SunTrust 2008 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

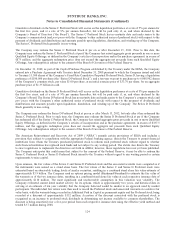

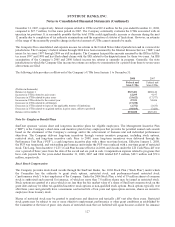

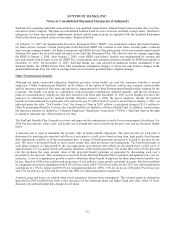

SunTrust also maintains unfunded, noncontributory non-qualified supplemental defined benefit pension plans that cover key

executives of the Company. The plans provide defined benefits based on years of service and final average salary. SunTrust’s

obligations for these non-qualified supplemental defined benefit pension plans are included with the qualified Retirement

Plans in the tables presented in this section under “Pension Benefits”.

On February 13, 2007, the Supplemental Executive Retirement Plan (“SERP”) was amended to reduce the benefit formula

for future service accruals. Current participants in the SunTrust SERP will continue to earn future accruals under a reduced

final average earnings formula. All future participants and ERISA Excess Plan participants will accrue benefits under benefit

formulas that mirror the revised benefit formulas in the SunTrust Retirement Plan. The effective date for changes impacting

the SERP is January 1, 2008. After January 1, 2008, a new SERP cash balance formula was implemented for existing and

new participants with no limit on pay for SERP Tier 2 participants and a minimum preserved benefit for SERP participants at

December 31, 2007. On December 31, 2007, SunTrust Banks, Inc. also adopted an additional written amendment to the

SunTrust Banks, Inc. ERISA Excess Plan. This amendment implements changes to mirror the cash balance changes in the

qualified Retirement Plan, but with an earnings limit of two times the qualified plan’s eligible earnings.

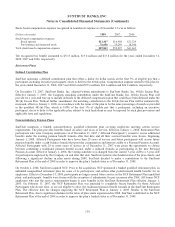

Other Postretirement Benefits

Although not under contractual obligation, SunTrust provides certain health care and life insurance benefits to retired

employees (“Other Postretirement Benefits” in the tables). At the option of SunTrust, retirees may continue certain health

and life insurance benefits if they meet age and service requirements for Other Postretirement Benefits while working for the

Company. The health care plans are contributory with participant contributions adjusted annually, and the life insurance

plans are noncontributory. Employees who have retired or will retire after December 31, 2003 are not eligible for retiree life

insurance or subsidized post-65 medical benefits. Effective January 1, 2008, the pre-65 employer subsidy for medical

benefits was discontinued for participants who will not be age 55 with at least 10 years of service before January 1, 2010. As

indicated under the table, “Net Periodic Cost,” the charge to Other in 2007 reflects a curtailment charge of $11.6 million to

Other Postretirement Benefits. Certain retiree health benefits are funded in a Retiree Health Trust. In addition, certain retiree

life insurance benefits are funded in a Voluntary Employees’ Beneficiary Association (“VEBA”). SunTrust reserves the right

to amend or terminate any of the benefits at any time.

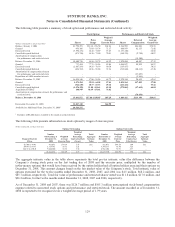

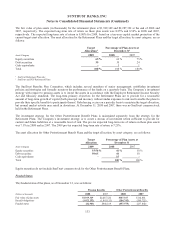

The SunTrust Benefits Plan Committee reviews and approves the assumptions for end-of-year measurement calculations. For

2008, the discount rate, salary scale, and health care cost trend rate were revised from the prior year and are discussed further

below.

A discount rate is used to determine the present value of future benefit obligations. The discount rate for each plan is

determined by matching the expected cash flows of each plan to a yield curve based on long term, high quality fixed income

debt instruments available as of the measurement date. A string of benefit payments projected to be paid by the plan for the

next 100 years is developed based on most recent census data, plan provisions and assumptions. The benefit payments at

each future maturity are discounted by the year-appropriate spot interest rates (which are developed from a yield curve of

approximately 315 Aa quality bonds with similar maturities as the benefit payments). The model then solves for the discount

rate that produces the same present value of the projected benefit payments as generated by discounting each year’s

payments by the spot rate. This assumption is reviewed by the SunTrust Benefits Plan Committee and updated every year for

each plan. A rate of compensation growth is used to determine future benefit obligations for those plans whose benefits vary

by pay. Based on 2008 salary analysis and projections of real inflation, wage growth, and merit increases, SunTrust modified

its compensation increase assumption from 4.0% for base salary and 4.5% for total salary for the 2007 year end measurement

calculations to 2.0% for all pay in 2009 (0% for nonqualified plans for 2009), 3.0% for all pay in 2010 and 4.0% for base pay

and 4.5% for total pay in 2011 and beyond for the 2008 year end measurement calculations.

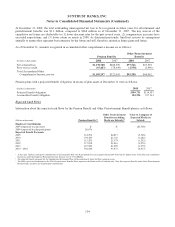

Actuarial gains and losses are created when actual experience deviates from assumptions. The actuarial gains on obligations

generated in 2008 resulted from lower salary increases for the retirement plans and higher lump sum rates, offset by lower

discount rates and participant data changes for all plans.

131