SunTrust 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

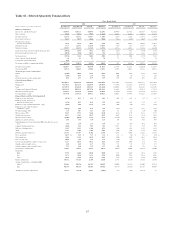

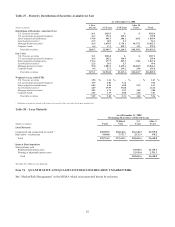

Total noninterest expense decreased $52.8 million, or 5.2%, despite a $45.0 million impairment charge on a client based

intangible in the second quarter of 2008. Noninterest expense before intangible amortization declined $91.0 million, or 9.2%,

driven by lower staff, discretionary, and indirect expenses, as well as lower structural expense resulting from the sales of

Lighthouse Partners and First Mercantile.

Corporate Other and Treasury

Corporate Other and Treasury’s net income for the twelve months ended December 31, 2008 was $830.6 million, an increase

of $573.9 million from the same period in 2007.

Net interest income increased $312.8 million over the same period in 2007 mainly due to increased gains on interest rate

swaps employed as part of an overall interest rate risk management strategy. Total average assets decreased $4.1 billion, or

17.1%, mainly due to the reduction in the size of the investment portfolio in 2007 as part of our overall balance sheet

management strategy. Total average deposits decreased $7.9 billion, or 35.5%, mainly due to a decrease in brokered and

foreign deposits as we reduced our reliance on wholesale funding sources.

Provision for loan losses decreased $0.6 million.

Total noninterest income increased $555.6 million compared to the same period in 2007 mainly due to increased gains on

securities and the sale of non-strategic businesses. Securities gains increased $431.4 million primarily due to the sale of Coke

common stock, partially offset by market value impairment related to certain ABS that were estimated to be other-than-

temporarily impaired. Trading gains and losses increased $40.2 million as gains on our long-term debt carried at fair value

were partially offset by losses on certain illiquid assets. Gains on our public debt carried at fair value, net of related hedges in

2008, were $431.7 million as compared to $140.9 million during 2007. The increase was also due to an $86.3 million gain on

our holdings of Visa in connection with its initial public offering and an $81.8 million gain on sale of TransPlatinum

subsidiary were offset by an $81.8 million decrease in gains on the sale/leaseback of real estate properties.

Total noninterest expense increased $124.1 million from the same period in 2007. The increase in expense was mainly due to

a $183.4 million contribution of Coke common stock to our charitable foundation recognized in marketing and customer

development expense.

EARNINGS AND BALANCE SHEET ANALYSIS 2007 vs. 2006

Consolidated Overview

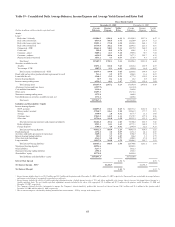

Net income totaled $1.6 billion, or $4.55 per diluted share for 2007, down 22.8% and 21.8%, respectively, from 2006. The

following are some of the key drivers of our 2007 financial performance as compared to 2006:

• Total revenue-FTE increased $34.1 million, or 0.4%, compared to 2006. Total revenue included approximately

$712.6 million in net market valuation related losses, which were offset by growth in net interest income, the

$234.8 million gain on sale of Coke common stock, fee-related noninterest income, and other gains, including real

estate related gains from various sale/leaseback transactions executed during 2007.

• Net interest income-FTE increased $73.8 million, or 1.6%, and the net interest margin increased 11 basis points to

3.11% compared to 2006. The increase in net interest income and net interest margin was due to our balance sheet

management initiatives that were implemented in 2006 and 2007.

• The average earning asset yield increased 29 basis points compared to 2006 while the average interest bearing

liability cost increased 17 basis points, resulting in a 12 basis point increase in interest rate spread. Total average

earning assets decreased $3.2 billion, or 2.0%, to $155.2 billion during 2007, while total average customer deposits

increased $844.9 million, or 0.9%, to $98.0 billion during 2007. Additionally, there was a shift in the mix of

deposits to higher cost products, with certificates of deposits increasing, while other deposit products, specifically

demand deposit accounts, money market, and savings, declined.

• Noninterest income decreased $39.7 million, or 1.1%, compared to 2006. The decrease was driven by $527.7

million of mark to market valuation losses related to the purchase of securities from (1) an institutional private

placement fund that we managed, (2) Three Pillars, a multi-seller commercial paper conduit that we sponsor and

(3) certain money market funds that we manage. The acquired securities were predominantly AAA or AA-rated at

the time originally purchased by these entities. In the fourth quarter of 2007, while certain securities were not

downgraded, these securities experienced an increase in the loss severity expectations of the underlying collateral,

75