Capital One 2008 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

140

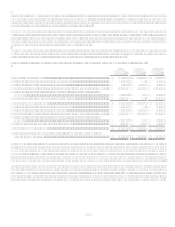

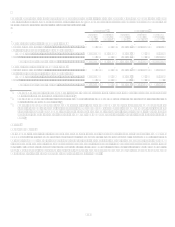

The remaining undivided interests in principal receivables and the related unpaid billed finance charge and fee receivables is

considered transferors interest which is retained by the Company and continues to be recorded as loans on the Consolidated Balance

Sheet as these loan receivables have not been sold to external investors. The amount of transferors interest fluctuates as the

accountholders make principal payments and incur new charges on the accounts. The amount of retained loan receivables,

representing transferors interest was $13.5 billion and $11.0 billion as of December 31, 2008 and 2007, respectively.

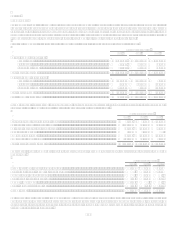

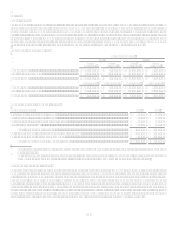

The Companys retained residual interests in the off-balance sheet securitizations are recorded in accounts receivable from

securitizations and are comprised of interest-only strips, retained senior tranches, retained subordinated tranches, cash collateral

accounts, cash reserve accounts and unpaid interest and fees on the investors portion of the transferred principal receivables. The

Companys retained residual interests are generally restricted or subordinated to investors interests and their value is subject to

substantial credit, repayment and interest rate risks on transferred assets if the off-balance sheet loans are not paid when due. As such,

the interest-only strip and retained subordinated interests are classified as trading assets in accordance with SFAS 155 and changes in

the estimated fair value are recorded in servicing and securitization income. Additionally, the Company may also retain senior

tranches in the securitization transactions which are considered to be higher investment grade securities and subject to lower risk of

loss. The retained senior tranches are classified as available for sale securities in accordance with SFAS 115 and changes in the

estimated fair value are recorded in other comprehensive income.

During 2008, the Company recorded a reduction in the interest-only strip of $224.8 million due predominately to increased credit

losses related to the off-balance sheet loans. Additionally, the Company held more retained residual interests either because of higher

enhancement levels required by the trusts for issuance of new securitizations or as part of our strategy to hold senior retained tranches.

These retained residual interests are subject to loss in the event assumptions used to determine the estimated fair value do not prevail,

or if borrowers default on the related off-balance loans and the Companys retained subordinate tranches are used to repay investors.

See the table below for key assumptions and sensitivities for retained interest valuations.

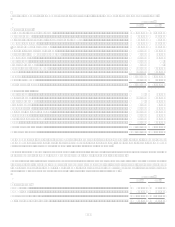

The gain on sale recorded from off-balance sheet securitizations is based on the estimated fair value of the assets sold and retained and

liabilities incurred, and is recorded at the time of sale, net of transaction costs, in servicing and securitizations income on the

Consolidated Statements of Income. The related receivable is the interest-only strip, which is based on the present value of the

estimated future cash flows from excess finance charges and past-due fees over the sum of the return paid to security holders,

estimated contractual servicing fees and credit losses. The Company periodically reviews the key assumptions and estimates used in

determining the value of the interest-only strip and other retained interests. The Company classifies the interest-only strip as a trading

asset in accordance with SFAS 155, and SFAS 115. The Company recognizes all changes in the fair value of the interest-only strip

immediately in servicing and securitizations income on the consolidated statements of income. In accordance with EITF 99-20 and

FSP EITF 99-20, the interest component of cash flows attributable to retained interests in securitizations is recorded in other interest

income.

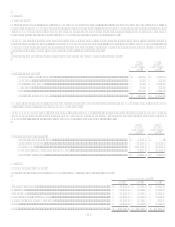

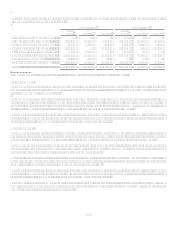

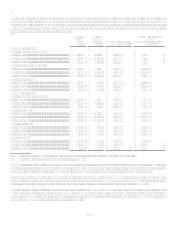

Key Assumptions for Retained Interest Valuations

The key assumptions used in determining the fair value of the interest-only strip and other retained residual interests resulting from

securitizations of loan receivables completed during the period included the weighted average ranges for net charge-off rates, principal

repayment rates, lives of receivables and discount rates included in the following table. The net charge-off rates are determined using

forecasted net charge-offs expected for the trust calculated consistently with other company net charge-off forecasts. The principal

repayment rate assumptions are determined using actual and forecasted trust principal repayment rates based on the collateral. The

lives of receivables are determined as the number of months necessary to pay off the investors given the principal repayment rate

assumptions. The discount rates are determined using primarily trust specific statistics and forward rate curves, and are reflective of

what market participants would use in a similar valuation. Additionally cash reserve and spread accounts are discounted over the

estimated life of the assets.

Year Ended December 31

2008

2007

Weighted average life for receivables (months) ................................................................................... 7 to 8

8 to 9

Principal repayment rate (weighted average rate)................................................................................. 15% to 16% 15% to 17%

Charge-off rate (weighted average rate) ............................................................................................... 6% to 7%

4% to 5%

Interest-only strip discount rate (weighted average rate) ...................................................................... 12% to 18% 11% to 13%

Retained notes discount rate (weighted average rate)........................................................................... 10% to 15% 7% to 11%