Capital One 2008 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122

Note 11

Retirement Plans

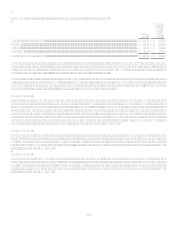

Defined Contribution Plan

The Company sponsors a contributory Associate Savings Plan in which substantially all full-time and certain part-time associates are

eligible to participate. The Company makes contributions to each eligible associates account, matches a portion of associate

contributions and makes discretionary contributions based upon the Company meeting a certain earnings per share target or other

performance metrics. The Companys contributions to this plan amounted to $110.3 million, $73.6 million and $70.9 million for the

years ended December 31, 2008, 2007 and 2006, respectively.

The Company sponsors other defined contribution plans that were assumed through recent acquisitions. These plans were all merged

into the Companys Associate Savings Plan at the end of 2007. As a result, there were no contributions of cash and shares of the

Companys common stock to these plans in 2008. In prior years, contributions of cash and shares of the Companys common stock

totaled $35.6 million and $12.6 million for the years ended December 31, 2007 and 2006, respectively, were made to these plans.

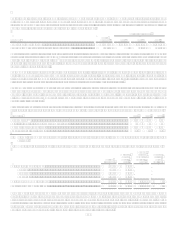

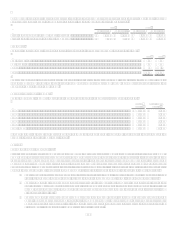

Defined Benefit Pension and Other Postretirement Benefit Plans

The Company sponsors defined benefit pension plans and other postretirement benefit plans. Pension plans include a legacy frozen

cash balance plan and plans assumed in the North Fork acquisition, including two qualified defined benefit pension plans and several

non-qualified defined benefit pension plans. The Companys legacy pension plan and the two qualified pension plans from the North

Fork acquisition were merged into a single plan effective December 31, 2007. Other postretirement benefit plans including a legacy

plan and plans assumed in the Hibernia and North Fork acquisitions, all of which provide medical and life insurance benefits, were

merged into a single plan effective January 1, 2008.

The Companys pension plans and the other postretirement benefit plans were valued using a December 31 measurement date.

The Companys policy is to amortize prior service amounts on a straight-line basis over the average remaining years of service to full

eligibility for benefits of active plan participants.

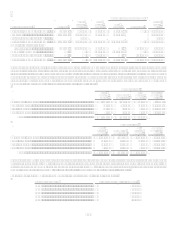

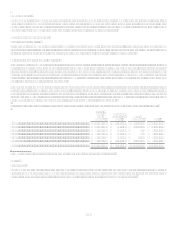

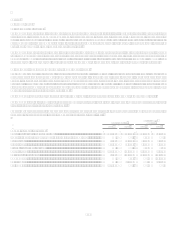

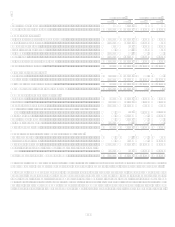

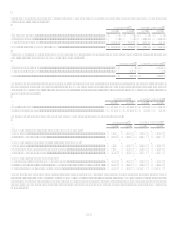

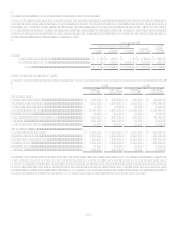

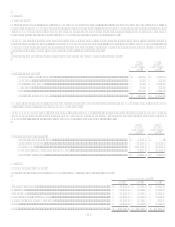

The following table sets forth, on an aggregated basis, changes in the benefit obligations and plan assets, how the funded status is

recognized in the balance sheet, and the components of net periodic benefit cost.

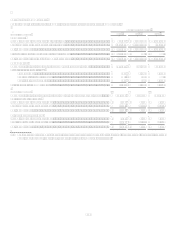

Pension Benefits

Postretirement

Benefits

2008

2007

2008

2007

Change in benefit obligation:

Benefit obligation at beginning of year................................................................ $ 207,926 $ 220,741 $ 59,783 $ 84,210

Impact of adopting the measurement date provisions of SFAS 158 ....................

906

Service cost.......................................................................................................... 2,500

15,014

1,687

8,823

Interest cost.......................................................................................................... 11,941

12,034

3,605

4,678

Plan participant contributions ..............................................................................

635

532

Benefits paid ........................................................................................................ (11,340) (20,028) (4,468) (4,218)

Net actuarial loss (gain) ....................................................................................... 3,381

(16,285) 11,552

(10,714)

Amendments ........................................................................................................

363

(22,074)

Curtailments.........................................................................................................

(8,808)

(1,454)

Settlements........................................................................................................... (24,657)