Capital One 2008 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

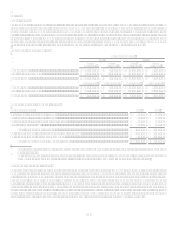

131

Note 13

Mortgage Servicing Rights

MSRs are recognized when mortgage loans are sold in the secondary market and the right to service these loans are retained for a fee,

and are carried at fair value; changes in fair value are recognized in mortgage servicing and other income. The Company may enter

into derivatives to economically hedge changes in fair value of MSRs. The Company originally sold mortgage loans through whole

loan sales transactions and in some instances the loans were subsequently securitized by the third party purchaser and transferred into

a VIE. The Company typically does not have any continuing involvement other than its right to service the loans and the Company

does not hold subordinate residual interests or enter into other guarantees or liquidity agreements with these structures. The Company

records the MSR at estimated fair value and has no other loss exposure over and above the recorded fair value. The servicing fee does

not represent a variable interest in the VIE and thus, the Company could not be deemed the primary beneficiary of these structures.

The Company continues to operate the mortgage servicing business and to report the changes in the fair value of MSRs in continuing

operations. To evaluate and measure fair value, the underlying loans are stratified based on certain risk characteristics, including loan

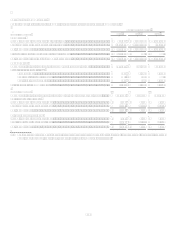

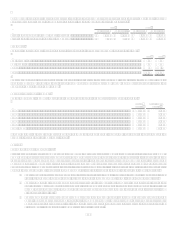

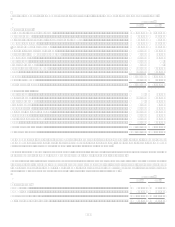

type, note rate and investor servicing requirements. The following table sets forth the changes in the fair value of mortgage servicing

rights during 2008 and 2007:

Mortgage Servicing Rights:

2008

2007

Balance, Beginning of period......................................................................................................................

.

$ 247,589 $ 252,295

Cumulative effect adjustment for the adoption of FAS 156 .......................................................................

.

15,187

Originations ................................................................................................................................................

.

65,948

Sales............................................................................................................................................................

.

(2,801) (3,340)

Change in fair value, net .............................................................................................................................

.

(94,244) (82,501)

Balance at December 31 .............................................................................................................................

.

$ 150,544 $ 247,589

Ratio of Mortgage Servicing Rights to Related Loans Serviced for Others ...............................................

.

0.66% 0.85%

Weighted Average Service Fee...................................................................................................................

.

0.28

0.28

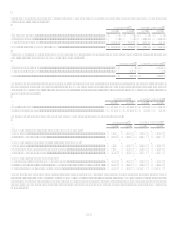

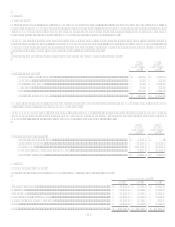

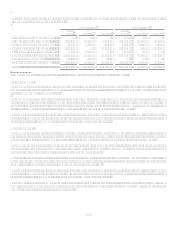

Fair value adjustments to the MSR for the year ended December 31, 2008 and 2007 included a $21.7 million and a $56.9 million,

respectively, decrease due to run-off in the serviced portfolio and a $72.5 million and $25.3 million, respectively, decrease due to

changes in the valuation inputs and assumptions.

The valuation adjustments for the MSR were partially offset by changes in the fair value of economic hedging instruments of $83.9

million and $44.4 million for the year ended December 31, 2008 and 2007, respectively, which were recognized in non-interest

income. For additional information on hedging activities, refer to note 17.

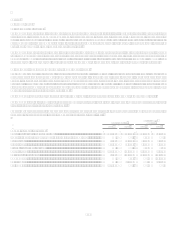

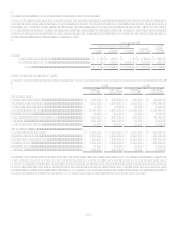

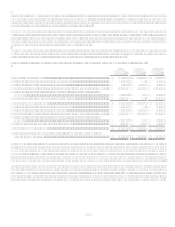

The significant assumptions used in estimating the fair value of the servicing assets at December 31 were as follows:

December 31,

2008

December 31,

2007

Weighted average prepayment rate (includes default rate) ................................................................. 26.65% 27.62%

Weighted average life (in years) ......................................................................................................... 3.2

3.4

Discount rate....................................................................................................................................... 11.14% 10.44%

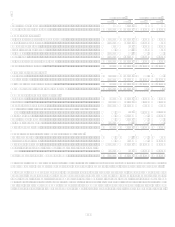

At December 31, 2008, the sensitivities to immediate 10% and 20% increases in the weighted average prepayment rates would

decrease the fair value of mortgage servicing rights by $8.1 million and $15.3 million, respectively.

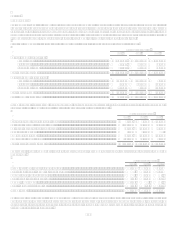

As of December 31, 2008, the Companys mortgage loan servicing portfolio consisted of mortgage loans with an aggregate unpaid

principal balance of $32.2 billion, of which $23.0 billion was serviced for investors other than the Company. As of December 31,

2007, the Companys mortgage loan servicing portfolio consisted of mortgage loans with an aggregate unpaid principal balance of

$42.0 billion, of which $29.4 billion was serviced for investors other than the Company.

Servicing income, which includes contractual servicing fees, late fees and ancillary fees, totaled $94.2 million, $174.3 million and

$7.5 million for the year ended December 31, 2008, 2007 and 2006, respectively. In December 2006, the Company completed its

acquisition of North Fork and as a result, mortgage servicing income for 2006 represents income earned from the acquisition date.

Servicing income is recorded in non-interest income.