SunTrust 2008 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

on the Company’s maximum exposure to losses by defining the loss amounts ceded to the Company as well as by

establishing trust accounts for each contract. The trust accounts, which are comprised of funds contributed by the Company

plus premiums earned under the reinsurance contracts, are maintained to fund claims made under the reinsurance contracts. If

claims exceed funds held in the trust accounts, the Company does not intend to make additional contributions beyond future

premiums earned under the existing contracts.

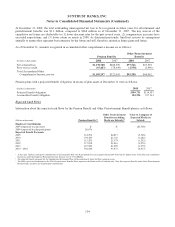

At December 31, 2008, the total loss exposure ceded to the Company was approximately $690 million; however, the

maximum amount of loss exposure based on funds held in each separate trust account was limited to $246.4 million. Of this

amount, $180.0 million of losses have been reserved for as of December 31, 2008, reducing our net loss exposure to $66.4

million. Future reported losses may exceed $66.4 million since future premium income will increase the amount of funds

held in the trust; however, future cash losses, net of premium income, are not expected to exceed $66.4 million. The amount

of future premium income is limited to the population of loans currently outstanding since additional loans are not being

added to the reinsurance contracts beginning in 2009, and future premium income could be significantly curtailed to the

extent we agree to relinquish control of individual trusts to the mortgage insurance companies. Premium income, which

totaled $58.8 million, $37.7 million and $27.5 million for each of the years ended December 31, 2008, 2007 and 2006,

respectively, are reported as part of noninterest income. The related provision for losses, which total $180.0 million and $0.2

million for each of the years ended December 31, 2008 and 2007, respectively, is reported as part of noninterest expense. No

losses were recorded in 2006.

As noted above, the reserve for estimated losses incurred under its reinsurance contracts totaled $180.0 million at

December 31, 2008. Our evaluation of the required reserve amount includes an estimate of claims to be paid by the trust

related to loans in default and as assessment of the sufficiency of future revenues, including premiums and investment

income on funds held in the trusts, to cover future claims.

Guarantees

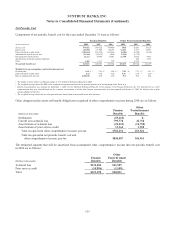

The Company has undertaken certain guarantee obligations in the ordinary course of business. In following the provisions of

FIN 45, “Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of

Indebtedness of Others,” the Company must consider guarantees that have any of the following four characteristics:

(i) contracts that contingently require the guarantor to make payments to a guaranteed party based on changes in an

underlying factor that is related to an asset, a liability, or an equity security of the guaranteed party; (ii) contracts that

contingently require the guarantor to make payments to a guaranteed party based on another entity’s failure to perform under

an obligating agreement; (iii) indemnification agreements that contingently require the indemnifying party to make payments

to an indemnified party based on changes in an underlying factor that is related to an asset, a liability, or an equity security of

the indemnified party; and (iv) indirect guarantees of the indebtedness of others. The issuance of a guarantee imposes an

obligation for the Company to stand ready to perform, and should certain triggering events occur, it also imposes an

obligation to make future payments. Payments may be in the form of cash, financial instruments, other assets, shares of

stock, or provisions of the Company’s services. The following is a discussion of the guarantees that the Company has issued

as of December 31, 2008, which have characteristics as specified by FIN 45.

Visa

The Company issues and acquires credit and debit card transactions through the Visa, U.S.A. Inc. card association or its

affiliates (collectively “Visa”). On October 3, 2007, Visa completed a restructuring and issued shares of Class B Visa

Inc. common stock to its financial institution members, including the Company, in contemplation of an initial public

offering (“IPO”). In March 2008, Visa completed its IPO and upon the closing, approximately 2 million of SunTrust’s

Class B shares were mandatorily redeemed. The Company received cash of $86.3 million in conjunction with the

redemption, which was recorded as a gain in noninterest income. As of December 31, 2008, SunTrust had 3.2 million

Class B shares remaining, the equivalent to 2.0 million Class A shares of Visa Inc. based on the current conversion

factor, which is subject to adjustment depending on the outcome of certain specifically defined litigation. The Class B

shares are not transferable until the latter of the third anniversary of the IPO closing, or the date which certain

specifically defined litigation has been resolved; therefore, the Class B shares are classified in other assets and

accounted for at their carryover basis, which is $0 as of December 31, 2008.

The Company is a defendant, along with Visa U.S.A. Inc. and MasterCard International (the “Card Associations”), as

well as several other banks, in one of several antitrust lawsuits challenging the practices of the Card Associations (the

“Litigation”). The Company has entered into judgment and loss sharing agreements with Visa and certain other banks in

140