Capital One 2008 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.100

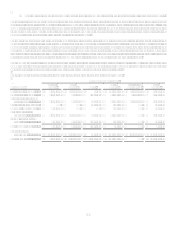

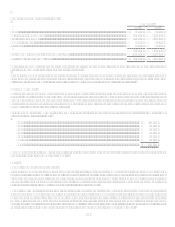

During 2007, the Company completed the sale of its interest in a relationship agreement to develop and market consumer credit

products in Spain and recorded a net gain related to this sale of $31.3 million consisting of a $41.6 million increase in non-interest

income partially offset by a $10.3 million increase in non-interest expense. This gain was recorded in the International sub-segment.

During 2007, the Company sold its remaining interest in DealerTrack, a leading provider of on-demand software and data solutions

for the automotive retail industry. The sale resulted in a $46.2 million gain, which was recorded in non-interest income and reported in

the Auto Finance sub-segment.

During 2007, the Company recorded $138.2 million of restructuring charges as part of its broad-based initiative to reduce expenses

and improve the Companys competitive cost position. The 2007 restructuring charges were recorded in non-interest expense and held

in the Other Segment.

During 2006, the Company sold a combination of previously purchased charged-off loan portfolios and the Company originated

charged-off loans resulting in the recognition of $83.8 million of non-interest income recognized in the Other Segment.

During 2006, the Company sold a number of Treasury and Agency securities realizing a loss of $34.9 million which was reported in

non-interest expense and held in the Other Segment.

Visa Litigation and IPO

During 2007, the Company recognized a pre-tax charge of $79.8 million for liabilities in connection with the Visa antitrust lawsuit

settlement with American Express. Additionally, the Company recorded a legal reserve of $59.1 million for estimated possible

damages in connection with other pending Visa litigation, reflecting our share of such potential damages as a Visa member. The 2007

litigation charges were recorded in non-interest expense and held in the Other Segment. During the first quarter of 2008, Visa

completed an initial public offering (IPO) of its stock. With IPO proceeds Visa established an escrow account for the benefit of

member banks to fund certain litigation settlements and claims. As a result, in the first quarter of 2008, the Company reversed its

Visa-related indemnification liabilities of $90.9 million recorded in other liabilities with a corresponding reduction of other non-

interest expense. In addition, the Company recognized a gain of $109.0 million in non-interest income for the redemption of

2.5 million shares related to the Visa IPO. Both items were included in the Other segment

MasterCard Stock Sale

During 2008, the Company recognized a gain of $44.9 million in non-interest income from the conversion and sale of 154,991 shares

of MasterCard, Inc. class B common stock, which was recorded in the Other Segment.

In 2007, shareholders approved an amendment to the MasterCard Certificate of Incorporation that provides for an accelerated

conversion of class B common stock into class A common stock. The MasterCard Board of Directors approved a conversion window

running from August 4 to October 5, 2007, during which time owners of class B shares could have voluntarily elected to convert and

sell a certain number of their shares. During the conversion period, Capital One elected to convert and sell 300,482 shares of

MasterCard class B common stock. The Company recognized gains of $43.4 million on these transactions in non-interest income in

the Other segment.

MasterCard IPO

During 2006, MasterCard, Inc. completed an initial public offering of its stock. In connection with this transaction, the Company

received 2,305,140 Class B shares of which 1,360,032 Class B shares were immediately redeemed by MasterCard, Inc. The Company

recognized a $20.5 million gain from the share redemption, which was reported in non-interest expense and held in the Other segment.

The Gulf Coast Hurricanes Impacts

During 2006, the Company determined that $25.7 million of allowance for loan losses previously established by Hibernia to cover

expected losses in the portion of the loan portfolio impacted by the Gulf Coast Hurricanes was no longer needed. This determination

was driven by improvements in credit performance of the impacted portfolios since the time those reserves were established. As a

result, the Local Banking segment includes the reversal of this allowance.