SunTrust 2008 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

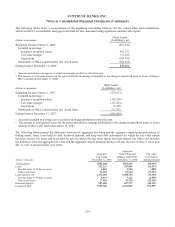

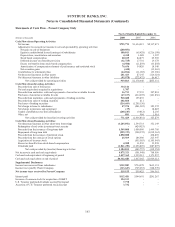

The application and development of management reporting methodologies is a dynamic process and is subject to periodic

enhancements. The implementation of these enhancements to the internal management reporting methodology may

materially affect the net income disclosed for each segment with no impact on consolidated results. Whenever significant

changes to management reporting methodologies take place, the impact of these changes is quantified and prior period

information is reclassified wherever practicable. The Company will reflect these changes in the current period and will

update historical results.

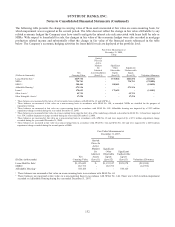

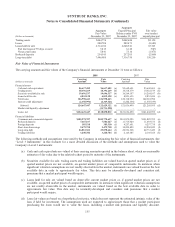

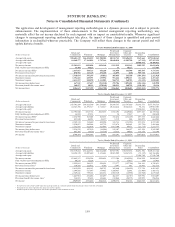

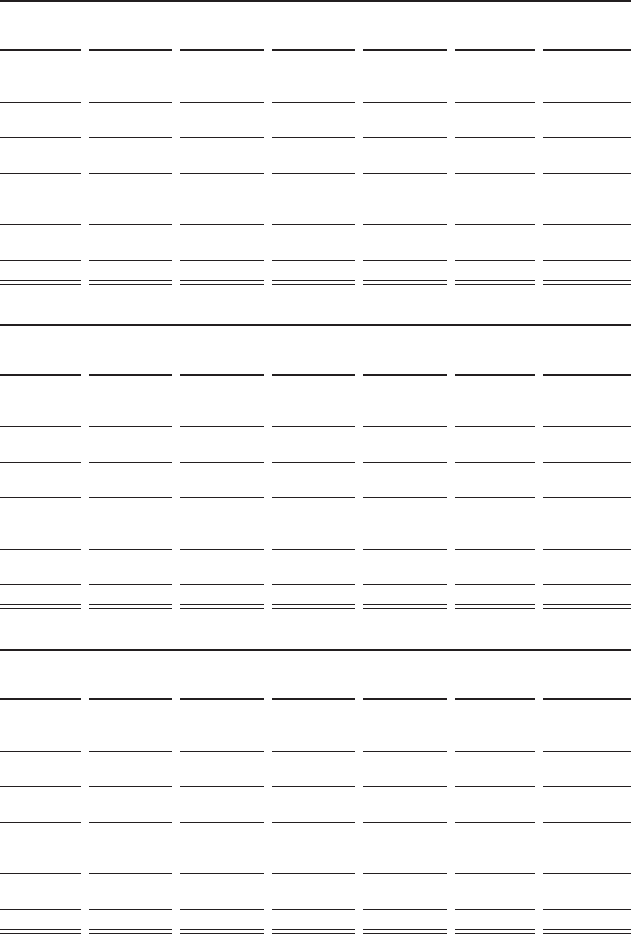

Twelve Months Ended December 31, 2008

(Dollars in thousands)

Retail and

Commercial Wholesale Mortgage

Wealth and

Investment

Management

Corporate

Other and

Treasury

Reconciling

Items Consolidated

Average total assets $58,603,247 $46,454,855 $41,980,502 $8,943,745 $19,696,253 $169,663 $175,848,265

Average total liabilities 84,460,577 17,261,054 2,767,244 10,040,018 42,905,700 (67,239) 157,367,354

Average total equity - - - - - 18,480,911 18,480,911

Net interest income $2,582,613 $499,898 $456,268 $331,919 $143,363 $605,595 $4,619,656

Fully taxable-equivalent adjustment (FTE) 34,404 64,825 - 31 18,227 - 117,487

Net interest income (FTE)12,617,017 564,723 456,268 331,950 161,590 605,595 4,737,143

Provision for loan losses2878,983 167,429 491,280 26,895 (160) 909,788 2,474,215

Net interest income after provision for loan losses 1,738,034 397,294 (35,012) 305,055 161,750 (304,193) 2,262,928

Noninterest income 1,352,665 649,193 435,954 951,466 1,098,433 (14,248) 4,473,463

Noninterest expense 2,623,157 818,870 1,333,082 960,735 168,782 (14,225) 5,890,401

