Capital One 2008 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.119

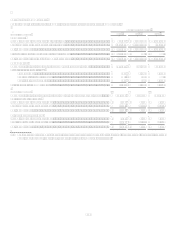

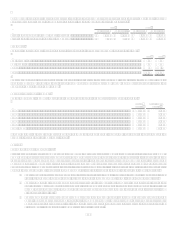

Note 10

Shareholders Equity, Other Comprehensive Income and Earnings Per Common Share

Preferred Shares

On November 14, 2008 the Company entered into an agreement (the Securities Purchase Agreement) to issue 3,555,199 Fixed Rate

Cumulative Perpetual Preferred Shares, Series A, par value $0.01 per share ( the Series A Preferred Stock), to the United States

Department of the Treasury (U.S. Treasury) as part of the Companys participation in the CPP, having a liquidation amount per

share equal to $1,000. The Series A Preferred Stock pays cumulative dividends at a rate of 5% per year for the first five years and

thereafter at a rate of 9% per year. The Company may not redeem the Series A Preferred Stock during the first three years except with

the proceeds from a qualified equity offering. The American Recovery and Reinvestment Act includes provisions that would allow

the Company to redeem the Series A Preferred Stock using proceeds other than those received from a qualified equity offering under

certain circumstances and with regulatory approval. After three years, the Company may, at its option, redeem the Series A Preferred

Stock at the liquidation amount plus accrued and unpaid dividends. The Series A Preferred Stock is generally non-voting.

In addition, the Company issued a warrant (the Warrant) to purchase 12,657,960 of the Companys common shares to the U.S.

Treasury as part of the Securities Purchase Agreement. The Warrant has an exercise price of $42.13 per share. The Warrant expires

ten years from the issuance date. If, on or prior to December 31, 2009, the Company receives aggregate gross cash proceeds of not less

than the purchase price of the Series A Preferred Stock from one or more qualified equity offerings announced after October 13,

2008, the number of shares of common stock issuable pursuant to the U.S. Treasurys exercise of the Warrant will be reduced by one-

half of the original number of shares, taking into account all adjustments, underlying the Warrant. Pursuant to the Securities Purchase

Agreement, the U.S. Treasury has agreed not to exercise voting power with respect to any shares of common stock issued upon

exercise of the Warrant.

The Company received proceeds of $3.55 billion for the Series A Preferred Stock and the Warrant. The Company allocated the

proceeds based on a relative fair value basis between the Series A Preferred Stock and the Warrant, recording $3.06 billion and $491.5

million, respectively. Fair value of the preferred stock was estimated using independent quotes from third party sources who

considered the structure, subordination and size of the preferred stock issuance in comparison to the trust preferred securities issued by

special purpose trusts established by the Company. Fair value of the stock warrant was estimated using a pricing model with the most

significant assumptions being the forward dividend yield and implied volatility of the Companys stock price. The $3.06 billion of

Series A Preferred Stock is net of a discount of $491.5 million. The discount will be accreted to the $3.55 billion liquidation

preference amount over a five year period. The accretion of the discount and dividends on the preferred stock reduce net income

available to common shareholders.

The Company is subject to a number of restrictions as a result of participation in the CPP. Among these are restrictions on dividend

payments to common shareholders and restrictions on share repurchases. If the Series A Preferred Stock has not been redeemed by

November 14, 2011 or the U.S. Treasury has not transferred the Series A Preferred Stock to a third party, the consent of the U.S

Treasury will be required to (1) declare or pay any dividend or make any distribution on the Companys common stock (other than

regular quarterly cash dividends of not more than $0.375 per share of common stock) or (2) redeem, purchase or acquire any shares of

our common stock or other equity or capital securities, other than in connection with benefit plans consistent with past practice and

certain other circumstances specified in the Securities Purchase Agreement.

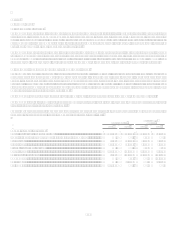

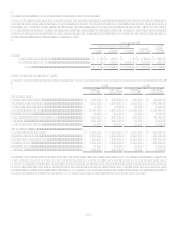

Common Shares

Secondary Equity Offering

On September 30, 2008, the Company raised $760.8 million through the issuance of 15,527,000 shares of common stock at $49 per

share.

Share Repurchases

On January 31, 2008, the Companys Board of Directors authorized the repurchase of up to $2.0 billion of the Companys common

stock. The Company did not repurchase any shares during 2008 under this authorization due to market conditions. Any future

repurchases are subject to the conditions of the Securities Purchase Agreement entered into with the U.S. Treasury as noted above.

The Company has no intention to repurchase shares at this time.