Capital One 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

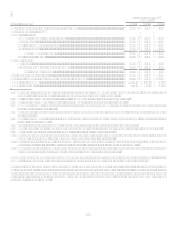

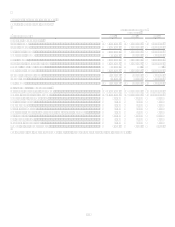

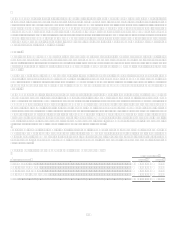

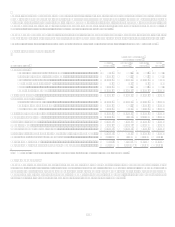

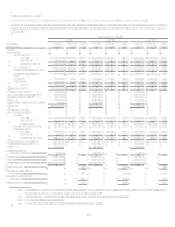

Table 9: Deposit Composition and Average Deposit Rates

Year Ended December 31, 2008

Period End

Balance

Average

Balance

% of

Deposits

Average

Deposit

Rate

Non-interest bearing.................................................................................. $ 11,293,852 $ 10,772,019 11.52% N/A

NOW accounts.......................................................................................... 10,522,219 9,305,767 9.95% 1.29%

Money market deposit accounts................................................................ 29,171,168 26,216,946 28.04% 2.74%

Savings accounts....................................................................................... 7,119,510 7,821,040 8.36% 0.91%

Other consumer time deposits................................................................... 36,509,357 25,414,506 27.18% 4.13%

Total core deposits........................................................................... 94,616,106 79,530,278 85.05% 2.46%

Public fund certificates of deposit of $100,000 or more ........................... 1,174,294 1,415,864 1.52% 2.94%

Certificates of deposit of $100,000 or more.............................................. 10,084,750 9,119,666 9.75% 4.29%

Foreign time deposits................................................................................ 2,745,639 3,441,838 3.68% 3.52%

Total deposits .................................................................................. $ 108,620,789 $ 93,507,646 100.00% 2.69%

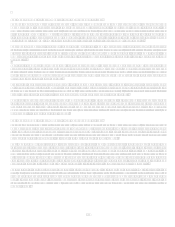

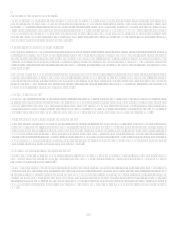

Year Ended December 31, 2007

Period End

Balance

Average

Balance

% of

Deposits

Average

Deposit

Rate

Non-interest bearing.................................................................................. $ 11,046,549 $ 11,446,706 13.43% N/A

NOW accounts.......................................................................................... 9,356,766 9,319,221 10.94% 2.50%

Money market deposit accounts................................................................ 23,901,637 23,074,931 27.08% 4.31%

Savings accounts....................................................................................... 8,071,334 8,327,672 9.77% 1.70%

Other consumer time deposits................................................................... 16,747,588 17,905,484 21.01% 4.52%

Total core deposits........................................................................... 69,123,874 70,074,014 82.23% 3.11%

Public fund certificates of deposit of $100,000 or more ........................... 1,631,253 1,951,412 2.29% 5.09%

Certificates of deposit of $100,000 or more.............................................. 8,398,095 9,233,313 10.84% 4.62%

Foreign time deposits................................................................................ 3,607,954 3,952,877 4.64% 5.10%

Total deposits .................................................................................. $ 82,761,176 $ 85,211,616 100.00% 3.41%

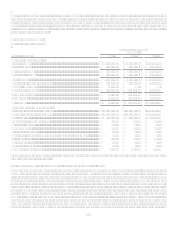

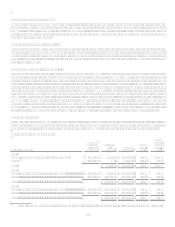

Year Ended December 31, 2006

Period End

Balance

Average

Balance

% of

Deposits

Average

Deposit

Rate

Non-interest bearing.................................................................................... $ 11,648,070 $ 4,906,313 9.72% N/A

NOW accounts............................................................................................ 4,868,874 974,126 1.93% 2.75%

Money market deposit accounts.................................................................. 25,025,123 12,066,857 23.90% 3.46%

Savings accounts......................................................................................... 8,455,865 4,248,016 8.41% 2.58%

Other consumer time deposits..................................................................... 19,724,693 14,914,294 29.53% 4.31%

Total core deposits............................................................................. 69,722,625 37,109,606 73.49% 3.23%

Public fund certificates of deposit of $100,000 or more ............................. 1,826,993 1,060,748 2.10% 7.33%

Certificates of deposit of $100,000 or more................................................ 10,059,043 8,814,475 17.45% 4.19%

Foreign time deposits.................................................................................. 3,953,285 3,513,866 6.96% 4.85%

Total deposits .................................................................................... $ 85,561,946 $ 50,498,695 100.00% 3.59%

Additional information regarding funding can be found in Item 8 Financial Statements and Supplementary DataNotes to the

Consolidated Financial StatementsNote 8.