Capital One 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

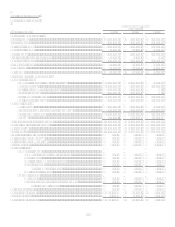

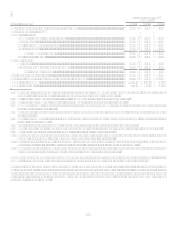

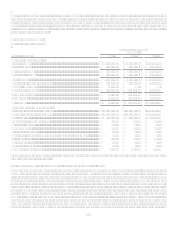

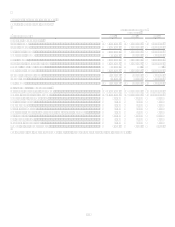

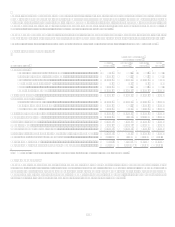

Auto Finance (a sub-segment of Other National Lending)

Table 6: Auto Finance

As of and for the Year Ended

December 31,

(Dollars in thousands)

2008

2007

2006

Earnings (Managed Basis)

Interest income................................................................................................... $ 2,614,967 $ 2,638,290 $ 2,237,205

Interest expense.................................................................................................. 1,087,573 1,127,421 864,688

Net interest income ............................................................................................ 1,527,394 1,510,869 1,372,517

Non-interest income........................................................................................... 59,235 112,261 81,384

Total revenue ..................................................................................................... 1,586,629 1,623,130 1,453,901

Provision for loan and lease losses .................................................................... 1,320,515 1,056,120 494,835

Goodwill impairment charge ............................................................................. 810,876

Non-interest expense.......................................................................................... 503,942 618,568 599,807

Income before taxes ........................................................................................... (1,048,704) (51,558) 359,259

Income taxes ...................................................................................................... (89,759) (17,736) 125,740

Net income (loss)............................................................................................... $ (958,945) $ (33,822) $ 233,519

Selected Metrics (Managed Basis)

Period end loans held for investment................................................................. $ 21,481,911 $ 25,128,352 $ 21,751,827

Average loans held for investment..................................................................... $ 23,483,706 $ 24,150,231 $ 20,490,920

Loans held for investment yield......................................................................... 11.14% 10.92% 10.92%

Net interest margin............................................................................................. 6.50% 6.26% 6.70%

Revenue margin ................................................................................................. 6.76% 6.72% 7.10%

Risk adjusted margin.......................................................................................... 2.17% 3.66% 4.82%

Non-interest expense as a % of average loans held for investment ................... 2.15% 2.56% 2.93%

Efficiency ratio .................................................................................................. 31.76% 38.11% 41.25%

Net charge-off rate ............................................................................................. 4.59% 3.06% 2.28%

30+ day delinquency rate................................................................................... 9.91% 7.84% 6.36%

Auto loan originations........................................................................................ $ 6,874,340

$ 13,176,533 $ 12,285,306

Number of total accounts (000s)........................................................................ 1,634 1,771 1,589

The Auto Finance sub-segment consists of automobile and other motor vehicle financing activities.

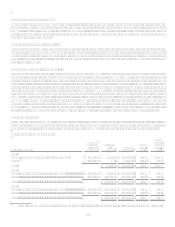

Year Ended December 31, 2008 Compared to Year Ended December 31, 2007

The Auto Finance sub-segment recognized a net loss of $958.9 million during 2008, compared with a net loss of $33.8 million during

2007. Excluding the $804.4 million after tax impact of the goodwill impairment incurred in the fourth quarter of 2008, the Auto

Finance sub-segment recognized a net loss of $154.5 million in 2008, driven primarily by higher credit related expenses due to the

worsening economy and the general conditions surrounding the auto industry over the past year.

As a result of the uncertain operating environment, the Auto Finance sub-segment chose to purposefully reduce the size of the loan

portfolio from the prior period. Originations in 2008 were $6.9 billion, 48% lower than the prior year, driven by pullbacks across both

the dealer and direct channels. Loans held for investment decreased 15% year over year, as the business focused on its most resilient

customer segments during these economic challenges.

Despite the significant volume pullbacks over the period, total revenue in 2008 declined only 2% from 2007. Partially offsetting the

volume driven revenue impacts was an ability to modestly increase net interest margin as several key competitors pulled back or

exited markets over the period.

During 2008, the Auto Finance sub-segments net charge-off rate was 4.59%, up 153 basis points from 3.06% during 2007. Net

charge-offs increased $340.4 million, or 46%, while average loans outstanding during 2008 decreased $666.5 million, or 3%,

compared to 2007. Declining auction rates for used vehicles contributed approximately $31.1 million to the increase in net charge-

offs. The 30-plus day delinquency rate was 9.91%, up 207 basis points at December 31, 2008 versus prior year. The provision for loan

losses increased $264.4 million, or 25% in 2008 driven by further weakening in the U.S. economy, partially offset by the shrinking

loan portfolio over the period.