Capital One 2008 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

142

Collections of interest and fees received on securitized receivables are used to pay interest to investors, servicing and other fees, and

are available to absorb the investors share of credit losses. Amounts collected in excess of that needed to pay the above amounts are

remitted, in general, to the Company. Under certain conditions, some of the cash collected may be retained to ensure future payments

to investors.

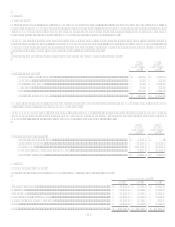

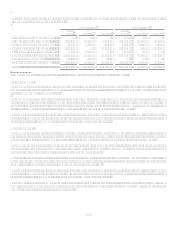

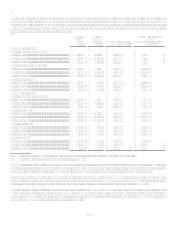

Year Ended December 31

2008

2007

Proceeds from new securitizations........................................................................................................

.

$ 10,046,699 $ 12,641,050

Collections reinvested in revolving securitizations...............................................................................

.

85,351,341

92,917,318

Repurchases of accounts from the trust ................................................................................................

.

251,776

344,287

Servicing fees received .........................................................................................................................

.

956,163

969,552

Cash flows received on retained interests(1) ...........................................................................................

.

$ 6,374,957

$ 5,290,100

(1) Includes all cash receipts of excess spread and other payments (excluding servicing fees) from the trust to the Company.

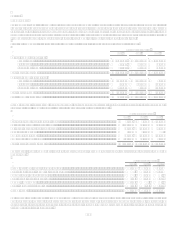

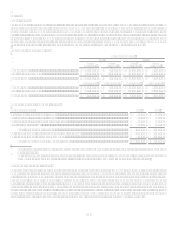

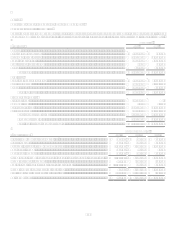

For the year ended December 31, 2008 the Company recognized gross gains of $58.4 million on both the public and private sale of

$10.0 billion of loan principal receivables compared to gross gains of $63.8 million on the sale of $12.6 billion of loan principal

receivables for the year ended December 31, 2007 and gross gains of $50.4 million on the sale of $12.3 billion of loans in 2006. These

gross gains are included in servicing and securitizations income. In addition, the Company recognized, as a reduction to servicing and

securitizations income, upfront securitization transaction costs and recurring credit facility commitment fees of $43.9 million, $45.0

million, and $66.1 million for the years ended December 31, 2008, 2007, and 2006 respectively. The remainder of servicing and

securitizations income represents servicing income and excess interest and non-interest income generated by the transferred

receivables, less the related net losses on the transferred receivables and interest expense related to the securitization debt.

Secured Borrowings

In addition to issuing securitizations that qualify as sales, the Company also issued securitizations that are accounted for as secured

borrowings. Similar to off-balance sheet securitizations, the Company transfers a pool of loan receivables to a special purpose entity;

however, these SPEs do not qualify as QSPEs and thus, are considered VIEs that are consolidated by the Company. The transferred

loan receivables continue to be accounted for as loans and the Company continues to carry an appropriate allowance for loan and lease

loss for these assets. The Company receives proceeds for the issuance of debt securities and the Company records the securitization

debt in other borrowings. The investors and the trusts have no recourse to the Companys assets if the loans associated with these

secured borrowings are not paid when due. The Company has not provided any financial or other support during the periods presented

that it was not previously contractually required to provide.

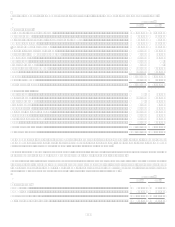

The agreements were entered into between 2005 and 2007, relating to the transfers of pools of auto loans totaling $25.1 billion to auto

securitization trusts. Principal payments on the borrowings are based on principal collections, net of losses, on the transferred auto

loans. The secured borrowings accrue interest predominantly at fixed rates and mature between April 2009 and May 2011, or earlier

depending upon the repayment of the underlying auto loans. At December 31, 2008 and 2007, $7.4 billion and $13.0 billion,

respectively, of the secured borrowings were outstanding. At December 31, 2008 and 2007 the auto loans within the trust totaled $7.8

billion and $13.7 billion.

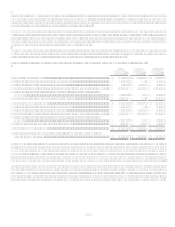

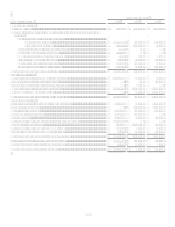

The Company is required to remit principal collections to the trusts when the securitization transaction is scheduled to mature or

earlier if an amortizing event has occurred. Securitization transactions may amortize earlier than scheduled due to certain early

amortization triggers which would accelerate the need for funding. No early amortization events related to the Companys

securitizations accounted for as secured borrowings have occurred for the years ended December 31, 2008 and 2007.

Collections of interest and fees received on securitized receivables are used to pay interest to investors, servicing and other fees, and

are available to absorb the investors share of credit losses. Under certain conditions, some of the cash collected may be retained to

ensure future payments to investors. Amounts collected in excess of the amount that is used to pay the above amounts are generally

remitted to the Company.

Also included within secured borrowings at December 31, 2008 is $140 million of tender option bonds related to the Companys

investments in certain community development entities which are consolidated variable interest entities. As at December 31, 2007, the

amount of tender option bonds was $74 million. See Note 20 for further details.