SunTrust 2008 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

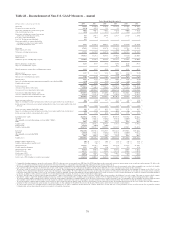

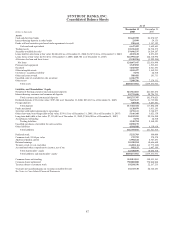

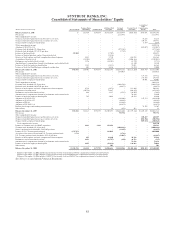

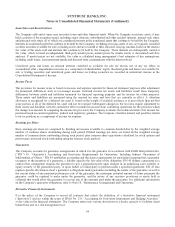

SUNTRUST BANKS, INC.

Consolidated Statements of Shareholders’ Equity

(Dollars and shares in thousands) Preferred Stock

Common Shares

Outstanding Common Stock

Additional Paid

in Capital

Retained

Earnings

Treasury Stock

and Other1

Accumulated

Other

Comprehensive

Income Total

Balance, January 1, 2006 $- 361,984 $370,578 $6,761,684 $9,310,978 ($493,936) $938,091 $16,887,395

Net income - - - - 2,117,471 - - 2,117,471

Other comprehensive income:

Change in unrealized gains (losses) on derivatives, net of tax - - - - - - 36,235 36,235

Change in unrealized gains (losses) on securities, net of tax - - - - - - 330,771 330,771

Change related to employee benefit plans - - - - - - 5,879 5,879

Total comprehensive income - - - - - - 2,490,356

Adoption of SFAS No. 158 - - - - - - (385,027) (385,027)

Common stock dividends, $2.44 per share - - - - (879,568) - - (879,568)

Preferred stock dividends, $1,548.78 per share - - - - (7,729) - - (7,729)

Issuance of preferred stock 500,000 - - (7,705) - - - 492,295

Issuance of forward purchase contract for preferred stock - - - (9,416) - - - (9,416)

Exercise of stock options and stock compensation element expense - 3,481 - 9,710 - 226,858 - 236,568

Acquisition of treasury stock - (13,102) - (98,877) - (1,006,166) - (1,105,043)

Performance and restricted stock activity - 1,196 - (24,503) - 18,770 - (5,733)

Amortization of compensation element of performance and restricted stock - - - - - 18,340 - 18,340

Issuance of stock for employee benefit plans - 1,141 - (5,913) - 72,081 - 66,168

Issuance of stock for BancMortgage contingent consideration - 203 - 2,216 - 12,784 - 15,000

Balance, December 31, 2006 $500,000 354,903 $370,578 $6,627,196 $10,541,152 ($1,151,269) $925,949 $17,813,606

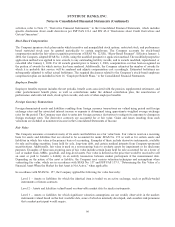

Net income - - - - 1,634,015 - - 1,634,015

Other comprehensive income:

Change in unrealized gains (losses) on derivatives, net of tax - - - - - - 139,732 139,732

Change in unrealized gains (losses) on securities, net of tax - - - - - - 243,986 243,986

Change related to employee benefit plans - - - - - - 70,401 70,401

Total comprehensive income 2,088,134

Common stock dividends, $2.92 per share - - - - (1,026,594) - - (1,026,594)

Preferred stock dividends, $6,055.02 per share - - - - (30,275) - - (30,275)

Exercise of stock options and stock compensation element expense - 2,794 - (1,471) - 211,460 - 209,989

Acquisition of treasury stock - (10,758) - 71,267 - (924,652) - (853,385)

Performance and restricted stock activity - 682 - 8,197 (3,535) (10,507) - (5,845)

Amortization of compensation element of performance and restricted stock - - - - - 34,820 - 34,820

Issuance of stock for employee benefit plans - 785 - 2,046 - 60,594 - 62,640

Adoption of SFAS No. 159 - - - - (388,604) - 147,374 (241,230)

Adoption of SFAS No. 157 - - - - (10,943) - - (10,943)

Adoption of FIN 48 - - - - (41,844) - - (41,844)

Adoption of FSP FAS 13-2 - - - - (26,273) - - (26,273)

Pension plan changes and resulting remeasurement - - - - - - 79,707 79,707

Other activity - 5 - 58 (459) 412 - 11

Balance, December 31, 2007 $500,000 348,411 $370,578 $6,707,293 $10,646,640 ($1,779,142) $1,607,149 $18,052,518

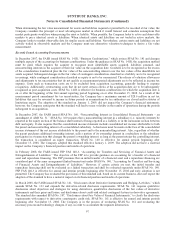

Net income - - - - 795,774 - - 795,774

Other comprehensive income:

Change in unrealized gains (losses) on derivatives, net of tax - - - - - - 688,487 688,487

Change in unrealized gains (losses) on securities, net of tax - - - - - - (806,586) (806,586)

Change related to employee benefit plans - - - - - - (507,925) (507,925)

Total comprehensive income 169,750

Issuance of common stock for GB&T acquisition - 2,221 2,221 152,292 - - - 154,513

Common stock dividends, $2.85 per share - - - - (1,004,146) - - (1,004,146)

Series A preferred stock dividends, $4,451.05 per share - - - - (22,255) - - (22,255)

Issuance of U.S. Treasury preferred stock 4,717,971 - - 132,029 - - - 4,850,000

Accretion of discount associated with U.S. Treasury preferred stock 3,732 - - (3,732) -

U.S. Treasury preferred stock dividends, $471.07 per share - - - - (22,847) - - (22,847)

Exercise of stock options and stock compensation element expense - 495 - 16,160 - 39,766 - 55,926

Performance and restricted stock activity - 1,693 - (46,797) (450) 46,712 - (535)

Amortization of compensation element of performance and restricted stock - - - - - 76,656 - 76,656

Issuance of stock for employee benefit plans - 1,695 - (56,834) - 134,862 - 78,028

Other activity - - - 501 - - - 501

Balance, December 31, 2008 $5,221,703 354,515 $372,799 $6,904,644 $10,388,984 ($1,481,146) $981,125 $22,388,109

1Balance at December 31, 2008 includes $1,367,752 for treasury stock and $113,394 for compensation element of restricted stock.

Balance at December 31, 2007 includes $1,688,521 for treasury stock and $90,622 for compensation element of restricted stock.

Balance at December 31, 2006 includes $1,090,782 for treasury stock and $60,487 for compensation element of restricted stock.

See Notes to Consolidated Financial Statements.

88