Capital One 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

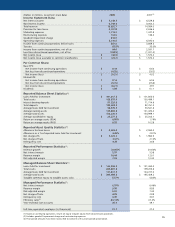

Credit cards have proven to be resilient across economic cycles. And, year after year, credit cards

continue to provide the best combination of risk-adjusted returns and credit losses of any asset

class. Relative to other big players in the credit card industry, our U.S. Card business continued to

outperform, delivering after-tax returns on managed loans of 1.46%. While U.S. Card faces significant

risks (including further economic degradation and the prospect of legislative and regulatory changes

which could impact profitability and resiliency), the business remains well positioned to successfully

navigate the downturn.

Our Small Business credit card business, included in our U.S. Card segment, had $5.8 billion in

managed loans at the end of 2008. Our Small Business credit cards continued to perform roughly in

line with our consumer credit card portfolio, while continuing to provide a much-needed liquidity

“lifeline” to the many small businesses across the country that drive our national economy.

Times were difficult for the other national lending businesses included in our U.S. Card segment.

Increasing loss rates due to a rapidly worsening economy caused us to retreat to higher ground in

installment lending and point-of-sale finance. Given the disproportionately poor credit performance of

recent vintages, we have virtually stopped originating installment loans outside our retail banking footprint.

In Capital One Auto Finance, we pulled back significantly in 2008. We reduced originations by

$6.3 billion, an almost 48% reduction versus 2007. We focused on repositioning the business in

light of the extreme difficulties facing the auto industry where auto manufacturers struggled, auto

sales plummeted, and used car prices collapsed (depressing recovery rates for bad loans). We improved

the credit quality of our new auto loans and leveraged pricing opportunities in the face of dwindling

competition. And we continued to aggressively bring down operating costs. Over time, we are

building a smaller auto finance business that we believe can deliver above hurdle rate returns on a

risk-adjusted basis through the cycle.

Our international businesses generated a modest profit in 2008, with solid profits in our Canadian

business offsetting losses in the UK business. The UK economy continued to deteriorate, leading us

to pull back and maintain a cautious stance. Losses in the UK were mainly driven by a significant

allowance build in light of growing economic weakness. In contrast to the UK, our Canadian credit

card business continued to perform well, with stable credit performance and solid returns aided by

a relatively strong Canadian economy.

Our Local Banking Business Is Winning While Driving Deposit Growth

Our Local Banking business has dramatically changed the risk profile of Capital One, significantly

reducing our funding risk in the current environment. But our Local Banking business is not merely

a funding source. We are building a business that can win in each of its local markets in consumer,

small business, and commercial banking.

Our Local Banking business substantially completed the integration and re-branding of its New York

region operations in 2008. For the past year, we were often competing off our back foot as we

6