Capital One 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

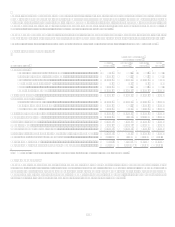

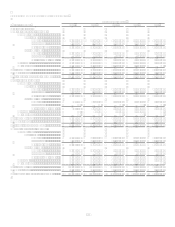

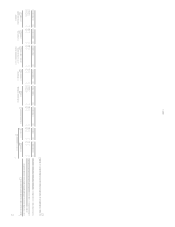

TABLE FNET CHARGE-OFFS

Table F shows the Companys net charge-offs for the periods presented on a reported and managed basis.

Year Ended December 31

(Dollars in thousands)

2008(1)

2007(1)

2006

2005

2004

Reported:

Average loans held for investment........ $ 98,970,903

$ 93,541,825 $ 63,577,279 $ 40,734,237 $ 34,265,668

Net charge-offs ..................................... 3,478,171

1,960,541 1,407,489 1,446,649 1,295,568

Net charge-offs as a percentage of

average loans held for investment.... 3.51% 2.10% 2.21% 3.55% 3.78%

Managed:

Average loans held for investment........ $ 147,812,266 $ 144,727,007 $ 111,328,595 $ 85,265,023 $ 73,711,673

Net charge-offs ..................................... 6,424,937

4,161,995 3,158,080 3,623,154 3,251,761

Net charge-offs as a percentage of

average loans held for investment.... 4.35% 2.88% 2.84% 4.25% 4.41%

(1) Based on continuing operations.

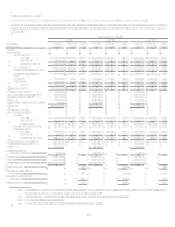

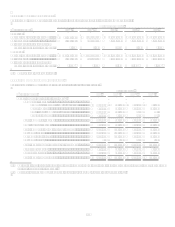

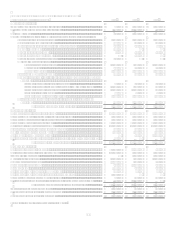

TABLE GNONPERFORMING ASSETS

Table G shows a summary of nonperforming assets for the periods indicated.

As of December 31

(Dollars in thousands)

2008

2007(2)

2006(2)

2005(2)

Nonperforming loans held for investment(1):

Commercial lending..........................................................

Commercial and multi-family real estate ................ $ 142,261

$ 29,391 $ 13,745 $ 7,800

Middle market ......................................................... 38,677

28,772 10,820 50,957

Small ticket commercial real estate......................... 167,467

16,026 237

Specialty lending..................................................... 37,217

6,086 226

Total commercial lending ................................................. 385,622

80,275 25,028 58,757

Small business lending...................................................... 75,619

42,490 32,563 29,292

Total commercial & small business lending ..................... 461,241

122,765 57,591 88,049

Consumer auto ............................................................... 164,646

156,580 86,943 61,053

Consumer real estate...................................................... 178,414

113,831 21,762 17,340

Consumer other.............................................................. 51

137 264 217

Total nonperforming loans held for investment................ 804,352

393,313 166,560 166,659

Foreclosed property .......................................................... 88,961

48,016 16,146 8,436

Repossessed assets............................................................ 65,635

56,877 30,844 22,917

Total nonperforming assets............................................... $ 958,948

$ 498,206 $ 213,550 $ 198,012

(1) Our policy is not to classify credit card loans as nonperforming loans. Credit card loans continue to accrue finance charges and

fees until charged-off at 180-days.

(2) Certain prior period amounts have been reclassified to conform to current period presentation.