Capital One 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 36

The Company records valuation allowances to reduce deferred tax assets to the amount that is more likely than not to be realized. In

making this assessment, management analyzes future taxable income, reversing temporary differences and ongoing tax planning

strategies. Should a change in circumstances lead to a change in judgment about the realizability of deferred tax assets in future years,

the Company would adjust related valuation allowances in the period that the change in circumstances occurs, along with a

corresponding increase or charge to income.

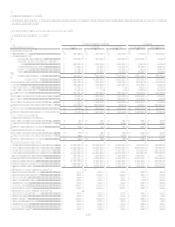

For the years ended December 31, 2008 and 2007, the provision for income taxes on continuing operations was $0.5 billion and $1.3

billion, respectively, and as of December 31, 2008 and 2007, the valuation allowance was $67.7 million and $21.3 million,

respectively.

III. Off-Balance Sheet Arrangements

The Company has various types of off-balance sheet arrangements that we enter into in the ordinary course of business. Off-balance

sheet activities typically utilize special purpose entities (SPEs) that may be in the form of limited liability companies, partnerships

or trusts. The SPEs raise funds by issuing debt to third party investors. The SPEs hold various types of financial assets whose cash

flows are the primary source of repayment for the liabilities of the SPE. Investors only have recourse to the assets held by the SPE but

may also benefit from other credit enhancements.

The Companys involvement in these arrangements can take many different forms, including securitization activities, servicing

activities, the purchase or sale of mortgage-backed and other asset backed securities in connection with our investment portfolio, and

loans to variable interest entities (VIEs) that hold debt, equity, real estate or other assets. In certain instances, the Company also

provides guarantees to VIEs or holders of variable interests in VIEs. See Item 8. Financial Statements and Supplementary Data

Notes to the Consolidated Financial Statements Note 13 Mortgage Servicing Rights; Note 18 Securitizations; Note 19

Commitments, Contingencies and Guarantees; and Note 20 Other Variable Interest Entities for more detail on the Companys

involvement and exposure related to off-balance sheet arrangements.

Special Purpose Entities

A SPE is an entity in the form of a trust or other legal vehicle designed to fulfill a specific limited need of the company that was

initially involved in the organization of the SPE. The primary use of SPEs is to obtain liquidity and favorable capital treatment by

securitizing certain assets of the Company. In a securitization, a company transfers assets to an SPE and receives cash proceeds for the

assets that have been transferred upon the issuance of debt and equity instruments, certificates or other notes of indebtedness. The

transferred assets and the related debt issuances are recorded on the balance sheet of the SPE and are not reflected on the companys

balance sheet, assuming the transfer satisfies the sale criteria of SFAS 140. Investors usually have recourse to the assets in the SPE

and may also benefit from other credit enhancements, such as a collateral account or overcollateralization in the form of excess assets

in the SPE, or from other liquidity guarantees. The SPE can typically obtain a more favorable credit rating from rating agencies than

the transferor could obtain for its own debt issuances, resulting in less expensive financing costs. The SPE may also enter into

derivative contracts in order to convert the yield or currency of the underlying assets to match the needs of the SPE investors, or to

limit or change the credit risk of the SPE. The Company may be the provider of certain credit enhancements as well as the

counterparty to any related derivative contracts.

Qualifying SPEs

Qualifying special purpose entities (QSPEs) are a special class of SPEs which are defined in SFAS 140. These SPEs have

significant limitations on the types of assets and derivative instruments they may own and may not actively manage their assets

through discretional sales and are generally limited to making decisions inherent in servicing activities and issuance of liabilities.

QSPEs are passive entities designed to purchase assets and pass through the cash flows from the transferred assets to the investors of

the QSPE. QSPEs are generally exempt from consolidation by the transferor of assets to the QSPE and any investor or counterparty.

In April 2008, the FASB voted to eliminate QSPEs from the accounting guidance. On September 15, 2008, the FASB issued exposure

drafts to amend SFAS 140 and FASB Interpretation No. 46 (Revised 2003), Consolidation of Variable Interest Entities (FIN 46(R)).

The two proposed Statements would significantly change accounting for transfers of financials assets, due to elimination of the

concept of a QSPE, and would change the criteria for determining whether to consolidate a VIE. The proposals are currently in a

public comment period and are subject to change. As the proposals stand, however, the change would have a significant impact on the

Companys consolidated financial statements as a result of the loss of sales treatment for assets previously sold to a QSPE, as well as

for future sales. As of December 31, 2008, the total assets of QSPEs to which the Company has transferred and received sales

treatment were $45.9 billion.