SunTrust 2008 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

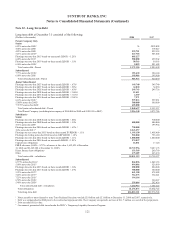

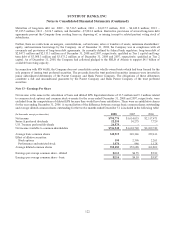

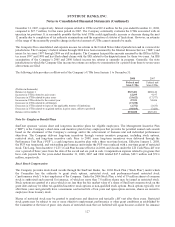

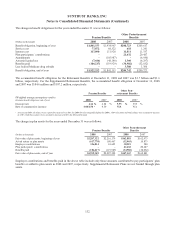

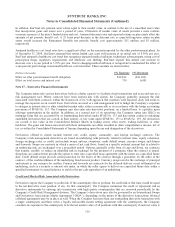

A reconciliation of the expected income tax expense at the statutory federal income tax rate of 35% to the Company’s actual

income tax expense (benefit) and effective tax rate for the past three years is as follows:

2008 2007 2006

(Dollars in thousands) Amount

Percent of

Pre-Tax

Income Amount

Percent of

Pre-Tax

Income Amount

Percent of

Pre-Tax

Income

Income tax expense at federal statutory rate $254,976 35.0 % $787,335 35.0 % $1,045,254 35.0 %

Increase (decrease) resulting from:

Tax-exempt interest (74,921) (10.2) (74,183) (3.3) (62,113) (2.1)

Dividends received deduction (13,766) (1.9) (14,949) (0.6) (14,859) (0.6)

Dividends paid on employee stock ownership plan shares (13,173) (1.8) (13,437) (0.6) (12,240) (0.4)

Charitable contribution (64,196) (8.8) (2,168) (0.1) (1,429) -

Income tax credits, net (75,164) (10.3) (75,480) (3.4) (68,646) (2.3)

State income taxes, net (74,009) (10.2) 18,578 0.8 6,201 0.2

Dividends on subsidiary preferred stock --(23,884) (1.0) (21,779) (0.7)

Other (7,018) (1.0) 13,702 0.6 (1,419) -

Total income tax expense (benefit) and rate ($67,271) (9.2) % $615,514 27.4 % $868,970 29.1 %

