Capital One 2008 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123

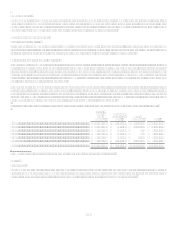

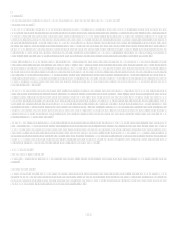

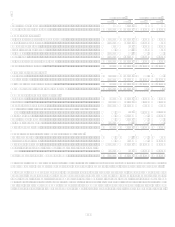

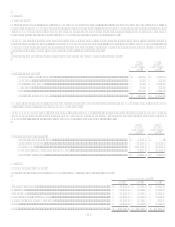

Pension Benefits

Postretirement Benefits

2008

2007

2008

2007

Special termination benefits..............................................................................

.

4,895

Benefit obligation at end of year.......................................................................

.

$ 189,751

$ 207,926 $ 73,700

$ 59,783

Change in plan assets:

Fair value of plan assets at beginning of year ...................................................

.

$ 308,335

$ 303,726 $ 8,356

$ 7,682

Actual return on plan assets ..............................................................................

.

(80,678) 23,757 (1,375) 674

Employer contributions.....................................................................................

.

945

880 3,833

3,686

Plan participant contributions ...........................................................................

.

635

532

Settlements........................................................................................................

.

(24,657)

Benefits paid .....................................................................................................

.

(11,340) (20,028) (4,468) (4,218)

Fair value of plan assets at end of year .............................................................

.

$ 192,605

$ 308,335 $ 6,981

$ 8,356

Funded status at end of year..............................................................................

.

$ 2,854

$ 100,409 $ (66,719) $ (51,427)

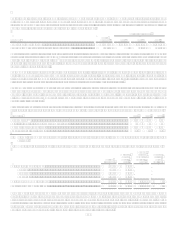

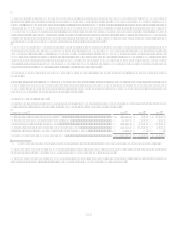

Balance Sheet Presentation:

Other assets.......................................................................................................

.

$ 13,316

$ 111,013 $

$

Other liabilities .................................................................................................

.

(10,462) (10,604) (66,719) (51,427)

Net amount recognized at end of year...............................................................

.

$ 2,854

$ 100,409 $ (66,719) $ (51,427)

Accumulated benefit obligation at end of year.............................................

.

$ 189,751

$ 207,926 n/a

n/a

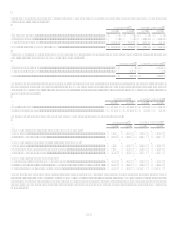

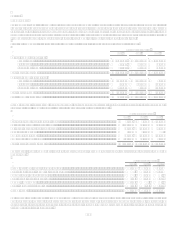

Components of net periodic benefit cost:

Service cost.......................................................................................................

.

$ 2,500

$ 15,014 $ 1,687

$ 8,373

Interest cost.......................................................................................................

.

11,941

12,034 3,605

4,678

Expected return on plan assets..........................................................................

.

(21,091) (21,688) (608) (574)

Amortization of transition obligation, prior service credit, and net actuarial

loss ...............................................................................................................

.

188 (7,959) (4,308)

Curtailment gain ...............................................................................................

.

(8,483)

(1,454)

Special termination benefits..............................................................................

.

4,895

Settlement loss recognized................................................................................

.

10,829

Net periodic benefit cost ...................................................................................

.

$ 4,179

$ 1,960 $ (3,275) $ 6,715

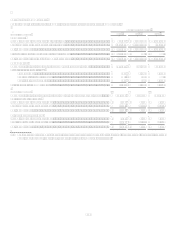

Changes recognized in other comprehensive income, pretax:

Transition obligation.........................................................................................

.

$

$ $

$ 276

Prior service (cost) credit..................................................................................

.

(363)

21,798

Net actuarial gain (loss) ....................................................................................

.

(105,150) 18,354 (13,535) 10,814

Reclassification adjustments for amounts recognized in net periodic benefit

cost ...............................................................................................................

.

10,829

511 (9,748) (4,308)

Total recognized in other comprehensive income.............................................

.

$ (94,321) $ 18,502 $ (23,283) $ 28,580

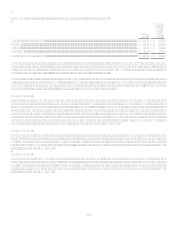

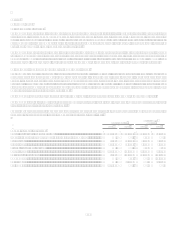

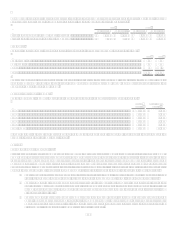

During 2008, the Company recognized a settlement within the qualified pension plan due to making lump-sum cash payments to

former employees of GreenPoints mortgage origination operations in exchange for their rights to receive specified pension benefits.

During 2007, the Company recognized curtailments attributable to the freezing of one of the qualified plans assumed in the North

Fork acquisition and to the termination of employees in the closure of GreenPoints mortgage origination operations. Special

termination benefits in 2007 relate to the Companys offering of immediate vesting in pension benefits to eligible employees who

were terminated in the closure of GreenPoints mortgage origination operations. The $22.1 million reduction in other postretirement

benefit obligation from plan amendments in 2007 relates to the Companys decision to begin phasing out its contributions toward

retiree health care costs so that employees becoming retirement eligible in 2013 and later years will receive no employer contributions.