Net income/(loss) before taxes 467,542 227,617 (932,140) 295,786 1,091,401 (304,216) 845,990

Provision (benefit) for income taxes3160,917 10,322 (370,360) 108,921 260,799 (120,382) 50,216

Net income/(loss) $306,625 $217,295 ($561,780) $186,865 $830,602 ($183,834) $795,774

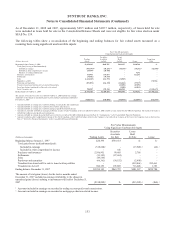

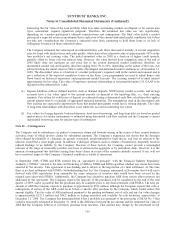

Twelve Months Ended December 31, 2007

(Dollars in thousands)

Retail and

Commercial Wholesale Mortgage

Wealth and

Investment

Management

Corporate

Other and

Treasury

Reconciling

Items Consolidated

Average total assets $58,591,299 $39,421,580 $45,554,067 $8,898,787 $23,747,010 $1,582,775 $177,795,518

Average total liabilities 84,525,396 12,391,317 2,718,817 10,434,414 49,821,210 96,351 159,987,505

Average total equity - - - - - 17,808,013 17,808,013

Net interest income $2,798,040 $517,752 $523,253 $352,198 ($169,026) $697,327 $4,719,544

Fully taxable-equivalent adjustment (FTE) 36,910 47,851 - 54 17,837 28 102,680

Net interest income (FTE)12,834,950 565,603 523,253 352,252 (151,189) 697,355 4,822,224

Provision for loan losses2285,840 46,923 81,157 8,519 404 242,079 664,922

Net interest income after provision for loan losses 2,549,110 518,680 442,096 343,733 (151,593) 455,276 4,157,302

Noninterest income 1,250,027 480,964 365,752 812,874 542,863 (23,796) 3,428,684

Noninterest expense 2,562,938 812,434 823,946 1,013,500 44,673 (23,714) 5,233,777

Net income/(loss) before taxes 1,236,199 187,210 (16,098) 143,107 346,597 455,194 2,352,209

Provision (benefit) for income taxes3445,705 (8,876) (21,539) 54,816 89,918 158,170 718,194

Net income $790,494 $196,086 $5,441 $88,291 $256,679 $297,024 $1,634,015

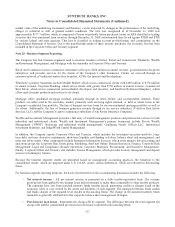

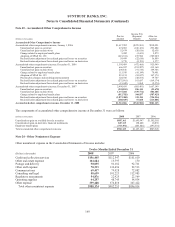

Twelve Months Ended December 31, 2006

(Dollars in thousands)

Retail and

Commercial Wholesale Mortgage

Wealth and

Investment

Management

Corporate

Other and

Treasury

Reconciling

Items Consolidated

Average total assets $58,519,264 $38,268,531 $42,014,600 $8,927,391 $30,553,856 $2,031,504 $180,315,146

Average total liabilities 84,394,130 12,007,649 2,151,683 10,021,909 54,267,154 (74,119) 162,768,406

Average total equity - - - - - 17,546,740 17,546,740

Net interest income $2,889,337 $554,326 $598,491 $373,306 ($143,225) $388,230 $4,660,465

Fully taxable-equivalent adjustment (FTE) 40,278 32,229 - 71 15,437 (49) 87,966

Net interest income (FTE)12,929,615 586,555 598,491 373,377 (127,788) 388,181 4,748,431

Provision for loan losses2110,595 122,412 8,748 3,697 641 16,443 262,536

Net interest income after provision for loan losses 2,819,020 464,143 589,743 369,680 (128,429) 371,738 4,485,895

Noninterest income 1,194,605 767,087 379,425 1,100,467 52,692 (25,904) 3,468,372

Noninterest expense 2,549,641 759,148 601,671 1,007,310 (13,950) (23,960) 4,879,860

Net income/(loss) before taxes 1,463,984 472,082 367,497 462,837 (61,787) 369,794 3,074,407

Provision (benefit) for income taxes3534,055 95,652 124,681 172,064 (98,575) 129,059 956,936

Net income $929,929 $376,430 $242,816 $290,773 $36,788 $240,735 $2,117,471

1Net interest income is fully taxable-equivalent and is presented on a matched maturity funds transfer price basis for the line of business.

2Provision for loan losses represents net charge-offs for the segments.

3Includes regular income tax provision and taxable-equivalent income adjustment reversal.

159