SunTrust 2008 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

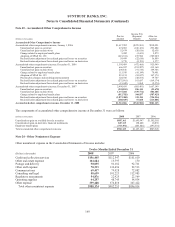

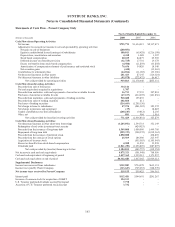

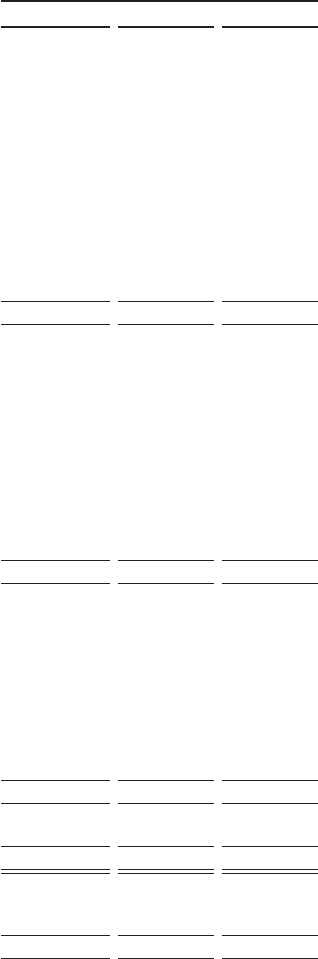

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

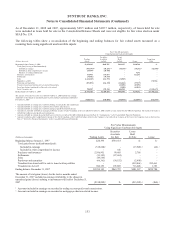

Statements of Cash Flow – Parent Company Only

Twelve Months Ended December 31

(Dollars in thousands) 2008 2007 2006

Cash Flows from Operating Activities:

Net income $795,774 $1,634,015 $2,117,471

Adjustments to reconcile net income to net cash provided by operating activities:

Net gain on sale of businesses (200,851) --

Equity in undistributed losses/(earnings) of subsidiaries 180,013 (65,428) (1,216,198)

Depreciation, amortization and accretion 4,410 1,028 1,907

Stock based compensation 20,185 24,275 25,969

Deferred income tax (benefit) provision (32,725) 17,701 19,378

Excess tax benefits from stock-based compensation (4,580) (11,259) (33,258)

Amortization of compensation element of performance and restricted stock 76,656 34,820 18,340

Net securities gains (448) - (15,065)

Contributions to retirement plans (64,016) (11,185) (33,306)

Net decrease/(increase) in other assets 241,423 27,145 (116,324)

Net (decrease)/increase in other liabilities (95,978) (272,472) 86,417

Net cash provided by operating activities 919,863 $1,378,640 $855,331

Cash Flows from Investing Activities:

Proceeds from sale of businesses 314,146 --

Net cash equivalents acquired in acquisitions 1,707 --

Proceeds from maturities, calls and repayments of securities available for sale 16,713 37,355 307,801

Purchases of securities available for sale (47,237) (214,005) (121,836)

Proceeds from maturities, calls and repayments of trading securities 518,600 195,235 -

Proceeds from sales of trading securities 402,020 211 -

Purchases of trading securities (214,693) (1,205,136) -

Net change in loans to subsidiaries 47,574 (241,583) 123,372

Net change in premises and equipment (39) - 12,823

Capital contributions (to)/from subsidiaries (268,245) (9,812) 2,105

Other, net 883 904 1,014

Net cash provided by/(used in) investing activities 771,429 (1,436,831) 325,279

Cash Flows from Financing Activities:

Net (decrease)/increase in other short-term borrowings (1,245,076) 1,594,733 351,149

Redemption of real estate investment trust security -(424,923) -

Proceeds from the issuance of long-term debt 1,549,800 1,000,000 1,499,700

Repayment of long-term debt (959,372) (900,572) (1,012,563)

Proceeds from the issuance of preferred stock 4,850,000 - 492,295

Proceeds from the exercise of stock options 25,569 186,000 215,947

Acquisition of treasury stock -(853,385) (1,105,043)

Excess tax benefits from stock-based compensation 4,580 11,259 33,258

Dividends paid (1,041,470) (1,056,869) (887,297)

Net cash provided by/(used in) financing activities 3,184,031 (443,757) (412,554)

Net increase in cash and cash equivalents 4,875,323 (501,948) 768,056

Cash and cash equivalents at beginning of period 1,437,365 1,939,313 1,171,257

Cash and cash equivalents at end of period $6,312,688 1,437,365 $1,939,313

Supplemental Disclosures:

Income taxes received from subsidiaries $332,802 $734,078 $615,131

Income taxes paid by Parent Company (313,647) (703,653) (548,570)

Net income taxes received by Parent Company $19,155 $30,425 $66,561

Interest paid $332,481 $344,691 $291,267

Issuance of common stock for acquisition of GB&T 154,513 --

U.S. Treasury preferred dividends accrued but unpaid 7,778 --

Accretion of U.S. Treasury preferred stock discount 3,732 --

163