Capital One 2008 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

Note 2

Discontinued Operations

Shutdown of Mortgage Origination Operations of Wholesale Mortgage Banking Unit

In the third quarter of 2007, the Company shut down the mortgage origination operations of its wholesale mortgage banking unit,

GreenPoint. GreenPoint was acquired by the Company in December 2006 as part of the North Fork acquisition. The results of the

mortgage origination operations of GreenPoint have been accounted for as a discontinued operation and have been removed from the

Companys results from continuing operations for the years ended December 31, 2008, 2007 and 2006.

The results of GreenPoints mortgage servicing business continue to be reported as part of the Companys continuing operations. The

mortgage servicing function was moved into the Local Banking segment in conjunction with the shutdown of the mortgage origination

operation and the results of the Local Banking segment include the mortgage servicing results for the year ended December 31, 2008

and 2007. The commercial and consumer mortgage loans held for investment portfolios were reported in the Local Banking segment

and the Other segment, respectively, for the years ended December 31, 2008 and 2007.

The Company retained $1.6 billion of certain GreenPoint loans and reclassified them from mortgage loans held for sale to held for

investment during 2007. Continuing cash flows from the held for investment loan portfolios are included in the Companys results of

continuing operations for the years ended December 31, 2008, 2007 and 2006, and classified as operating cash flows in the

Consolidated Statement of Cash Flows. The Company will have no significant continuing involvement in the operations of the

originate and sell business of GreenPoint.

The loss from discontinued operations for the year ended December 31, 2008 includes an expense of $103.7 million, recorded in non-

interest expense, for representations and warranties provided by the Company on loans previously sold to third parties by

GreenPoints mortgage origination operation.

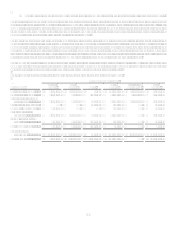

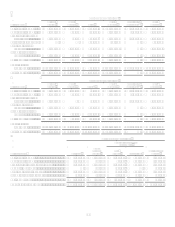

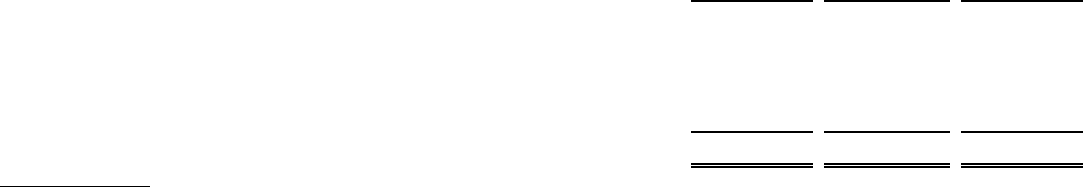

The following is summarized financial information for discontinued operations related to the closure of the Companys wholesale

mortgage banking unit:

Year Ended

December 31,

2008

Year Ended

December 31,

2007

Year Ended

December 31,

2006

Net interest income(1) ....................................................................................................

.

$ 6,939 $ 62,402 $ 8,184

Non-interest income.....................................................................................................

.

5,544 140,245 (4,292)

Provision for loan and lease losses ..............................................................................

.

80,151

Non-interest expense....................................................................................................

.

214,957 1,358,719 23,502

Income tax benefit .......................................................................................................

.

(71,959) (214,836) (7,726)

Loss from discontinued operations, net of taxes......................................................

.

$ (130,515) $ (1,021,387) $ (11,884)

(1) Net interest income includes funding credits of $27.3 million in 2008 and funding charges of $70.0 million in 2007 based on

funds transfer pricing methodology.

The Companys wholesale mortgage banking unit had assets of approximately $35.0 million and $91.3 million as of December 31,

2008 and 2007, respectively, consisting of $19.3 million and $35.8 million, respectively, of mortgage loans held for sale and other

related assets. The related liabilities consisted of obligations to fund these assets and for representations and warranties on loans

previously sold to third parties.

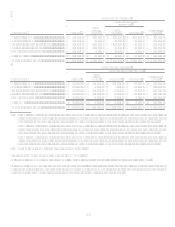

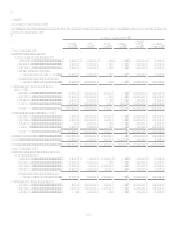

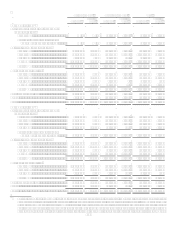

Note 3

Segments

The segments reflect the manner in which financial information is currently evaluated. The Company strategically manages and

reports the results of its business through two operating segment levels: Local Banking and National Lending. The Local Banking

segment includes the Companys branch, treasury services and national deposit gathering activities; its commercial, branch based

small business lending and certain branch originated consumer lending; and its mortgage servicing and home loans origination

activities.

During the first quarter of 2008, the Company reorganized its National Lending sub-segments. Segment and sub-segment results have

been restated for all periods presented. The National Lending segment consists of the following sub-segments:

U.S. Card sub-segment which consists of the Companys domestic credit card business, including small business credit

cards, and the installment loan businesses.