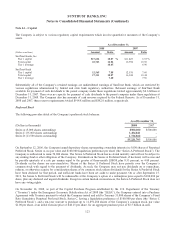

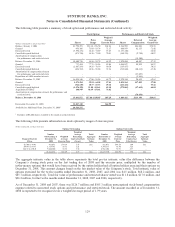

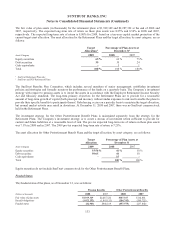

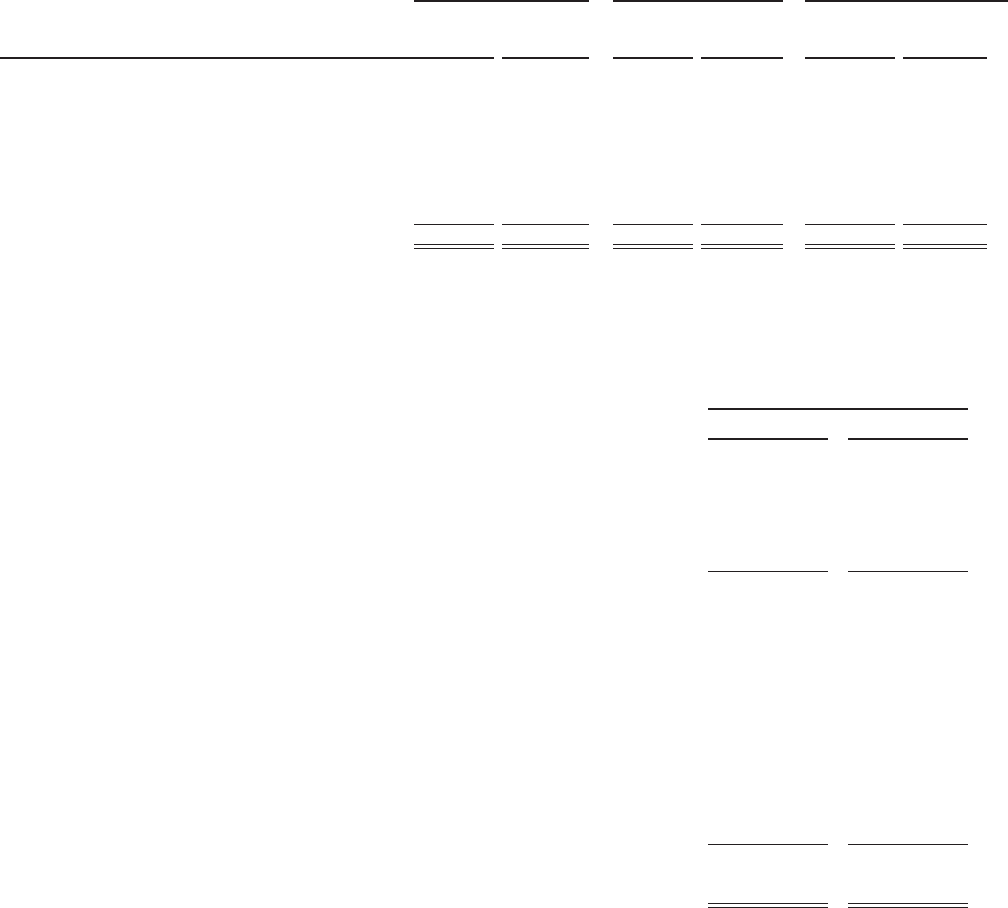

Deferred income tax liabilities and assets result from temporary differences between assets and liabilities measured for

financial reporting purposes and for income tax return purposes. These assets and liabilities are measured using the enacted

tax rates and laws that are currently in effect. The significant components of the net deferred tax liability at December 31

were as follows:

December 31,

(Dollars in thousands) 2008 2007

Deferred Tax Assets

Allowance for loan losses $887,401 $474,252

Accrued expenses 344,103 286,912

Other real estate owned 33,428 6,481

State NOL/valuation allowance (net of federal benefit) 96,524 57,499

Other 170,510 105,887

Gross deferred tax asset $1,531,966 $931,031

Deferred Tax Liabilities

Net unrealized gains in accumulated other comprehensive income $541,981 $929,048

Leasing 917,921 852,254

Employee benefits 164,053 148,529

Mortgage 485,045 484,459

Securities 143,096 (165,944)

Intangible assets 62,617 43,373

Fixed assets 67,908 33,800

Loans 44,207 87,616

Undistributed dividends 42,053 128,835

Other 64,374 97,164

Gross deferred tax liability $2,533,255 $2,639,134

Net deferred tax liability $1,001,289 $1,708,103

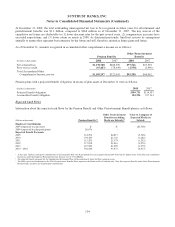

SunTrust and its subsidiaries file consolidated income tax returns where permissible or required. Each subsidiary generally

remits current taxes to or receives current refunds from the parent company based on what would be required had the

subsidiary filed an income tax return as a separate entity. Deferred tax assets resulting from state net operating loss (“NOL”)

carryforwards consisted of $148.5 million (net of a valuation allowance of $40.5 million) for 2008 and $88.5 million (net of a

valuation allowance of $37.1 million) for 2007. The state net operating losses expire, if not utilized, in varying amounts from

2009 to 2028.

As of December 31, 2008, the Company’s gross cumulative unrecognized tax benefits (“UTBs”) amounted to $330.0 million,

of which $266.7 million (net of federal tax benefit) would affect the Company’s effective tax rate, if recognized. As of

December 31, 2007, the Company’s gross cumulative UTBs amounted to $325.4 million. Additionally, the Company

recognized a gross liability of $70.9 million and $80.0 million for interest related to its UTBs as of December 31, 2008 and

126