Capital One 2008 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.90

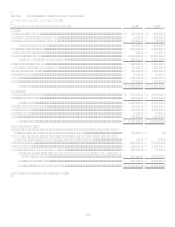

Significant Accounting Policies

Cash and Cash Equivalents

Cash and cash equivalents includes cash and due from banks, federal funds sold and resale agreements and interest-bearing deposits at

other banks. Cash paid for interest for the years ended December 31, 2008, 2007 and 2006 was $4.0 billion, $4.5 billion and $2.9

billion, respectively. Cash paid for income taxes for the years ended December 31, 2008, 2007 and 2006 was $1.2 billion, $1.5 billion

and $1.5 billion, respectively.

Securities Available for Sale

The Company considers the nature of investments in securities in order to determine the appropriate classification and currently treat

investments in debt securities as securities available for sale. These securities are stated at fair value, with the unrealized gains and

losses, net of tax, reported as a component of cumulative other comprehensive income. The fair value of securities is based on quoted

market prices, or if quoted market prices are not available, then the fair value is estimated using the quoted market prices for similar

securities, pricing models or discounted cash flow analyses, using observable market data where available. The amortized cost of debt

securities is adjusted for amortization of premiums and accretion of discounts to maturity. Such amortization or accretion is included

in interest income. Realized gains and losses on sales of securities are determined using the specific identification method. The

Company evaluates its unrealized loss positions for impairment in accordance with SFAS 115, as amended by FSP No. 115-1, The

Meaning of Other-Than-Temporary Impairment and its Application to Certain Investments and EITF 99-20, Recognition of Interest

Income and Impairment on Purchased Beneficial Interests and Beneficial Interests That Continue to Be Held by a Transferor in

Securitized Financial Assets and FSP EITF 99-20. As such, when there is other-than-temporary impairment, the Company recognizes

an impairment loss in earnings equal to the entire difference between the investments cost and its fair value. See Note 4 for additional

details.

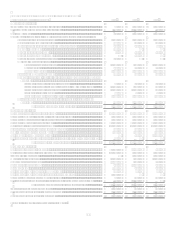

Mortgage Loans Held for Sale

The Company classifies loans originated with the intent of selling in the secondary market as held for sale. Loans originated for sale

are primarily sold in the secondary market as whole loans. Whole loan sales are executed with either the servicing rights being

retained or released to the buyer. For sales where the loans are sold with the servicing released to the buyer, the gain or loss on the sale

is equal to the difference between the proceeds received and the carrying value of the loans sold. If the loans are sold with the

servicing rights retained, the gain or loss on the sale is also impacted by the fair value attributed to the servicing rights. In the third

quarter of 2007, the Company shut down the mortgage origination operations of its wholesale mortgage banking unit, GreenPoint. The

results of the mortgage origination operation of GreenPoint have been accounted for as discontinued operations and have been

removed from the Companys results of continuing operations for all periods presented. The results of GreenPoints mortgage

servicing business continue to be reported as part of the Companys continuing operations.

Mortgage loans held for sale are carried at the lower of aggregate cost, net of deferred fees, deferred origination costs and effects of

hedge accounting, or fair value. The fair value of mortgage loans held for sale is determined using current secondary market prices for

loans with similar coupons, maturities and credit quality. The fair value of mortgage loans held for sale is impacted by changes in

market interest rates. The exposure to changes in market interest rates is hedged primarily by selling forward contracts on agency

securities. These derivative instruments are recorded on the balance sheet at fair value with changes in fair value being recorded in

mortgage banking operations in current earnings. Also, changes in the fair value of mortgage loans held for sale are recorded as an

adjustment to the loans carrying basis through mortgage banking operations income in current earnings.

Prior to the shutdown of GreenPoint, the Company entered into commitments to originate or purchase loans whereby the interest rate

of the loan was determined prior to funding (interest rate lock commitment). Interest rate lock commitments on mortgage loans that

the Company intended to sell in the secondary market were considered freestanding derivatives. These derivatives were carried at fair

value with changes in fair value reported as a component of gain on sale of the loans. As of December 31, 2008, the Company has no

loan commitments due to the shutdown of the mortgage origination operations of GreenPoint. See Note 17 for additional details on

mortgage banking derivatives.

As of December 31, 2008 and 2007, the balance in mortgage loans held for sale was $68.5 million and $315.9 million, respectively.

Loan Securitizations

The Company primarily securitizes credit card loans, auto loans and installment loans. Securitization provides the Company with a

significant source of liquidity and favorable regulatory capital treatment for securitizations accounted for as off-balance sheet

arrangements. See Note 18 for additional detail.