SunTrust 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

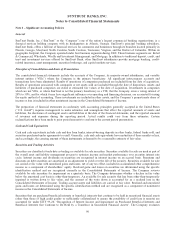

Notes to Consolidated Financial Statements (Continued)

whether or not a security is within the scope of EITF 99-20 at the time the security is acquired. The Company evaluates

whether there has been an adverse change in the present value of estimated cash flows from the present value of cash flows

previously projected, in order to determine if an other-than-temporary impairment exists. In January 2009, the Financial

Accounting Standards Board (“FASB”) issued FSP EITF 99-20-1 “Amendments to the Impairment and Interest Income

Measurement Guidance of EITF Issue No. 99-20.” This FSP amends EITF 99-20 to be consistent with the impairment model

under Statement of Financial Accounting Standards (“SFAS”) No. 115, “Accounting for Certain Investments in Debt and

Equity Securities,” which requires entities to assess whether it is probable that the holder of debt and equity securities will be

unable to collect all amounts due according to the contractual terms. While the FSP changes the impairment model that was

followed for impairment recognition for the interim periods during 2008, retrospective application to a prior interim

reporting period is not permitted. The Company adopted the FSP effective December 31, 2008, and it did not have an impact

to the Company’s financial position and results of operations as the company’s securities that are within the scope of EITF

99-20 had already been impaired in prior interim periods.

Nonmarketable equity securities include venture capital equity and certain mezzanine securities that are not publicly traded

as well as equity investments acquired for various purposes. These securities are accounted for under the cost or equity

method and are included in other assets. The Company reviews nonmarketable securities accounted for under the cost

method on a quarterly basis and reduces the asset value when declines in value are considered to be other-than-temporary.

Equity method investments are recorded at cost adjusted to reflect the Company’s portion of income, loss or dividends of the

investee. Realized income, realized losses and estimated other-than-temporary unrealized losses on cost and equity method

investments are recognized in noninterest income in the Consolidated Statements of Income.

Loans Held for Sale

Loans held for sale are recorded at either the lower of cost or fair value, applied on a loan-by-loan basis, or fair value if

elected to be accounted for under Statement of Financial Accounting Standards (“SFAS”) No. 159, “The Fair Value Option

for Financial Assets and Financial Liabilities.” Origination fees and costs for loans held for sale recorded at the lower of cost

or fair value are capitalized in the basis of the loan and are included in the calculation of realized gains and losses upon sale.

Origination fees and costs are recognized in earnings at the time of origination for newly-originated loans held for sale that

are recorded at fair value. Fair value is derived from observable current market prices, when available, and includes loan

servicing value. When observable market prices are not available, the Company will use judgment and estimate fair value

using internal models, in which the Company uses its best estimates of assumptions it believes would be used by market

participants in estimating fair value. Adjustments to reflect unrealized gains and losses resulting from changes in fair value

and realized gains and losses upon ultimate sale of the loans are classified as noninterest income in the Consolidated

Statements of Income.

The Company transfers certain residential mortgage loans, commercial loans, and student loans to a held for sale

classification at the lower of cost or fair value. At the time of transfer, any credit losses are recorded as a reduction in the

allowance for loan losses with subsequent losses as well as other interest rate related valuations recorded as a component of

noninterest income in the Consolidated Statements of Income. The Company may also transfer loans from held for sale to

held for investment. At the time of transfer, any difference between the carrying amount of the loan and its outstanding

principal balance is recognized as an adjustment to yield using the interest method, unless the loan was elected upon

origination to be accounted for at fair value under SFAS No. 159. If a held for sale loan is transferred to held for investment

for which fair value accounting was elected, it will continue to be accounted for at fair value in the held for investment

portfolio.

Loans

Loans that management has the intent and ability to hold for the foreseeable future or until maturity or pay-off are considered

held for investment. The Company’s loan balance is comprised of loans held in portfolio, including commercial loans,

consumer loans, real estate loans and lines, credit card receivables, nonaccrual and restructured loans, direct financing leases,

and leveraged leases. Interest income on all types of loans is accrued based upon the outstanding principal amounts, except

those classified as nonaccrual loans. The Company typically classifies commercial and commercial real estate loans as

nonaccrual when one of the following events occurs: (i) interest or principal has been in default 90 days or more, unless the

loan is secured by collateral having realizable value sufficient to discharge the debt in full and the loan is in the legal process

of collection; (ii) collection of recorded interest or principal is not anticipated; or (iii) income for the loan is recognized on a

cash basis due to the deterioration in the financial condition of the debtor. Consumer and residential mortgage loans are

typically placed on nonaccrual when payments have been in default for 90 and 120 days or more, respectively.

91