SunTrust 2008 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2008 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

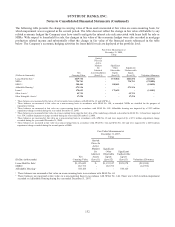

closely related to the host debt instrument. The Company elected to carry these instruments at fair value in order to

remove the mixed attribute accounting model required by SFAS No. 133. The provisions of that statement require

bifurcation of a single instrument into a debt component, which would be carried at amortized cost, and a derivative

component, which would be carried at fair value, with such bifurcation being based on the fair value of the derivative

component and an allocation of any remaining proceeds to the host debt instrument. Since the adoption of SFAS

No. 155, the Company has elected to carry substantially all newly-issued certificates of deposit at fair value. In cases

where the embedded derivative would not require bifurcation under SFAS No. 133, the instrument may be carried at fair

value under SFAS No. 159 to allow the Company to economically hedge the embedded features.

Loans and Loans Held for Sale

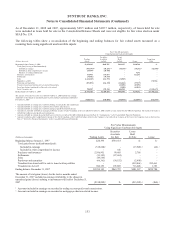

In the second quarter of 2007, the Company began recording at fair value certain newly-originated mortgage loans held

for sale based upon defined product criteria. SunTrust chose to fair value these mortgage loans held for sale in order to

eliminate the complexities and inherent difficulties of achieving hedge accounting and to better align reported results

with the underlying economic changes in value of the loans and related hedge instruments. This election impacts the

timing and recognition of origination fees and costs, as well as servicing value. Specifically, origination fees and costs,

which had been appropriately deferred under SFAS No. 91 and recognized as part of the gain/loss on sale of the loan,

are now recognized in earnings at the time of origination. For the year ended December 31, 2008, approximately $112.1

million of loan origination fees were recognized in noninterest income and approximately $110.7 million of loan

origination costs were recognized in noninterest expense due to this fair value election. For the year ended

December 31, 2007, approximately $79.4 million of loan origination fees were recognized in noninterest income and

approximately $78.4 million of loan origination costs were recognized in noninterest expense due to this fair value

election. The servicing value, which had been recorded as MSRs at the time the loan was sold, is now included in the

fair value of the loan and initially recognized at the time the Company enters into IRLCs with borrowers. The Company

began using derivatives to economically hedge changes in servicing value as a result of including the servicing value in

the fair value of the loan. The mark to market adjustments related to loans held for sale and the associated economic

hedges is captured in mortgage production income.

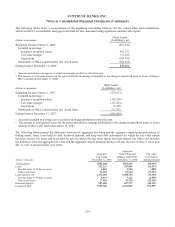

In the normal course of business, the Company may elect to transfer certain fair valued mortgage loans held for sale to

mortgage loans held for investment. During the year ended December 31, 2008, $83.9 million of such loans were

transferred from mortgage loans held for sale to mortgage loans held for investment due to a change in management’s

intent with respect to these loans based on the limited marketability of these loans given the lack of liquidity for certain

loan types.

On May 1, 2008, SunTrust acquired 100% of the outstanding common shares of GB&T. As a result of the acquisition,

SunTrust acquired approximately $1.4 billion of loans, primarily commercial real estate loans. SunTrust elected to

account for at fair value, in accordance with SFAS No. 159, $171.6 million of the acquired loans, which were classified

as nonaccrual, in order to eliminate the complexities of accounting for the loans under Statement of Position 03-3,

“Accounting for Certain Loans or Debt Securities Acquired in a Transfer.” Upon acquisition, the loans had a fair value

of $111.1 million. On December 31, 2008, primarily as a result of paydowns, payoffs and transfers to OREO, the loans

had a fair value of $31.2 million.

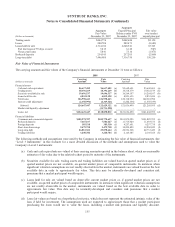

Trading Loans

The Company often maintains a portfolio of loans that it trades in the secondary market. Pursuant to the provisions of

SFAS No. 159, the Company elected to carry certain trading loans at fair value in order to reflect the active management

of these positions. Subsequent to the initial adoption, additional loans were purchased and recorded at fair value as part

of the Company’s normal loan trading activities. As of December 31, 2008, approximately $248.9 million of trading

loans were outstanding.

146