SunTrust 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

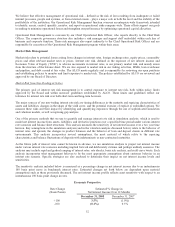

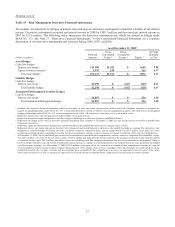

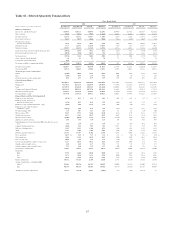

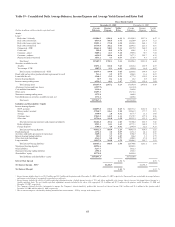

CONTRACTUAL COMMITMENTS

In the normal course of business, we enter into certain contractual obligations, including obligations to make future payments

on debt and lease arrangements, contractual commitments for capital expenditures, and service contracts. Table 17

summarizes our significant contractual obligations at December 31, 2008, except for pension and other postretirement benefit

plans, included in Note 16, “Employee Benefit Plans,” to the Consolidated Financial Statements.

Table 17 – Contractual Commitments

As of December 31, 2008

(Dollars in millions) 1 year or less 1-3 years 3-5 years After 5 years Total

Time deposit maturities1$29,059 $7,538 $1,721 $71 $38,389

Short-term borrowings19,480 - - - 9,480

Long-term debt 11,536 10,078 7,311 7,871 26,796

Operating lease obligations 208 375 313 728 1,624

Capital lease obligations11321016

Purchase obligations2104 282 226 640 1,252

Total $40,388 $18,276 $9,573 $9,320 $77,557

1Amounts do not include accrued interest.

2Includes contracts with a minimum annual payment of $5 million.

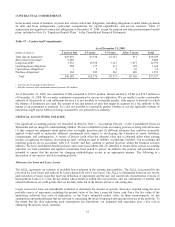

As of December 31, 2008, our cumulative UTBs amounted to $330.0 million. Interest related to UTBs was $70.9 million as

of December 31, 2008. We are under continuous examination by various tax authorities. We are unable to make a reasonable

estimate of the periods of cash settlement because it is not possible to reasonably predict, with respect to periods for which

the statutes of limitations are open, the amount of tax and interest (if any) that might be assessed by a tax authority or the

timing of an assessment or payment. It is also not possible to reasonably predict whether or not the applicable statutes of

limitations might expire without us being examined by any particular tax authority.

CRITICAL ACCOUNTING POLICIES

Our significant accounting policies are described in detail in Note 1, “Accounting Policies,” to the Consolidated Financial

Statements and are integral to understanding MD&A. We have identified certain accounting policies as being critical because

(1) they require our judgment about matters that are highly uncertain and (2) different estimates that could be reasonably

applied would result in materially different assessments with respect to ascertaining the valuation of assets, liabilities,

commitments, and contingencies. A variety of factors could affect the ultimate value that is obtained either when earning

income, recognizing an expense, recovering an asset, valuing an asset or liability, or reducing a liability. Our accounting and

reporting policies are in accordance with U.S. GAAP, and they conform to general practices within the financial services

industry. We have established detailed policies and control procedures that are intended to ensure these critical accounting

estimates are well controlled and applied consistently from period to period. In addition, the policies and procedures are

intended to ensure that the process for changing methodologies occurs in an appropriate manner. The following is a

description of our current critical accounting policies.

Allowance for Loan and Lease Losses

The ALLL represents our estimate of probable losses inherent in the existing loan portfolio. The ALLL is increased by the

provision for loan losses and reduced by loans charged off, net of recoveries. The ALLL is determined based on our review

and evaluation of larger loans that meet our definition of impairment and the size and current risk characteristics of pools of

homogeneous loans (i.e., loans having similar characteristics) within the loan portfolio and our assessment of internal and

external influences on credit quality that are not fully reflected in the historical loss or risk-rating data.

Larger nonaccrual loans are individually evaluated to determine the amount of specific allowance required using the most

probable source of repayment, including the present value of the loan’s expected future cash flows, the fair value of the

underlying collateral less costs of disposition, or the loan’s estimated market value. In these measurements, we use

assumptions and methodologies that are relevant to estimating the level of impaired and unrealized losses in the portfolio. To

the extent that the data supporting such assumptions has limitations, our judgment and experience play a key role in

enhancing the specific ALLL estimates.

61