Capital One 2008 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

125

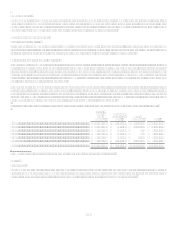

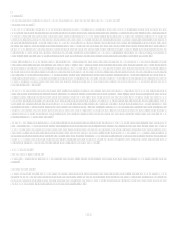

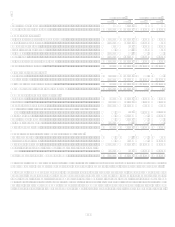

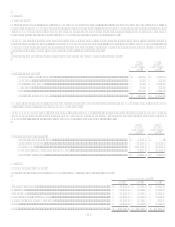

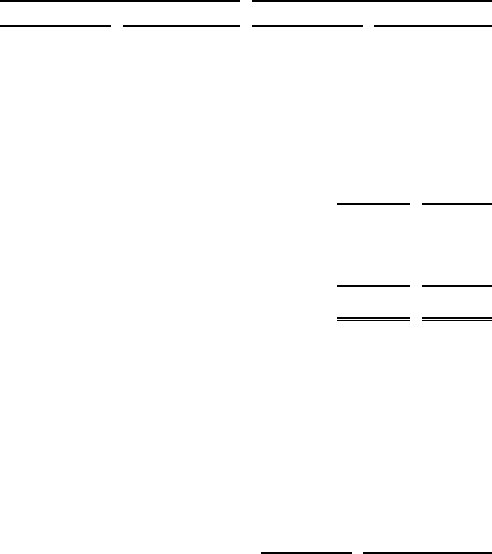

Assumed health care cost trend rates have a significant effect on the amounts reported for the other postretirement benefit plans. A

one-percentage point change in assumed health care cost trend rates would have the following effects:

2008

2007

1% Increase

1% Decrease

1% Increase

1% Decrease

Effect on year-end postretirement benefit obligation................................ $ 7,752 $ (6,533) $ 5,684 $ (4,817)

Effect on total service and interest cost components ................................ $ 698 $ (579) $ 1,780 $ (1,459)

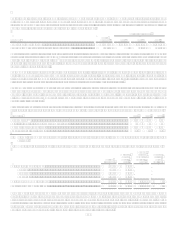

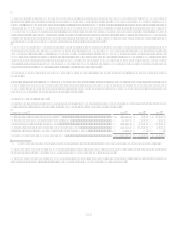

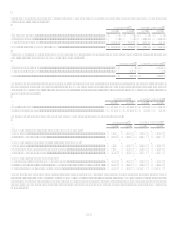

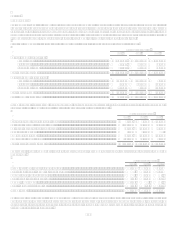

Plan Assets

The qualified defined benefit pension plan asset allocations as of the annual measurement dates are as follows:

2008

2007

Equity securities..........................................................................................................................................................

.

65% 70%

Debt securities.............................................................................................................................................................

.

34% 30%

Other ...........................................................................................................................................................................

.

1%

Total............................................................................................................................................................................

.

100% 100%

The investment guidelines provide the following asset allocation targets and ranges: domestic equity target of 50% and allowable

range of 45% to 55%, international equity target of 20% and allowable range of 15% to 25%, and domestic debt securities target of

30% and allowable range of 25% to 40%.

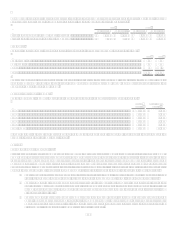

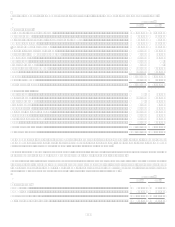

Expected future benefit payments

The following benefit payments, which reflect expected future service, as appropriate, are expected to be paid:

Pension

Benefits

Postretirement

Benefits

2009 .............................................................................................................................................................

.

$ 16,169 $ 3,497

2010 .............................................................................................................................................................

.

15,037 3,824

2011 .............................................................................................................................................................

.

15,225 4,182

2012 .............................................................................................................................................................

.

15,399 4,367

2013 .............................................................................................................................................................

.

14,377 4,853

2014 - 2018 ..................................................................................................................................................

.

68,878 29,610

In 2009, $0.9 million in contributions are expected to be made to the pension plans, and $3.5 million in contributions are expected to

be made to the other postretirement benefit plans.

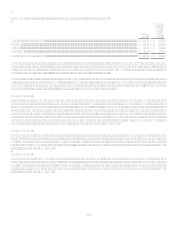

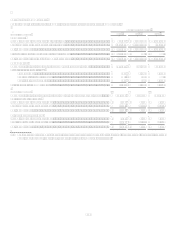

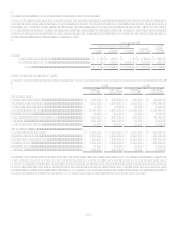

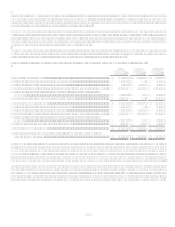

Note 12

Fair Value of Assets and Liabilities

Effective January 1, 2008, the Company adopted SFAS 157, which provides a framework for measuring fair value under GAAP.

SFAS 157 defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in

the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the

measurement date. SFAS 157 requires that valuation techniques maximize the use of observable inputs and minimize the use of

unobservable inputs. SFAS 157 also establishes a fair value hierarchy which prioritizes the valuation inputs into three broad levels.

Based on the underlying inputs, each fair value measurement in its entirety is reported in one of the three levels. These levels are:

Level 1 Valuation is based upon quoted prices for identical instruments traded in active markets. Level 1 assets and

liabilities include debt and equity securities traded in an active exchange market, as well as U.S. Treasury securities.

Level 2 Valuation is based upon quoted prices for similar instruments in active markets, quoted prices for identical or

similar instruments in markets that are not active, and model based valuation techniques for which all significant

assumptions are observable in the market or can be corroborated by observable market data for substantially the full term

of the assets or liabilities.

Level 3 Valuation is determined using model-based techniques with significant assumptions not observable in the

market. These unobservable assumptions reflect the Companys own estimates of assumptions that market participants

would use in pricing the asset or liability. Valuation techniques include the use of third party pricing services, option

pricing models, discounted cash flow models and similar techniques.