0 per share.

55