SunTrust 2008 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

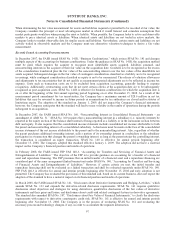

Notes to Consolidated Financial Statements (Continued)

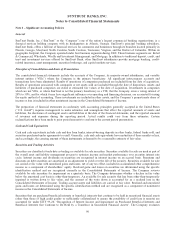

Derivatives entered into in a dealer capacity and those that either do not qualify for, or for which the Company has elected

not to apply, hedge accounting are accounted for as freestanding derivatives. Where derivatives have been used in client

transactions, the Company generally manages the risk associated with these contracts within the framework of its

value-at-risk (“VaR”) approach that monitors total exposure daily and seeks to manage the exposure on an overall basis. In

addition, as a normal part of its operations, the Company enters into certain interest rate lock commitments (“IRLCs”) on

mortgage loans that are accounted for as freestanding derivatives under SFAS No. 133. Freestanding derivatives are carried

at fair value on the balance sheet, with changes in fair value recorded in noninterest income.

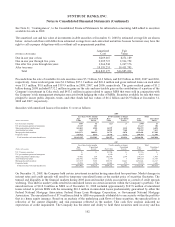

Derivatives are used as a risk management tool to hedge the Company’s exposure to changes in interest rates or other

identified market risks, either economically or in accordance with the hedge accounting provisions of SFAS No. 133. When a

derivative is entered into for the purpose of hedge accounting pursuant to the provisions of SFAS No. 133, the Company

prepares written hedge documentation and has, to date, designated the derivative as (1) a hedge of the fair value of a

recognized asset or liability (fair value hedge) or (2) a hedge of a forecasted transaction, such as, the variability of cash flows

to be received or paid related to a recognized asset or liability (cash flow hedge). The written hedge documentation is

completed in accordance with SFAS No. 133 and includes identification of, among other items, the risk management

objective, hedging instrument, hedged item and methodologies for assessing and measuring hedge effectiveness and

ineffectiveness, along with support for management’s assertion that the hedge will be highly effective. Methodologies related

to hedge effectiveness and ineffectiveness are consistent between similar types of hedge transactions and have included

(i) statistical regression analysis of changes in the cash flows of the actual derivative and a perfectly effective hypothetical

derivative, (ii) statistical regression analysis of changes in the fair values of the actual derivative and the hedged item and

(iii) comparison of the critical terms of the hedged item and the hedging derivative. For designated hedging relationships, the

Company performs retrospective and prospective effectiveness testing using quantitative methods and generally does not

assume perfect effectiveness through the matching of critical terms. Changes in the fair value of a derivative that is highly

effective and that has been designated and qualifies as a fair value hedge are recorded in current period earnings, along with

the changes in the fair value of the hedged item that are attributable to the hedged risk. Changes in the fair value of a

derivative that is highly effective and that has been designated and qualifies as a cash flow hedge are initially recorded in

accumulated other comprehensive income and reclassified to earnings in the same period that the hedged item impacts

earnings; and any ineffective portion is recorded in current period earnings. Assessments of hedge effectiveness and

measurements of hedge ineffectiveness are performed at least quarterly for ongoing effectiveness. Hedge accounting ceases

on transactions that are no longer deemed effective, or for which the derivative has been terminated or de-designated. For

discontinued fair value hedges where the hedged item remains outstanding, the hedged item would cease to be remeasured at

fair value attributable to changes in the hedged risk and any existing basis adjustment would be recognized as a yield

adjustment over the remaining life of the hedged item. For discontinued cash flow hedges where the hedged transaction

remains probable to occur as originally designated, the unrealized gains and losses recorded in accumulated other

comprehensive income would be reclassified to earnings in the period when the previously designated hedged cash flows

occur. If the previously designated transaction were no longer probable of occurring, any unrealized gains and losses in

accumulated other comprehensive income would be immediately reclassified to earnings.

In addition to freestanding derivative instruments, the Company evaluates contracts to determine whether any embedded

derivatives exist and whether any of those embedded derivatives are required to be bifurcated and separately accounted for as

freestanding derivatives in accordance with the provisions of SFAS No. 133. The Company adopted the provisions of SFAS

No. 155, “Accounting for Certain Hybrid Financial Instruments, an amendment of FASB Statements No. 133 and 140,” as of

January 1, 2006 and SFAS No. 159, as of January 1, 2007, which both permit an election to carry certain financial

instruments at fair value. The Company has bifurcated embedded derivatives from certain of its brokered deposits and short-

term debt in accordance with the provisions of SFAS No. 133. The Company has elected to fair value certain other brokered

deposits and short-term debt under either SFAS No. 155 or SFAS No. 159.

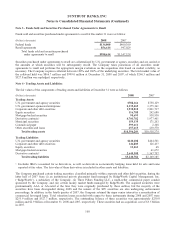

Effective January 1, 2008, the Company adopted Staff Accounting Bulletin (“SAB”) 109, and began including the value

associated with servicing of loans in the measurement of all written loan commitments issued after that date. The adoption,

net of other changes in the valuation of IRLCs, resulted in the acceleration of $18.3 million in mortgage-related income

during the first quarter of 2008.

The Company adopted FSP FIN 39-1, “Amendment of FASB Interpretation No. 39,” on January 1, 2008 and has elected not

to offset fair value amounts related to collateral arrangements recognized for derivative instruments under master netting

arrangements. Under master netting arrangements, the Company is obligated to return collateral of $1.1 billion and has the

right to reclaim collateral of $1.6 billion as of December 31, 2008. For additional information on the Company’s derivative

95