Capital One 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

Non-interest expenses were $2.3 billion in 2007, compared to $1.2 billion in 2006. The primary reason for the increase is the addition

of North Fork to the Local Banking segment results in 2007. In addition, during 2007 the Local Banking segment continued to incur

costs associated with the integration of Hibernia and North Fork. These activities progressed as planned during the year and all

Hibernia related integration activities were completed. In 2007, the Company opened 39 new banking locations across Louisiana, New

Jersey, New York, Texas and Virginia. The costs of operating these branches, including lease costs, depreciation and personnel, is

included in non-interest expense.

National Lending Segment

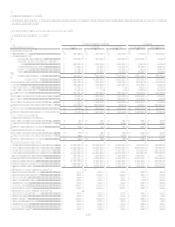

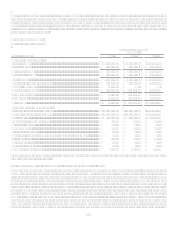

Table 3: National Lending

As of and for the Year Ended

December 31,

(Dollars in thousands)

2008

2007

2006

Earnings (Managed Basis)

Interest income ...............................................................................................

.

$ 13,068,005 $ 13,675,686 $ 12,070,528

Interest expense ..............................................................................................

.

4,077,131 4,834,450 4,174,394

Net interest income.........................................................................................

.

8,990,874 8,841,236 7,896,134

Non-interest income .......................................................................................

.

4,737,612 4,870,727 4,375,126

Total revenue..................................................................................................

.

13,728,486 13,711,963 12,271,260

Provision for loan and lease losses.................................................................

.

7,428,476 4,691,687 3,207,646

Goodwill impairment......................................................................................

.

810,876

Non-interest expense ......................................................................................

.

4,893,898 5,420,204 5,529,104

Income before taxes........................................................................................

.

595,236

3,600,072 3,534,510

Income taxes...................................................................................................

.

485,265

1,237,163 1,240,608

Net income .....................................................................................................

.

$ 109,971

$ 2,362,909 $ 2,293,902

Selected Metrics (Managed Basis)

Period end loans held for investment..............................................................

.

$ 101,147,134 $ 106,508,443 $ 102,359,180

Average loans held for investment .................................................................

.

$ 102,689,253 $ 102,235,384 $ 95,396,391

Total deposits .................................................................................................

.

$ 1,459,131 $ 2,050,861 $ 2,383,902

Loans held for investment yield .....................................................................

.

12.73% 13.38% 12.65%

Net interest margin .........................................................................................

.

8.76% 8.65% 8.28%

Revenue margin..............................................................................................

.

13.37% 13.41% 12.86%

Risk adjusted margin ......................................................................................

.

7.49% 9.45% 9.62%

Non-interest expense as a % of average loans held for investment ................

.

4.77% 5.30% 5.80%

Efficiency ratio ...............................................................................................

.

35.65% 39.53% 45.06%

Net charge-off rate..........................................................................................

.

5.88% 3.96% 3.24%

30+ day delinquency rate................................................................................

.

5.93% 5.17% 4.09%

Number of accounts (000s).............................................................................

.

44,816

48,537 49,373

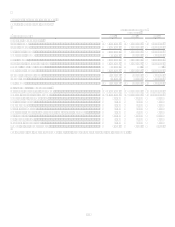

The National Lending segment consists of two sub-segments: U.S. Card and Other National Lending. Other National Lending consists

of Auto Finance and International.

Year Ended December 31, 2008 Compared to Year Ended December 31, 2007

The National Lending segment contributed $110.0 million of net income during 2008, compared to $2.4 billion during 2007. At

December 31, 2008, loans outstanding in the National Lending segment totaled $101.1 billion while deposits outstanding totaled $1.5

billion. Profits are primarily generated from net interest income, which includes past-due fees earned and deemed collectible from our

loans, and non-interest income, which includes fee-based services to customers. The reduction in net income was driven by an

increase in the provision for loan and lease losses of $2.7 billion to $7.4 billion and by the recognition of an impairment on goodwill

of $810.9 million in the Auto Finance sub-segment partially offset by a $526.3 million decrease in non-interest expense due to benefits

from the Companys cost reduction initiatives. The increase in the provision for loan and lease losses was due to a significantly worse

credit environment in 2008 as evidenced by an increase in the net charge-off rate to 5.88% from 3.96% in 2007. Total revenue was flat

compared to 2007 as average managed loans held for investment were essentially level, increasing only 0.44% from 2007 levels, with

growth in U.S. Card offset by declines in both Auto Finance and International. The net interest margin and revenue margin were

8.76% and 13.37%, respectively, during 2008 compared to 8.65% and 13.41%, respectively, during 2007. The risk adjusted margin

decreased to 7.49% from 9.45% in 2007 due to the increase in charge-offs. Accounts have declined by 3.7 million in U.S. Card as the